Showing 1–20 of 38

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030 (PDF)

NewMarkets & Economy

23 Pages

364 Downloads

364 Downloads

2026-02

FREE

Free Shipping364

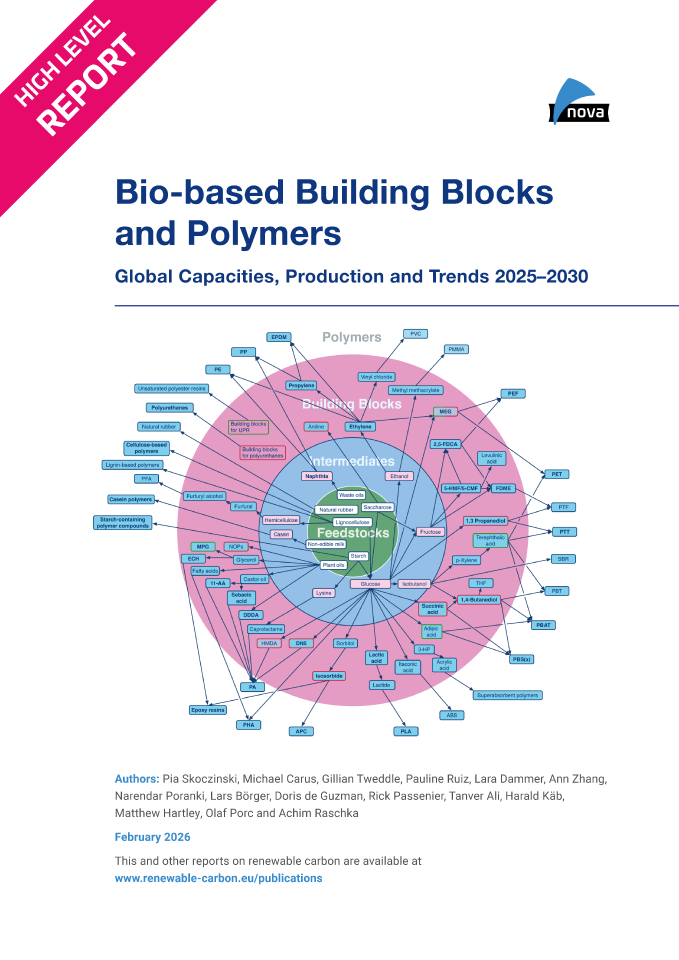

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Mapping of Global Advanced Plastic Recycling Capacities (PDF)

NewMarkets & Economy, Policy, Technology

35 Pages

2025-11

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

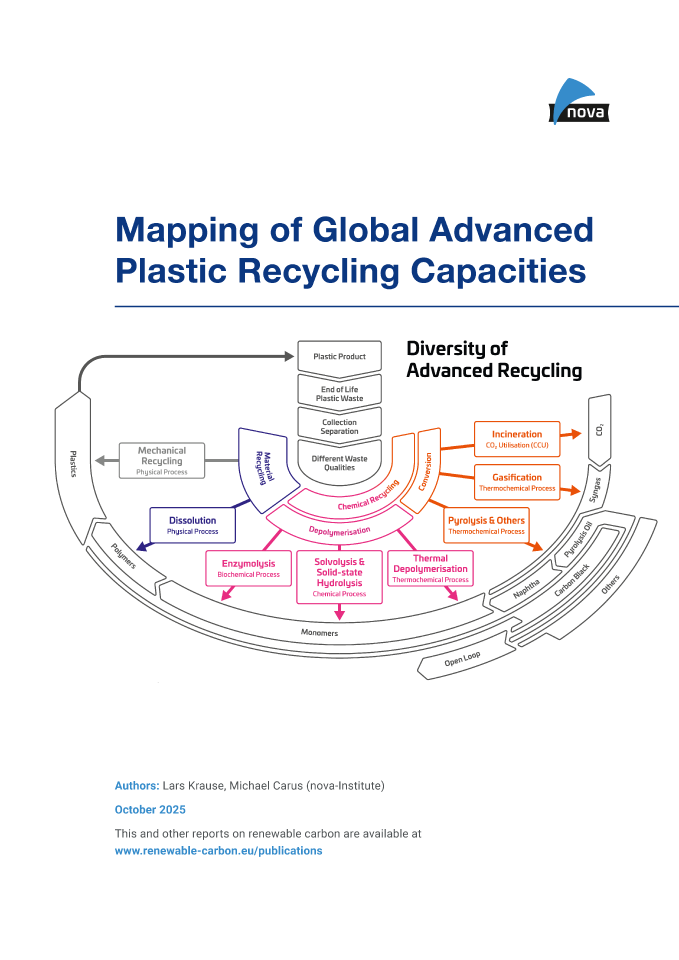

licenceChemical and physical recycling are essential to keeping carbon in the loop and fully establishing a circular economy. Despite delays in policy regulations and investment, experts foresee a bright future for new capacity, both globally and in Europe.

The development of advanced recycling technologies is very dynamic and at a fast pace, with new players constantly appearing on the market, from start-ups to chemistry giants and everything in between. New plants are being built, and new capacities are being achieved. Due to these dynamic developments, it is difficult to keep track of everything. The nova report “Mapping of global advanced plastic recycling capacities” aims to clear up this jungle of information. A comprehensive evaluation of the global input and output capacities was carried out for which 390 planned as well as installed and operating plants including their specific product yields were mapped to provide an overview about global advanced recycling capacities in the past, present, and future.

Further information: The new report represents a short study updating the current and future Advanced Recycling input- and output-capacities for the year 2024-2031. The report does not include any technology- or company-profiles which are published in another study (https://doi.org/10.52548/WQHT8696).

DOI No.: https://doi.org/10.52548/YKWB6074

-

2025-08

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

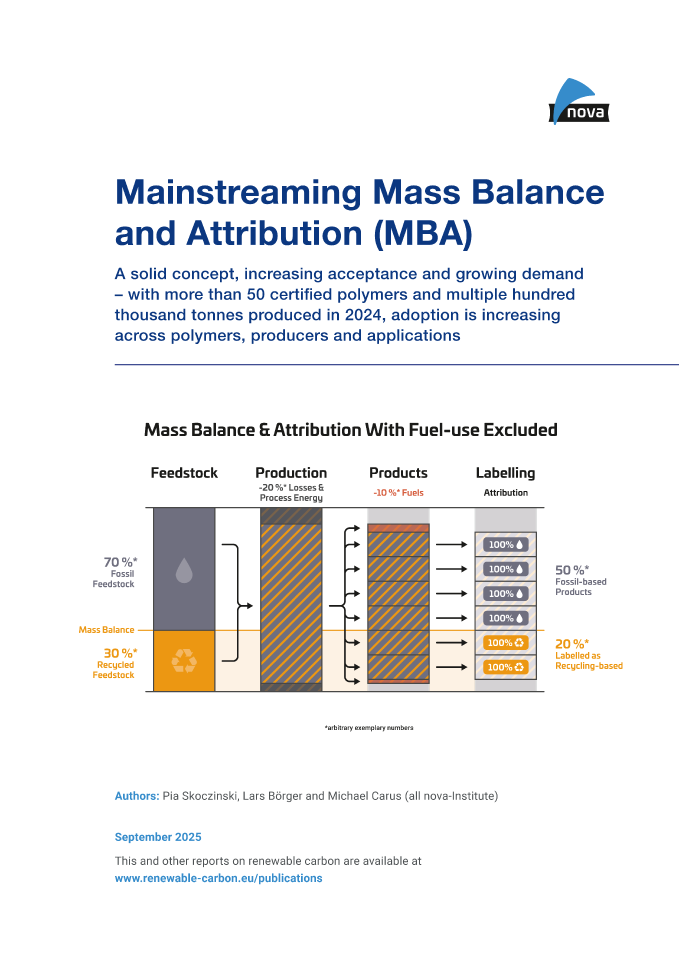

licenceA solid concept, increasing acceptance and growing demand – with more than 50 certified polymers and multiple hundred thousands of kilotonnes produced in 2024, adoption is increasing across polymers, producers and applications

The acceptance and accessibility of mass balanced attributed (MBA) chemicals, building blocks and polymers is a major issue for the chemical and plastics sectors, as well as for brand owners. MBA products could provide more options, better availability and reduced costs for the defossilisation compared to dedicated bio-based solutions.

However, both the MBA concept and the political regulations are crucial for scaling up, but difficult to understand. Furthermore, discussions about potentially misleading communication on the concept are confusing stakeholders. In addition, no production volumes are available.The new report “Mainstreaming Mass Balance and Attribution (MBA): A solid concept, increasing acceptance and growing demand – with more than 50 certified polymers and multiple hundred thousand tonnes produced in 2024, adoption is increasing across polymers, producers and applications” highlights this evolving landscape.

The first part of the report covers terminology, the historical development, the rationale and acceptance, and the latest regulatory environment in Brussels. The second part is dedicated to the underlying data.It covers feedstock used for certified MBA products, as well as the most frequently produced MBA chemicals and polymers (PE is No. 1). The leading producers (BASF is No. 1) and regions are identified, with 60 % of demand from Europe, and the largest share stemming from Germany, Belgium and France.

DOI No.: https://doi.org/10.52548/VDRG6920

-

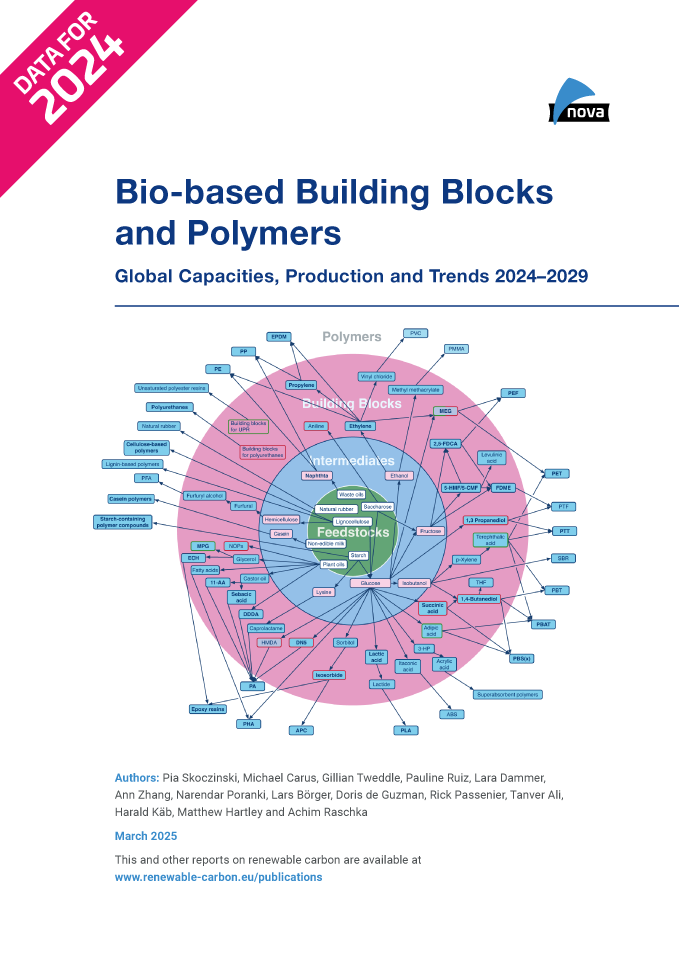

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2024–2029 (PDF)

NewMarkets & Economy

434 Pages

2025-03

3,000 € – 10,000 €Price range: 3,000 € through 10,000 € ex. tax

Plus 19% MwSt.Press

release Select

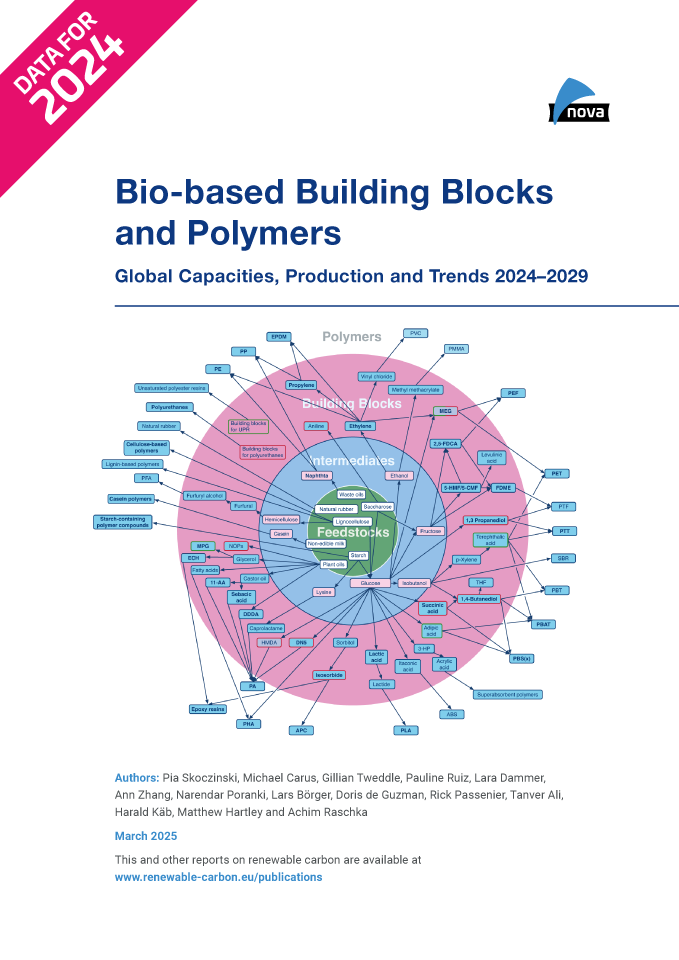

licence2024 was a respectable year for bio-based polymers, with an overall expected CAGR of 13 % to 2029. Overall, bio-based biodegradable polymers have large installed capacities with an expected CAGR of 17 % to 2029, but the current average capacity utilisation is moderate at 65 %. In contrast, bio-based non-biodegradable polymers have a much higher utilisation rate of 90 %, but will only grow by 10 % to 2029.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PP and cyclic APC capacities are increasing by 30 %. Despite a decline in production of biodegradables, especially for PLA in Asia, capacities have increased by 40 %. The same applies to PHA capacities. Commercial newcomers such as casein polymers and PEF recorded a rise in production capacity and are expected to continue to grow significantly until 2029.

DOI No.: https://doi.org/10.52548/UMTR4695

-

Bio-based Building Blocks and Polymers Global Capacities, Production and Trends 2024–2029 – Short Version (PDF)

Markets & Economy

28 Pages

1582 Downloads

1582 Downloads

2025-03

FREE

Free Shipping1582

Downloads2024 was a respectable year for bio-based polymers, with an overall expected CAGR of 13 % to 2029. Overall, bio-based biodegradable polymers have large installed capacities with an expected CAGR of 17 % to 2029, but the current average capacity utilisation is moderate at 65 %. In contrast, bio-based non-biodegradable polymers have a much higher utilisation rate of 90 %, but will only grow by 10 % to 2029.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PP and cyclic APC capacities are increasing by 30 %. Despite a decline in production of biodegradables, especially for PLA in Asia, capacities have increased by 40 %. The same applies to PHA capacities. Commercial newcomers such as casein polymers and PEF recorded a rise in production capacity and are expected to continue to grow significantly until 2029.

-

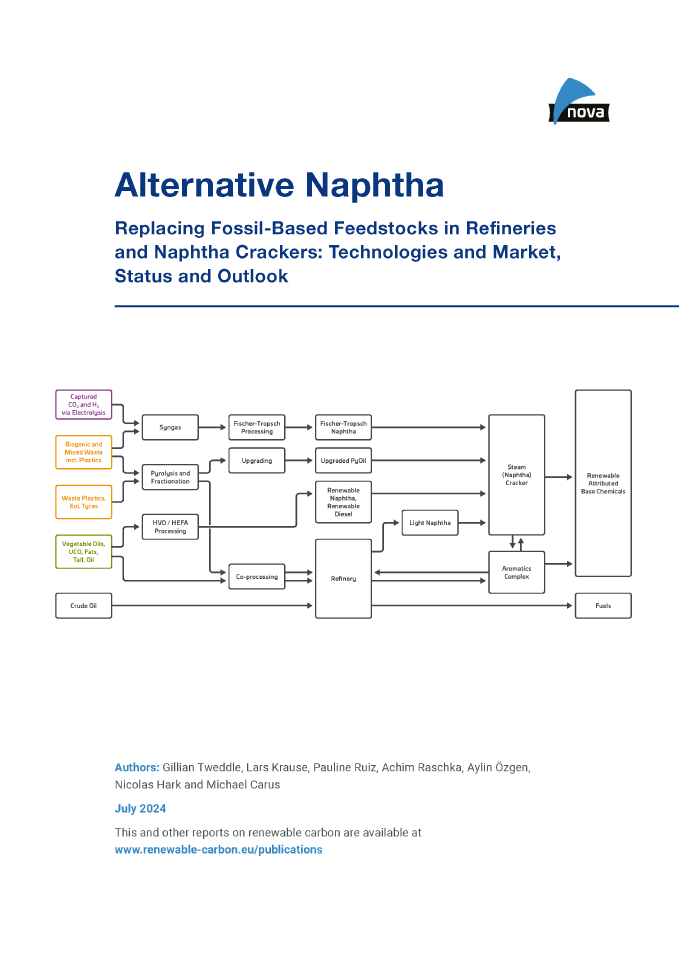

Alternative Naphtha – Technologies and Market, Status and Outlook (PDF)

Markets & Economy, Technology

188 Pages

2024-07

2,500 € – 9,000 €Price range: 2,500 € through 9,000 € ex. tax

Plus 19% MwSt.Select

licenceFor the defossilisation of the chemical industry, it is crucial to find alternatives to fossil-based naphtha. The “alternative naphtha” concept makes use of existing refinery, steam cracking and chemical industry infrastructure where a proportion of fossil-based feedstocks – crude oil or fossil-based naphthas can be replaced by renewable carbon alternatives derived from the three sources of renewable carbon: CO2, biomass and recycling.

This new report by nova-Institute presents an analysis of the routes, associated technologies, market players and volumes by which renewable carbon can be introduced to refinery and steam cracking operations as replacement for fossil based feedstocks.

With 188 pages, 22 tables and illustrated by 48 graphics the report provides a comprehensive view on the growth in capacity for these alternative sources of naphtha as chemical industry feedstock, production routes and the need for “upgrading”, key companies and partnerships and the regulatory environment.

DOI No.: https://doi.org/10.52548/JICP8041

-

Alternative Naphtha – Technologies and Market, Status and Outlook (PDF) – Short Version

Markets & Economy, Technology

20 Pages

1177 Downloads

1177 Downloads

2024-07

FREE

1177

DownloadsFor the defossilisation of the chemical industry, it is crucial to find alternatives to fossil-based naphtha. The “alternative naphtha” concept makes use of existing refinery, steam cracking and chemical industry infrastructure where a proportion of fossil-based feedstocks – crude oil or fossil-based naphthas can be replaced by renewable carbon alternatives derived from the three sources of renewable carbon: CO2, biomass and recycling.

This new report by nova-Institute presents an analysis of the routes, associated technologies, market players and volumes by which renewable carbon can be introduced to refinery and steam cracking operations as replacement for fossil based feedstocks.

With 188 pages, 22 tables and illustrated by 48 graphics the report provides a comprehensive view on the growth in capacity for these alternative sources of naphtha as chemical industry feedstock, production routes and the need for “upgrading”, key companies and partnerships and the regulatory environment.

DOI No.: https://doi.org/10.52548/JICP8041

-

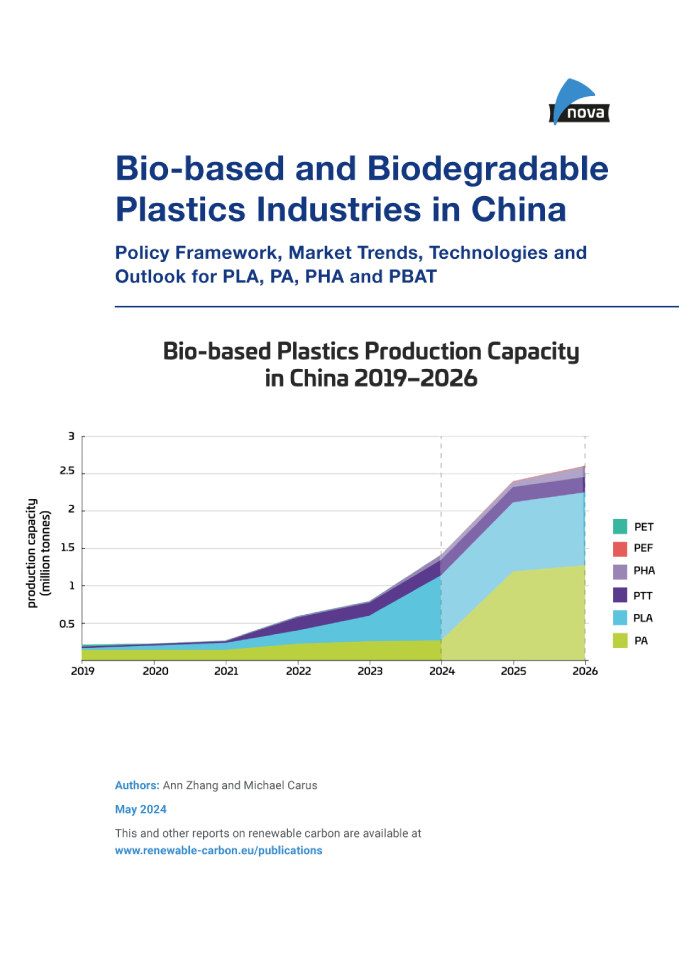

Bio-based and Biodegradable Plastics Industries in China – Short Version (PDF)

Markets & Economy, Policy, Sustainability & Health

14 Pages

1232 Downloads

1232 Downloads

2024-05

FREE

1232

DownloadsChina has emerged as a global leader in strategic technologies such as 5G, renewable energy, and electric vehicles in the past two decades. This dominance may leave European companies impressed and concerned about competition while also sparking curiosity about China’s leapfrogging advancement in these areas.

Paving the way to a net-zero chemical industry in 2060, using renewable biomass to produce bio-based chemicals has been one of the promising transitional solutions for the global chemical industry. As China and Europe strive to follow this path, a similar question may exist within the European chemical industry: What is the status of the bio-based industry in China? Can China and Europe find a cooperative and win-win way to develop this industry?

-

Bio-based and Biodegradable Plastics Industries in China (PDF)

Markets & Economy, Policy, Sustainability & Health

71 Pages

2024-05

1,500 € – 8,000 €Price range: 1,500 € through 8,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceChina has emerged as a global leader in strategic technologies such as 5G, renewable energy, and electric vehicles in the past two decades. This dominance may leave European companies impressed and concerned about competition while also sparking curiosity about China’s leapfrogging advancement in these areas.

Paving the way to a net-zero chemical industry in 2060, using renewable biomass to produce bio-based chemicals has been one of the promising transitional solutions for the global chemical industry. As China and Europe strive to follow this path, a similar question may exist within the European chemical industry: What is the status of the bio-based industry in China? Can China and Europe find a cooperative and win-win way to develop this industry?

-

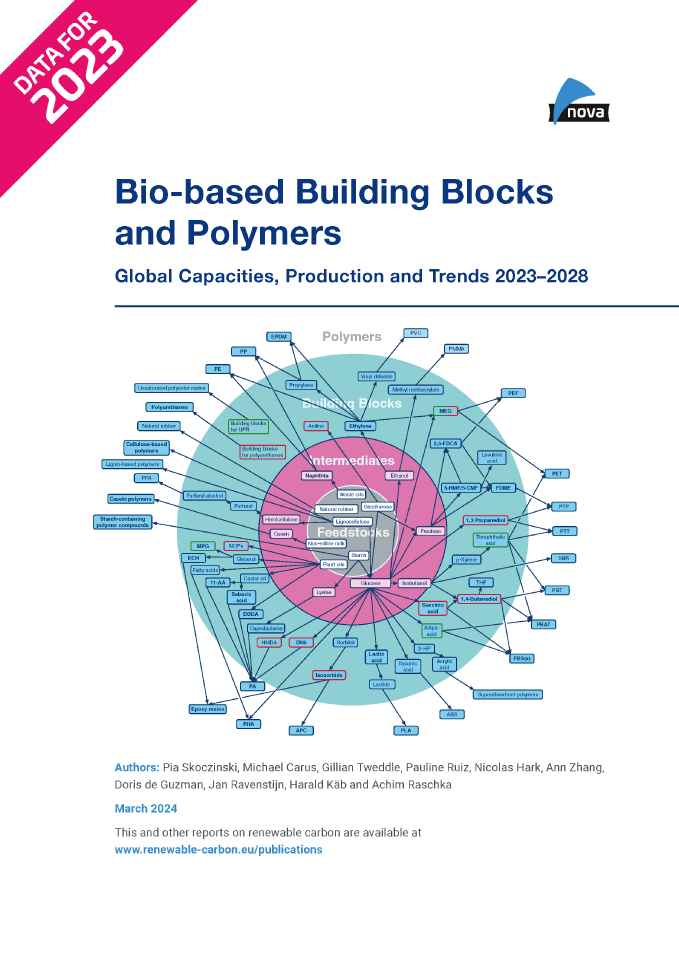

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2023–2028 – Short Version (PDF)

Markets & Economy

28 Pages

2461 Downloads

2461 Downloads

2024-03

FREE

2461

DownloadsNew report released on the global bio‑based polymer market 2023 – a deep and comprehensive insight into a dynamically growing market

The year 2023 was a promising year for bio‑based polymers: PLA capacities have been increased by almost 50 %, and at the same time polyamide capacities are steadily increasing, as well as epoxy resin production. Capacities for 100 % bio-based PE have been expanded and PE and PP made from bio‑based naphtha are being further established with growing volumes. Current and future expansions for PHAs are still on the horizon. After hinting at a comeback in 2022 bio-based PET production dropped in 2023 by 50 %.

DOI No.: https://doi.org/10.52548/VXTH2416

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2023–2028 (PDF)

Markets & Economy

438 Pages

2024-03

1,000 € – 3,000 €Price range: 1,000 € through 3,000 € ex. tax

Plus 19% MwSt.Select

licenceNew report released on the global bio‑based polymer market 2023 – a deep and comprehensive insight into a dynamically growing market

The year 2023 was a promising year for bio‑based polymers: PLA capacities have been increased by almost 50 %, and at the same time polyamide capacities are steadily increasing, as well as epoxy resin production. Capacities for 100 % bio-based PE have been expanded and PE and PP made from bio‑based naphtha are being further established with growing volumes. Current and future expansions for PHAs are still on the horizon. After hinting at a comeback in 2022 bio-based PET production dropped in 2023 by 50 %.

DOI No.: https://doi.org/10.52548/VXTH2416

-

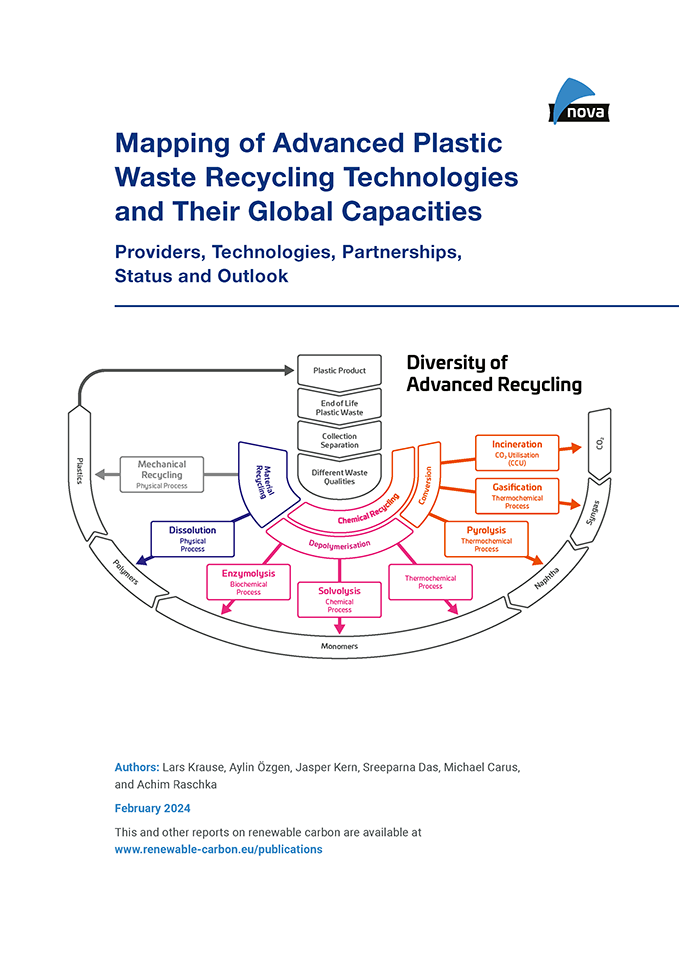

Mapping of Advanced Plastic Waste Recycling Technologies and their Global Capacities (PDF)

Markets & Economy, Technology

276 Pages

2024-02

3,000 € – 10,000 €Price range: 3,000 € through 10,000 € ex. tax

Plus 19% MwSt.Select

licenceAdvanced recycling technologies are developing at a fast pace, with new players constantly appearing on the market, from start-ups to giants and everything in between – new plants are being built, new capacities are being achieved, and new partnerships are established. Due to these developments, it is difficult to keep track of everything. The report “Mapping of advanced plastic waste recycling technologies and their global capacities” aims to clear up this jungle of information providing a structured, in-depth overview and insight. It has an exclusive focus on profiling available technologies and providers of advanced recycling including the addition of new technologies and updated/revised profiles. Furthermore, for the first time a comprehensive evaluation of the global input and output capacities was carried out for which more than 340 planned as well as installed and operating plants including their specific product yields were mapped.

Further information:

The new report “Mapping of advanced plastic waste recycling technologies and their global capacities” differs from the old report “Chemical Recycling – Status, Trends and Challenges” as follows:- All technology provider profiles from the old report included + updated to 2023.

- Overall >120 technologies and providers (vs. >70 technologies and providers in the old report)

- Global capacities

In summary, this report is suitable for interested readers who have already dealt with the advanced recycling topic and are looking for an up-to-date overview of all identified providers and a detailed description of the technologies.

DOI No.: https://doi.org/10.52548/WQHT8696

-

Mapping of Advanced Plastic Waste Recycling Technologies and their Global Capacities – Short Version (PDF)

Markets & Economy, Technology

12 Pages

2210 Downloads

2210 Downloads

2024-02

FREE

2210

DownloadsAdvanced recycling technologies are developing at a fast pace, with new players constantly appearing on the market, from start-ups to giants and everything in between – new plants are being built, new capacities are being achieved, and new partnerships are established. Due to these developments, it is difficult to keep track of everything. The report “Mapping of advanced plastic waste recycling technologies and their global capacities” aims to clear up this jungle of information providing a structured, in-depth overview and insight. It has an exclusive focus on profiling available technologies and providers of advanced recycling including the addition of new technologies and updated/revised profiles. Furthermore, for the first time a comprehensive evaluation of the global input and output capacities was carried out for which more than 340 planned as well as installed and operating plants including their specific product yields were mapped.

Further information:

The new report “Mapping of advanced plastic waste recycling technologies and their global capacities” differs from the old report “Chemical Recycling – Status, Trends and Challenges” as follows:- All technology provider profiles from the old report included + updated to 2023.

- Overall >120 technologies and providers (vs. >70 technologies and providers in the old report)

- Global capacities

In summary, this report is suitable for interested readers who have already dealt with the advanced recycling topic and are looking for an up-to-date overview of all identified providers and a detailed description of the technologies.

-

Carbon Dioxide (CO₂) as Feedstock for Chemicals, Advanced Fuels, Polymers, Proteins and Minerals (PDF)

Markets & Economy, Technology

242 Pages

2023-04

2,500 € – 10,000 €Price range: 2,500 € through 10,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceNew report on the use of CO₂ for chemicals, advanced fuels, polymers, proteins and minerals by nova-Institute – A deep and comprehensive insight into the evolving technologies, trends and the dynamically growing market of CO₂ transformation and utilisation.

Several successfully implemented technologies are now in commercial use, and many more are at the laboratory and pilot stage. A current total production capacity of novel CO₂-based products of about 1.3 Mt/a in 2022 is observed. The production capacity in 2022 is dominated by the production of CO₂-based aromatic polycarbonates, ethanol from captured CO/CO₂, aliphatic polycarbonate and methanol. By 2030, the capacity outlook for CO₂-based products is expected to exceed 6 Mt/a of CO₂-based products. High dynamic growth is observed for methanol projects, methane plants, ethanol and hydrocarbons – the latter especially for the aviation sector. The potential of CCU has been recognised by several global brands which are already expanding their feedstock portfolio. However, in Europe, investments and prospects for CO₂ utilisation are largely undermined by a lack of political support. In contrast, we see supportive policies in China as well as in the US with the Inflation Reduction Act. Such smart policies are needed to bridge the gap between now and 2050 for companies to remain competitive in the sustainable transformation.nova-Institute’s new report examines this renewable carbon source in detail: Which products can be made from CO₂, and by which processes? To which extend have the technologies already been developed and implemented in pilot, demonstration and commercial plants? Which companies are working on technologies to uses CO₂ as a feedstock? What are the trends in CO₂ utilisation in the coming years?

This report addresses the fuel, chemical and materials industries, brands, technology scouts, investors, and policy makers. The report provides 240 pages of information on CO₂ utilisation. All the 116 companies mentioned are described in detailed profiles.

DOI No.: https://doi.org/10.52548/HKBS8158

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2022-2027 (PDF)

Markets & Economy

387 Pages

2023-02

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

2022-06

2,500 € – 10,000 €Price range: 2,500 € through 10,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceAdvanced recycling technologies are developing at a fast pace, with new players constantly appearing on the market, from start-ups to giants and everything in between – new plants are being built, new capacities are being achieved, and new partnerships are established. Due to these developments, it is difficult to keep track of everything. The report “Mapping of advanced recycling technologies for plastics waste” aims to clear up this jungle of information providing a structured, in-depth overview and insight. It has an exclusive focus on profiling available technologies and providers of advanced recycling including the addition of new technologies and updated/revised profiles.

Further information:

The new report “Mapping of advanced recycling – Providers, technologies, and partnerships” differs from the old report “Chemical Recycling – Status, Trends and Challenges” as follows:

- All technology provider profiles from the old report included + updated to 2022.

- Overall >100 technologies and providers (vs. >70 technologies and providers in the old report)

- Extensive introductory part on polymer types, demand of different polymer types, waste fractions, political framework, position papers, technologies, LCAs, associations and waste management companies are no longer included in this report

In summary, this report is suitable for interested readers who have already dealt with the advanced recycling topic and are looking for an up-to-date overview of all identified providers and a detailed description of the technologies.

DOI No.: https://doi.org/10.52548/ITZE5668

P.S.: All you want to know about advanced recycling technologies and renewable chemicals, building-blocks, monomers, and polymers based on recycling: Hear about it at the Advanced Recycling Conference (ARC), 28-29 November 2023, Cologne, Germany (hybrid event).

-

Mimicking Nature The PHA Industry Landscape Latest trends and 28 producer profiles

Markets & Economy

59 Pages

2022-03

1,500 € – 8,000 €Price range: 1,500 € through 8,000 € ex. tax

Plus 19% MwSt.Select

licenceNatural PHAs are a class of materials that exist in nature for over millions of years. These materials are both bio-based and biodegradable, similar to other natural materials such as cellulose, proteins and starch. Natural PHAs are produced by an extensive variety of microorganisms through bacterial fermentation. Due to its high performance, biocompatibility, biodegradability and green credentials, the PHA family has a large design space and accommodates a wide range of market applications, as a broad variety of different polymers can be produced and blended. The potential of PHAs is enormous.

The report is a must-read for all those interested in the very latest in PHAs, as developers, producers or, above all, users. The information on the companies described has been checked with each of them and is state-of-the-art for February 2022.

Author of “Mimicking Nature” is Prof. Jan Ravenstijn, who has been working intensively on the topic of PHAs for 20 years, is the author of numerous publications and co-founder of the PHA industry association GO!PHA (www.gopha.org). The report is a joint publication of GO!PHA and nova-Institute (www.nova-institute.eu). -

Bio-based Naphtha and Mass Balance Approach – Status & Outlook, Standards & Certification Schemes

Markets & Economy

48 Pages

2021-03

850 € – 3,500 €Price range: 850 € through 3,500 € ex. tax

Plus 19% MwSt.Free ShippingPress

release Select

licenceNew report on alternative, non-fossil naphtha with the first comprehensive overview of technology, producers, plants and users

Bio-based naphtha has been available on the market for a few years now. In Europe, about 150,000 tonnes are already used annually, mainly for polymer production. As soon as the political-economic framework conditions are right, this number could quickly increase to several million tonnes, which have flowed into the HVO (hydrotreated or hydrogenated vegetable oils) biodiesel market so far. These fuels differ only slightly from fossil-based naphtha in their chemical composition. The report presents 17 companies worldwide with capacities ranging from a few thousand tonnes per year to 3 million tonnes. There are currently plans for 50 new or expanded plants.

-

Carbon dioxide (CO2) as chemical feedstock for polymers – technologies, polymers, developers and producers

Markets & Economy

100 Pages

2021-01

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceCompletely revised and extended third version of nova’s technology and trend report “Carbon Dioxide (CO2) as Chemical Feedstock for Polymers – Technologies, Polymers, Developers and Producers” available

The nova report addresses the polymer industry, brands, technology scouts, investors, and policy makers. The report provides 100 pages of information around CO2 utilisation for chemical building blocks and polymers.

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2020 – 2025

Markets & Economy

338 Pages

2021-01

100 € – 500 €Price range: 100 € through 500 € ex. tax

Plus 19% MwSt.Press

release Select

licenceReport on the global bio-based polymer market 2020 – A deep and comprehensive insight into this dynamic market

The year 2020 was a promising year for bio-based polymers: Sold out PLA in 2019 has led to the installation of increased capacities, PE and PP made from bio-based naphtha are breaking ground and future expansion for bio-based polyamides as well as for PBAT, PHAs and casein polymers is on the horizon. A lower production is only observed for bio-based PET.

![Carbon dioxide (CO2) as chemical feedstock for polymers – technologies, polymers, developers and producers [Digital]](https://renewable-carbon.eu/publications/wp-content/uploads/2021/01/TRCCU-1-100x141.png)

![Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2020 – 2025 [Digital]](https://renewable-carbon.eu/publications/wp-content/uploads/2021/01/Bio-based-building-blocks-2025-100x141.png)