Showing 41–60 of 286

-

331 Downloads

2023-02

FREE

331

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

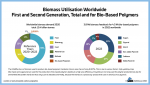

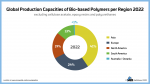

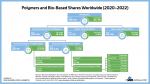

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

Global Production Capacities of Bio-based Polymers per region 2022 (PNG)

Markets & Economy

1 Page

255 Downloads

255 Downloads

2023-02

FREE

255

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

510 Downloads

2023-02

FREE

510

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

164 Downloads

2023-02

FREE

164

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

Shares of the produced bio-based polymers in different market sements in 2022 (PNG)

Markets & Economy

1 Page

290 Downloads

290 Downloads

2023-02

FREE

290

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

354 Downloads

2023-02

FREE

354

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2022-2027 (PDF)

Markets & Economy

387 Pages

2023-02

1,000 € – 3,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

351 Downloads

2023-02

FREE

351

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2022-2027 – Short Version (PDF)

Markets & Economy

28 Pages

1685 Downloads

1685 Downloads

2023-02

FREE

1685

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

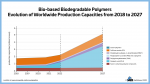

Bio-based biodegradable polymers – Evolution of worldwide production capacities 2018 to 2027 (PNG)

Markets & Economy

1 Page

487 Downloads

487 Downloads

2023-02

FREE

487

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

554 Downloads

2022-10

FREE

Free Shipping554

DownloadsThe new nova-Institute’s market report commissioned by the Bio-based Industries Consortium (BIC) shows macroeconomic effects of the European Bioeconomy in the period from 2008 to 2019. Using data from Eurostat and, where required, nova-Institute’s estimated bio-based shares, turnover and employment numbers of the bioeconomic sectors have been calculated. Even though the latest numbers no longer include the UK, the EU’s bioeconomy turnover remained stable, which has resulted in an increase of around 25% since 2008.

-

Overall turnover and employment of the bioeconomy and its bio-based industries in the EU-27 in 2019

Markets & Economy

1 Page

115 Downloads

115 Downloads

2022-10

FREE

115

DownloadsThe new nova-Institute’s market report commissioned by the Bio-based Industries Consortium (BIC) shows macroeconomic effects of the European Bioeconomy in the period from 2008 to 2019. Using data from Eurostat and, where required, nova-Institute’s estimated bio-based shares, turnover and employment numbers of the bioeconomic sectors have been calculated. Even though the latest numbers no longer include the UK, the EU’s bioeconomy turnover remained stable, which has resulted in an increase of around 25% since 2008.

This graphic shows the overall turnover and employment of the bioeconomy and its bio-based industries in the EU-27 in 2019.

-

nova-paper #16: The Biomass Utilisation Factor (BUF)

Markets & Economy, Policy, Sustainability & Health

62 Pages

1295 Downloads

1295 Downloads

2022-06

FREE

1295

DownloadsThe Biomass Utilisation Factor (BUF) is a new metric combining cascading use and production efficiency into one indicator to investigate the circularity of materials for the circular bioeconomy. Cascading use captures the repeated use of the original biomass, either for the same or a different purpose. Production efficiency looks at how much of the biomass input is actually transformed into useful products or materials.

The BUF can serve not only as an indicator for the circular economy principle of keeping materials in use, but also act as an efficient tool for stakeholders and policy makers to identify options that maximize biomass utilisation and keep materials in use for longer. In light of recent political developments in Europe, the BUF can serve as a tool that provides additional insights for achieving sustainable carbon cycles or help to respect the cascading principle of biomass utilisation.

-

Die neue Tugend: Kunststoff im Kreislauf (PDF)

Markets & Economy, Policy, Sustainability & Health

1 Page

275 Downloads

275 Downloads

2022-05

FREE

275

DownloadsRohstoffe werden knapp, sowohl Metalle wie auch Mineralien. Nur erneuerbarer Kohlenstoff ist praktisch unbegrenzt verfügbar. Daher werden Kunststoffe in Zukunft noch wichtiger sein als heute, und deshalb müssen sie so nachhaltig wie möglich gestaltet werden: aus erneuerbarem Kohlenstoff und voll recycelbar.

-

Biokomposite bieten Alternativen aus erneuerbaren Materialien (PDF)

Markets & Economy

6 Pages

190 Downloads

190 Downloads

2022-05

FREE

190

DownloadsZahlreiche Bioverbundwerkstoffe können heutzutage problemlos in einem breiten Spektrum von Anwendungen eingesetzt werden und haben als gleichwertige Alternative zu herkömmlichen Kunststoffen den Massenmarkt erreicht.

-

Augen auf bei Plastikverboten – zurück zur wissenschaftsbasierten Materialpolitik (PDF)

Markets & Economy

2 Pages

92 Downloads

92 Downloads

2022-05

FREE

92

DownloadsZahlreiche Bioverbundwerkstoffe können heutzutage problemlos in einem breiten Spektrum von Anwendungen eingesetzt werden und haben als gleichwertige Alternative zu herkömmlichen Kunststoffen den Massenmarkt erreicht.

-

Biocomposites offer alternatives from renewable materials (PDF)

Markets & Economy

6 Pages

608 Downloads

608 Downloads

2022-05

FREE

608

DownloadsNowadays, numerous biocomposites can easily be used in a wide range of applications and have reached the mass market as an equivalent alternative to conventional plastics. The second part of the document is in English.

-

2022-05

50 € ex. tax

Plus 19% MwSt.Press

release Add to

cartThe proceedings of the Renewable Materials Conference (10-12 May 2022, https://renewable-materials.eu) contain conference presentations, the conference journal, and the press release of the three winners of the innovation award “Renewable Material of the Year”!

-

Conference on CO2-based Fuels and Chemicals 2022 Proceedings

Markets & Economy, Policy, Sustainability & Health, Technology

2022-04

50 € ex. tax

Plus 19% MwSt.Press

release Add to

cartThe proceedings of the Conference on CO2-based Fuels and Chemicals 2022 (23-24 March 2022, https://co2-chemistry.eu) contain 26 presentations, the conference journal, and the press release of the three winners of the Innovation Award “Best CO2 Utilisation 2022“.

-

Mimicking Nature The PHA Industry Landscape Latest trends and 28 producer profiles

Markets & Economy

59 Pages

2022-03

1,500 € – 8,000 € ex. tax

Plus 19% MwSt.Select

licenceNatural PHAs are a class of materials that exist in nature for over millions of years. These materials are both bio-based and biodegradable, similar to other natural materials such as cellulose, proteins and starch. Natural PHAs are produced by an extensive variety of microorganisms through bacterial fermentation. Due to its high performance, biocompatibility, biodegradability and green credentials, the PHA family has a large design space and accommodates a wide range of market applications, as a broad variety of different polymers can be produced and blended. The potential of PHAs is enormous.

The report is a must-read for all those interested in the very latest in PHAs, as developers, producers or, above all, users. The information on the companies described has been checked with each of them and is state-of-the-art for February 2022.

Author of “Mimicking Nature” is Prof. Jan Ravenstijn, who has been working intensively on the topic of PHAs for 20 years, is the author of numerous publications and co-founder of the PHA industry association GO!PHA (www.gopha.org). The report is a joint publication of GO!PHA and nova-Institute (www.nova-institute.eu).