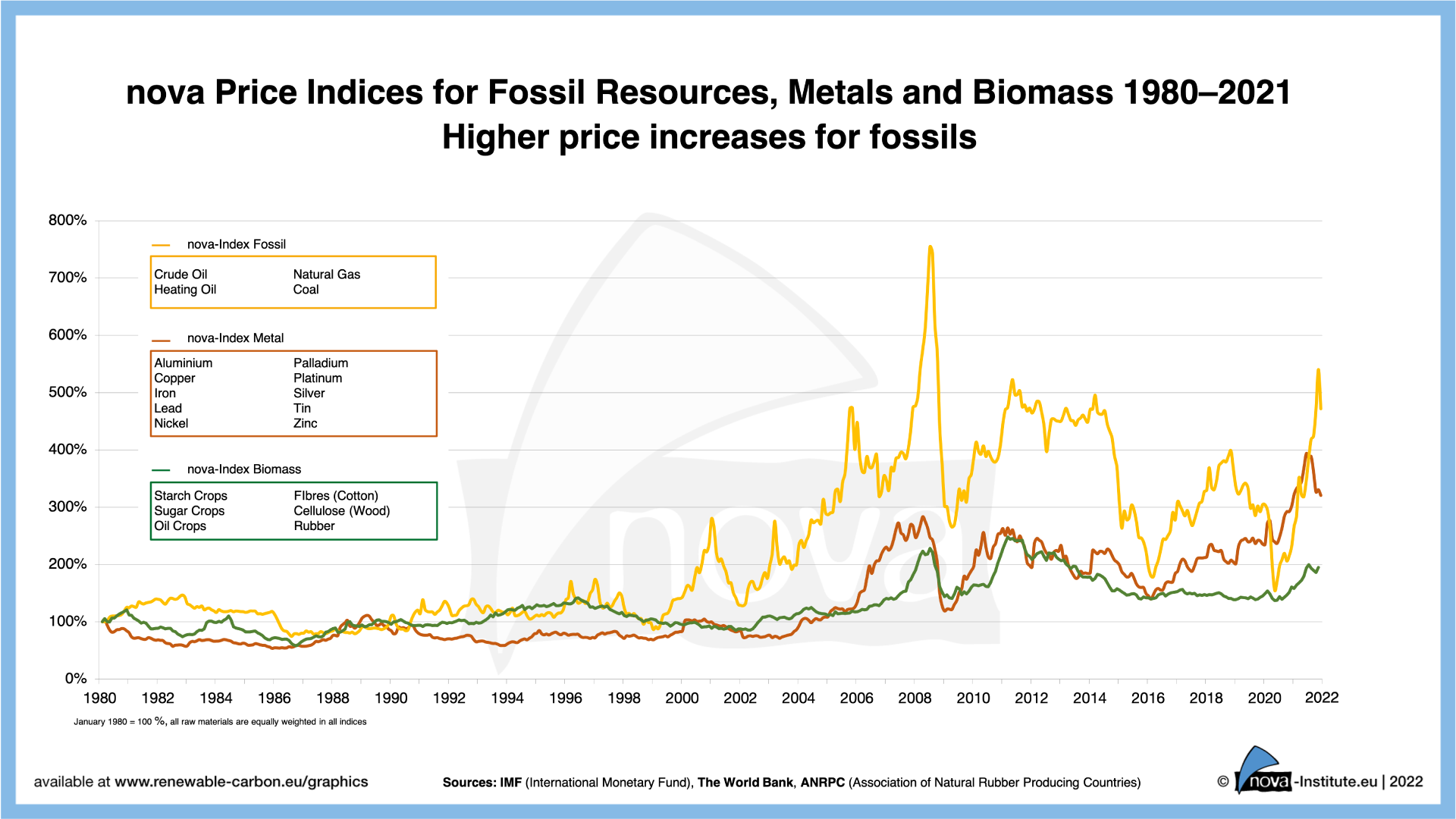

This chart by nova-Institute shows the price development of basic commodities since 1980. The raw materials have been grouped into three different price indices depending on their type of feedstock – namely fossil, metal and renewable raw materials. The index for fossil raw materials, for example, shows the price development of oil and gas, the biomass index includes the main biogenic resources from agriculture and forestry.

Fossil Resources

If we look at the recent development of the respective indices, we can see that the price index of fossil resources in particular has recorded a steady increase. A likely reason for this increase is that, due to the rather low price level of oil in recent years, only little investment was put into maintenance and increase of crude oil production. Additionally, some of the more relevant suppliers went bankrupt during this period. As a result, even in times of increasing demand the supply can only be increased slowly. This leads to current high oil prices and high profits for oil companies, which is reflected in steadily rising share prices against the general trend of the stock market.

At the beginning of 2021, the decision by OPEC and its partners to restrict oil production led to an additional undersupply of the market, which caused prices to rise. In July, the OPEC Plus Group agreed on a gradual increase in oil output. Together, they would put 400,000 barrels/day more on the market every month and gradually increase supply. But despite the increased production rates, overall supply was still insufficient and many industrialised countries were struggling with low stocks of fossil fuels throughout autumn 2021. The economy was slowed down by supply chain problems and massive bottlenecks at container ports. Prices continued to soar, especially for natural gas and coal. The spread of the Omicron variant of Covid19 at the end of November fuelled new concerns among market participants. This and the existing supply chain problems put pressure on the economic recovery in many countries. Only around the end of the year some optimism was spreading through the market, based on the realisation that the new Omicron variant would likely not lead to fatal consequences.

Metals

Besides fossil fuels, prices for metals also rose significantly last year. In this sector, especially prices for industrial metals like aluminium, nickel and copper reached record highs. Analysts identify the main cause of the rising prices in the growing demand following the previous Covid19 slump. But there are also influences on the supply side, such as increased energy prices and logistical problems that created supply gaps in various markets and led to increased prices. For example, numerous aluminium smelters across Europe had cut back or even interrupted their production, which in turn led to low supply in the face of continued high demand. Even though the price of industrial metals seems to have spiked and reached a consolidation level at the end of 2021 (i.e., a break in the strong upward trend), analysts expect that metal prices will remain high due to the continuing high energy prices.

For some particular metals, such as copper, nickel and palladium, further price increases are anticipated, because they are elemental to build a sustainable infrastructure. In 2022, these metals could reach new price highs due to high demand from e.g. the automotive industry.

However, the increasing electrification of the transport sector can play a crucial role in the future price development. Platinum and palladium are mainly needed for catalytic converters in petrol engines and will therefore retain importance in gasoline, diesel and hybrid cars. Platinum is also required for fuel cells. But neither precious metal is required for purely electric vehicles, so that the currently rising demand for these metals is likely to fall in the long term.

Biomass

Looking at the biomass index, biomass prices were able to decouple slightly from the other index and the hefty price increases of fossil fuels and metals. The biomass index shows a much more moderate increase overall, which improves the competitive situation of biomass also in the chemical industry.

However, prices for some specific biogenic feedstocks such as wood are increasing worldwide. Wood is more and more becoming a scarce commodity and wood prices have been rising continuously in recent years. Their impact is also reflected in the price index for biomass, although the hefty increase of wood prices is toned down by the price developments of other agricultural resources.

For the upcoming years, climate change, a lack of storage infrastructure and disrupted global supply chains pose potential threats to the price stability of biomass.

Sources

https://www.tecson.de/historische-oelpreise.html

https://www.boerse-frankfurt.de/nachrichten/8bc5816d-dff2-4ed4-804f-c7b353149c3a

https://www.handelsblatt.com/finanzen/maerkte/devisen-rohstoffe/rohstoffe-preise-fuer-oel-und-industriemetalle-setzen-zu-neuem-hoehenflug-an/27972506.html

All graphics from nova can be found here: https://renewable-carbon.eu/publications/?search=1&publication-type=graphics

Author

Olaf Porc, Michael Carus

Source

nova-Institute, press release, 2022-02.

Supplier

nova-Institut GmbH

Organization of the Petroleum Exporting Countries (OPEC)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals