Showing 21–40 of 235

-

2025-04

FREE

Plus 19% MwSt.Free Shipping0

More

Downloads

infoDas Rheinische Revier soll im Zuge des Kohleausstiegs zu einer „Modellregion Bioökonomie“ entwickelt werden. Der dadurch steigende Biomassebedarf könnte negative Auswertungen haben und muss daher gründlich untersucht werden. Aus diesem Grund hat das LANUV mit Unterstützung des nova-Instituts im Zeitraum vom 01.03.2023 bis 28.02.2025 das Projekt „Biomassepotenziale Rheinisches Revier“ durchgeführt. Ziel des Projekts war es, Grundlagen und Instrumente zu schaffen, um zu einer nachhaltigen Nutzung von Biomasse aus der Land- und Ernährungswirtschaft in der Region beizutragen.

-

Cellulose Fibres Conference 2025 (Proceedings, PDF)

Markets & Economy, Policy, Sustainability & Health, Technology

2025-03

150 € ex. tax

Plus 19% MwSt.Press

release Add to

cartThe Cellulose Fibres Conference 2025 – New with Biosynthetics! (https://cellulose-fibres.eu, 12-13 March 2025, Cologne, hybrid) covered the entire value chain of the sustainable textile industry, from lignocellulose, pulp, cellulose fibres such as rayon, viscose, modal or lyocell and new developments to a wide range of applications:

Textiles from renewable fibres, non-wovens such as wet wipes, as well as areas such as composites, hygiene, packaging or nano cellulose in the food industry. This year, for the first time, the conference included a dedicated session on biosynthetics – a promising area to complement the alternative for bio-based textiles. Deep insights have been offered into the future of cellulose fibres, which fits perfectly with the current shift towards circular economy, recycling and sustainable carbon cycles.The Cellulose Fibres Conference Proceedings include all released conference presentations, the conference journal, sponsor documents and the conference press release.

-

Evaluating LCA Approaches and Methodologies for Renewable Carbon Sources Report 1 of 3 – Renewable Carbon in LCA Guidelines (March 2025) (PDF)

Markets & Economy, Policy, Sustainability & Health

145 Pages

982 Downloads

982 Downloads

2025-03

FREE

Free Shipping982

DownloadsRenewable Carbon in LCA Guidelines (146 pages) evaluates methodological choices which impact LCAs for products containing renewable carbon in existing LCA frameworks and guidelines. The study specifically examines the similarities and differences in the methodological choices of guidelines, as well as the implications of these methodological aspects on the resulting LCA outcomes.The frameworks were selected based on their relevance and legitimacy in the industry, academia and policy field, and include: ISO 14040/44, ISO 14067, GHG Protocol Product Standard, PACT’s Pathfinder Framework, the PCF Guideline for the chemical industry by Together for Sustainability (TfS), EPD for the construction industry – ISO 14025 and EN 15804, the Renewable Energy Directive, the Product Environmental Footprint (PEF) and the JRC’s plastics LCA methodology. One field with a particularly large methodological freedom is recycling.

This report is the first report of a larger RCI project on LCA methodology, which includes two additional publications:

Report 2 of 3 – Renewable Carbon in Recycling Situations

Report 3 of 3 – Non-technical SummaryPlease find these additional reports by following the respective links at the bottom of this page.

DOI No.: https://doi.org/10.52548/VCYM7822

-

Evaluating LCA Approaches and Methodologies for Renewable Carbon Sources Report 2 of 3 – Renewable Carbon in Recycling Situations (March 2025) (PDF)

Markets & Economy, Policy, Sustainability & Health

37 Pages

679 Downloads

679 Downloads

2025-03

FREE

Free Shipping679

DownloadsThis report focuses on renewable carbon in recycling scenarios and the key challenges in LCA and carbon footprint assessments. It examines system boundaries, allocation methods, and biogenic carbon accounting approaches, highlighting their influence on sustainability evaluations. The report emphasises the cut-off and avoided-burden approaches for recycling while recommending the -1/+1 method for biogenic carbon transparency. However, it also identifies contradictions between LCA results and broader sustainability goals, such as the EU waste hierarchy, which prioritises recycling. To address these inconsistencies, the report suggests integrating LCA with additional sustainability metrics like land use and recyclability. Ultimately, refining these methodologies will enhance the accuracy and reliability of environmental assessments for bio-based and recycled materials.

This report is the second report of a larger RCI project on LCA methodology, which includes two additional publications:

Report 1 of 3 – Renewable Carbon in LCA Guidelines

Report 3 of 3 – Non-technical SummaryPlease find these additional reports by following the respective links at the bottom of this page.

DOI No.: https://doi.org/10.52548/QTVU8642

-

Evaluating LCA Approaches and Methodologies for Renewable Carbon Sources Report 3 of 3 – Non-technical Summary (March 2025) (PDF)

Markets & Economy, Policy, Sustainability & Health

15 Pages

876 Downloads

876 Downloads

2025-03

FREE

Free Shipping876

DownloadsThis Non-technical Summary (15 pages),highlights main insights into the project results and states key take-aways for policy-makers.

It compares several frameworks, such as ISO 14040, Product Environmental Footprint (PEF), and GHG Protocol, finding both commonalities and critical differences in areas like biogenic carbon accounting and recycling assessment. The study identifies significant methodological flexibility in existing frameworks, leading to inconsistencies in LCA results and challenges in standardisation. Key issues include differing treatment of carbon capture and utilisation (CCU), direct air capture (DAC), and allocation of environmental burdens in multifunctional processes. Policy recommendations emphasise the need for harmonisation, improved biogenic carbon accounting, and clear guidance on emerging technologies like DAC and mass balance attribution. Overall, the study calls for refining LCA methodologies to ensure fair comparison between renewable and fossil-based carbon solutions.

This report is the third report of a larger RCI project on LCA methodology, which includes two additional publications:

Report 1 of 3 – Renewable Carbon in LCA Guidelines

Report 2 of 3 – Renewable Carbon in Recycling SituationsPlease find these additional reports by following the respective links at the bottom of this page.

DOI No.: https://doi.org/10.52548/ZEKY1803

-

Core Elements of LCA for Renewable Carbon Solutions (PNG)

Policy, Sustainability & Health

1 Page

116 Downloads

116 Downloads

2025-03

FREE

Free Shipping116

DownloadsSeveral methodological aspects are relevant for LCA and carbon footprints in general and for products containing renewable carbon in particular.

-

Bio-based Polymers Worldwide (PDF)

Markets & Economy, Policy, Sustainability & Health

5 Pages

805 Downloads

805 Downloads

2025-02

FREE

Free Shipping805

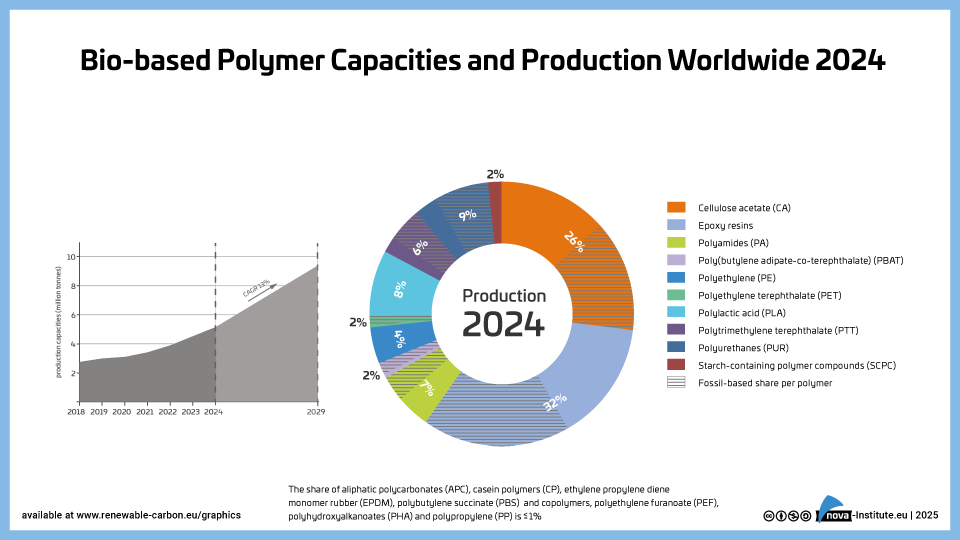

DownloadsExpert insight into capacity developments, investments and new policy frameworks:- Firstly, global capacity for bio-based polymers will grow strongly over the next five years, much faster than for fossil-based polymers

- Secondly, investments in new capacity will take place in China, Europe, the Middle East, and the US

- Thirdly, investment in bio-based polymer capacities is mainly driven by policy frameworks that create demand.

-

Bio-based-Polymer-Production-and-Bio-based-shares-2024 (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

179 Downloads

179 Downloads

2025-02

FREE

179

Downloads -

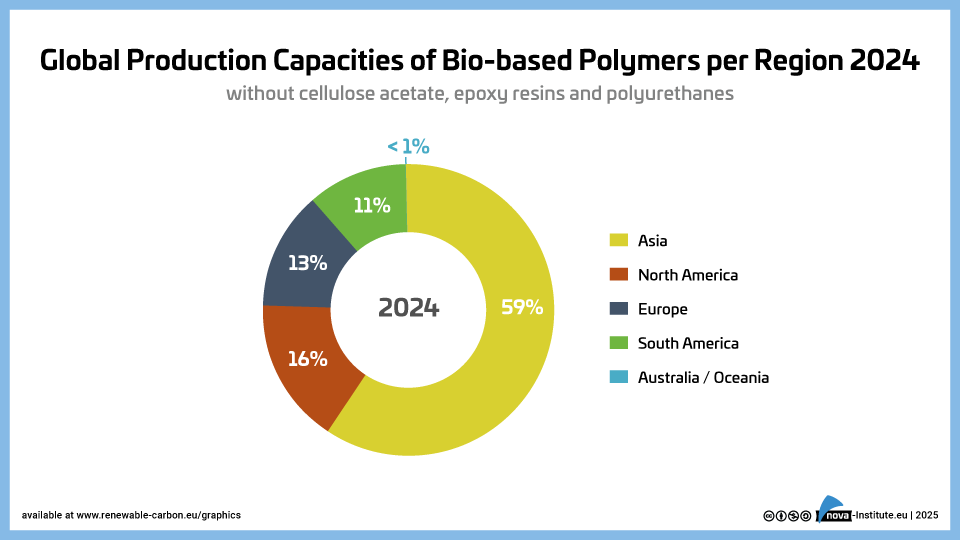

Global-Production-Capacities-of-Bio-based-Polymers-per-Region-2024 (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

40 Downloads

40 Downloads

2025-02

FREE

40

Downloads -

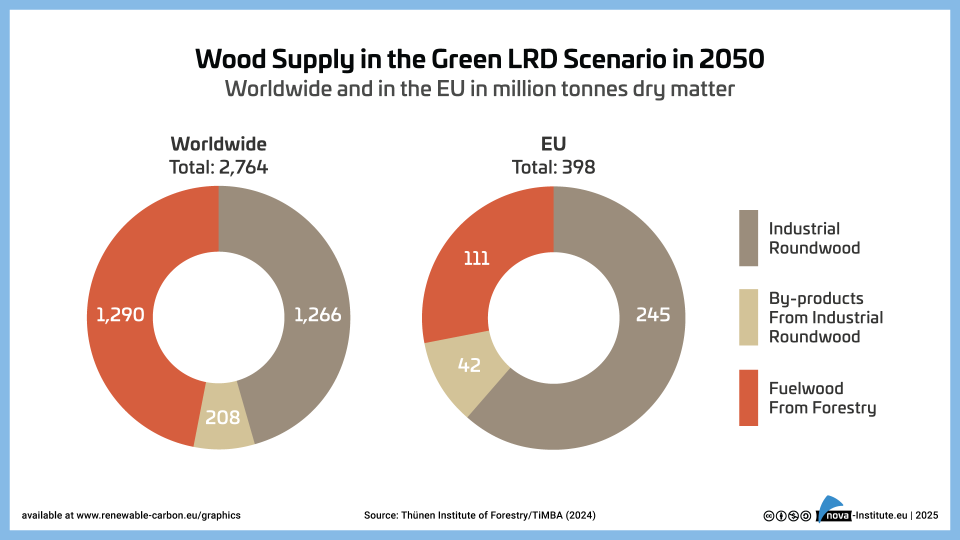

Wood Supply in the Green LRD Scenario in 2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

9 Downloads

9 Downloads

2025-02

FREE

9

Downloads -

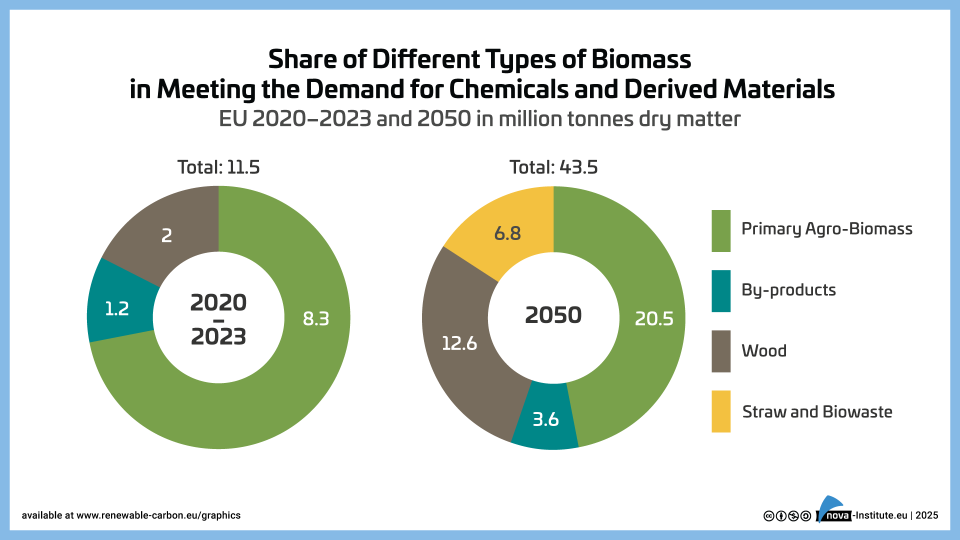

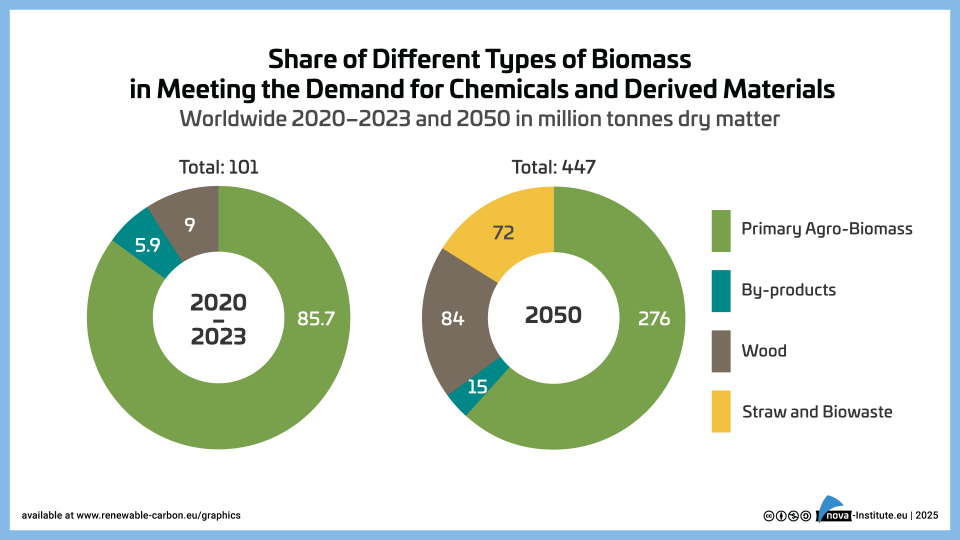

Share of Different Types of Biomass Worldwide 2023-2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

58 Downloads

58 Downloads

2025-02

FREE

58

Downloads -

Share-of-Different-Types-of-Biomass-EU-2023–2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

31 Downloads

31 Downloads

2025-02

FREE

31

Downloads -

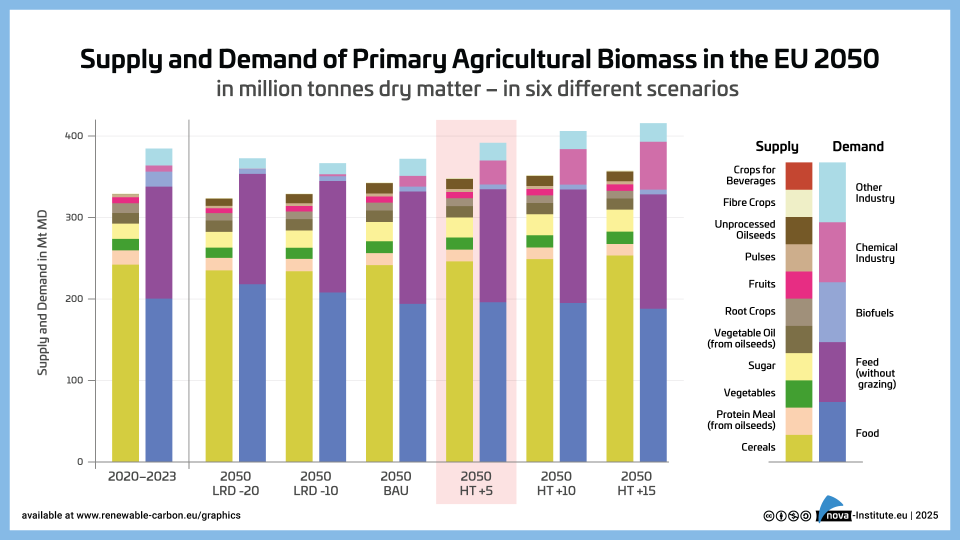

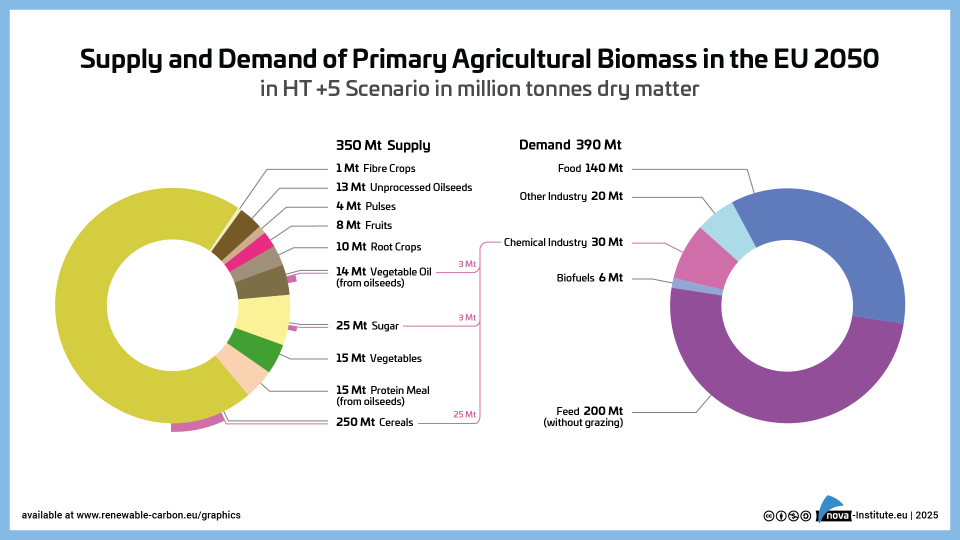

Supply and Demand of Agriculture Biomass in the EU 2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

32 Downloads

32 Downloads

2025-02

FREE

32

Downloads -

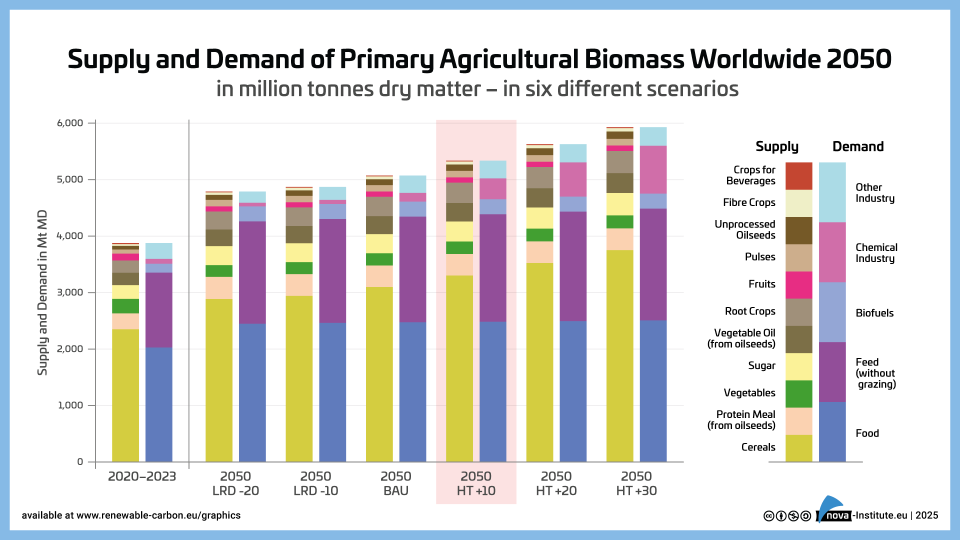

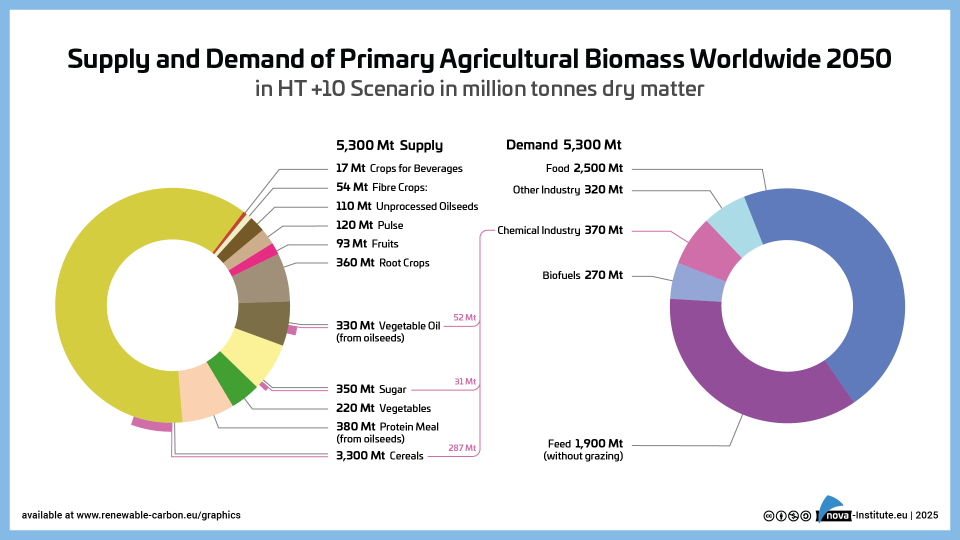

Supply and Demand of Agriculture Biomass Worldwide 2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

37 Downloads

37 Downloads

2025-02

FREE

37

Downloads -

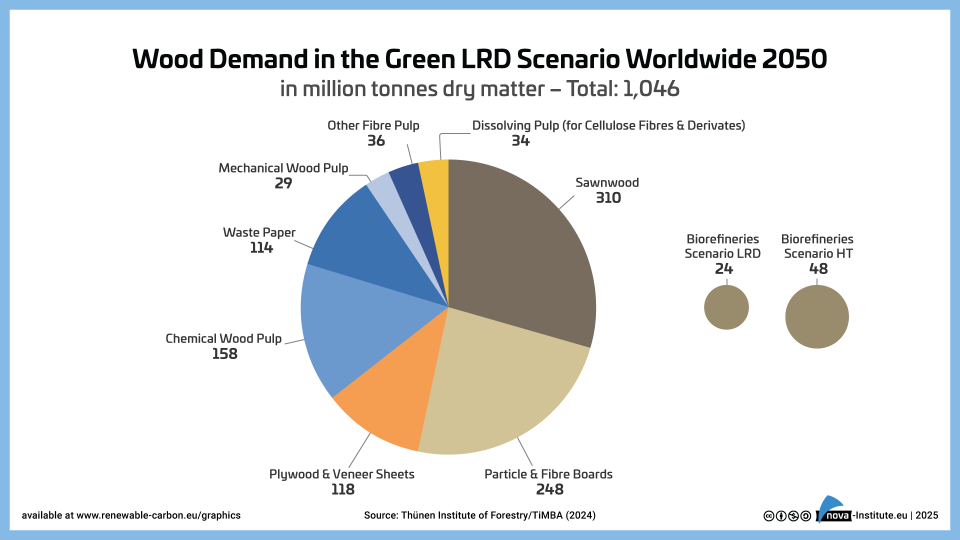

Wood Demand in the Green LRD Scenario Worldwide 2050 – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

14 Downloads

14 Downloads

2025-02

FREE

14

Downloads -

Supply and Demand of Agricultural Biomass in the EU 2050 in HT +5 Scenario – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

25 Downloads

25 Downloads

2025-02

FREE

25

Downloads -

Supply and Demand of Agricultural Biomass Worldwide 2050 in HT +10 Scenario – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

38 Downloads

38 Downloads

2025-02

FREE

38

Downloads -

Is there Enough Biomass to Defossilise the Chemicals and Derived Materials Sector by 2050? – A Joint BIC and RCI Scientific Background Report (PDF)

Markets & Economy, Policy, Sustainability & Health

41 Pages

1852 Downloads

1852 Downloads

2025-02

FREE

Free Shipping1852

DownloadsThis reports presents the findings of a joint project of the Bio-based Industries Consortium (BIC) and the Renewable Carbon Initiative (RCI), which focuses on whether agricultural and woody biomass combined sustainably provide enough biomass to meet 20% of the future carbon demand of the chemical and derived materials industries in 2050 (up from 5.5% (EU27) and 10% (global) in 2023).

This leading question was investigated with professional experts to model a business-as-usual, a low resource depletion, and a high-tech scenario to better analyse the possible ranges of biomass availability under different developments.

Agriculture: By 2050, under the BAU scenario, production is projected to increase by 31% to 5.07 billion tonnes. Cereals increase by 32% to 3.1 billion tonnes, sugar by 40% to 340 million tonnes and vegetable oils by 45% to 317 million tonnes. In the Green LRD scenarios, production is projected to increase by 24–26%, and in the Green HT scenarios by 38–53% – compared to 31% in the BAU scenario.

Forestry: Global supply and demand of industrial roundwood (coniferous and non-coniferous) will increase by an estimated 38% between 2020 and 2050, from 0.9 to 1.3 billion tdm. The largest increase in supply is expected in Asia (69%), including China and Russia, but a significant increase of 32% is also seen for Europe.

The report concludes that sustainably meeting 20% of total carbon demand of the chemicals and derived materials sector in 2050 via biomass seems a realistic and achievable estimate.

DOI No.: https://doi.org/10.52548/PIRL6916

-

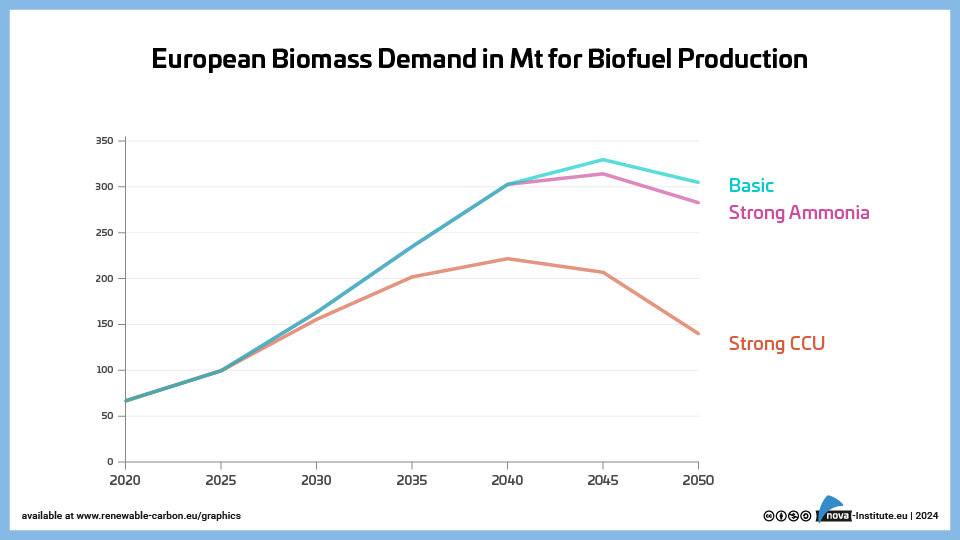

EU and Global: Biomass Demand for Transport Fuels, Aviation and Shipping up to 2050 and Implications for Biomass Supply to the Chemical Sector (PDF)

Markets & Economy, Policy, Sustainability & Health

44 Pages

1270 Downloads

1270 Downloads

2025-01

FREE

Free Shipping1270

DownloadsThe Renewable Carbon Initiative’s Scientific Background Report explores three potential future scenarios for carbon-based fuel demand up to 2050 under current policy frameworks. It predicts a sharp rise in the demand for second-generation biomass biofuels, driven primarily by increasing quotas for aviation and shipping fuels. This growth raises concerns about ecological and resource sustainability and creates challenges for sectors like chemicals and materials, which rely on renewable carbon to reduce fossil dependency. Without similar regulatory incentives, these sectors may face limited access to critical feedstocks like biomass and captured carbon.

The report highlights that while bio-based and synthetic fuel production could indirectly benefit the chemical industry through by-products, competition with the fuel sector poses significant obstacles.The report includes 11 tables, 9 graphics, and a detailed overview of EU fuel regulations. Though focused on Europe, it also provides global insights, making it a valuable resource for stakeholders in biomass and CO2 utilisation sectors.

-

European Biomass Demand in Mt for Biofuel Production – Graphic (PNG)

Markets & Economy, Policy, Sustainability & Health

1 Page

31 Downloads

31 Downloads

2025-01

FREE

31

Downloads

Advanced Recycling Conference 2024 (Proceedings) [Digital]

Advanced Recycling Conference 2024 (Proceedings) [Digital]

![Cellulose Fibres Conference 2025 (Proceedings, PDF) [Digital]](https://renewable-carbon.eu/publications/wp-content/uploads/2020/05/21-01-07_RC-Publications-Cover-Proceedings_Cellulose-Fibres-100x141.png)