Showing 101–120 of 215

-

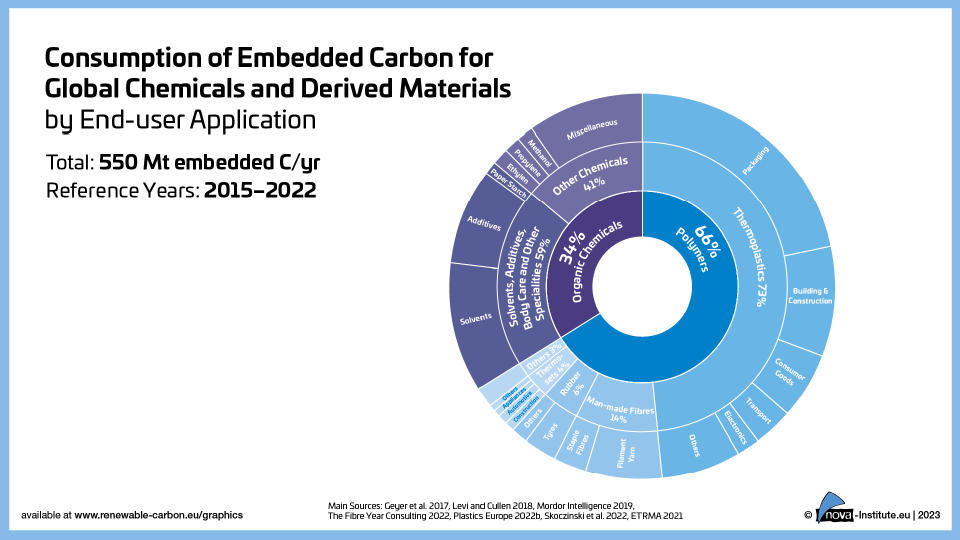

Consumption of Embedded Carbon for Global Chemicals and Derived Materials by End-user Application (PNG)

Markets & Economy, Policy

1 Page

125 Downloads

125 Downloads

2023-07

FREE

Free Shipping125

DownloadsFigure from the RCI Carbon Flows Report 2023

-

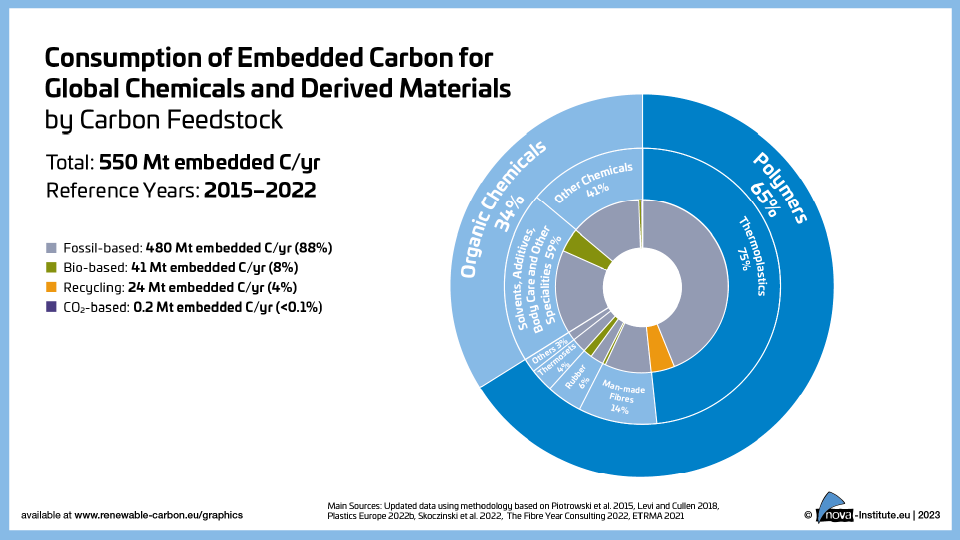

Consumption of Embedded Carbon for Global Chemicals and Derived Materials by Carbon Feedstock (PNG)

Markets & Economy, Policy

1 Page

120 Downloads

120 Downloads

2023-07

FREE

Free Shipping120

DownloadsFigure from the RCI Carbon Flows Report 2023

-

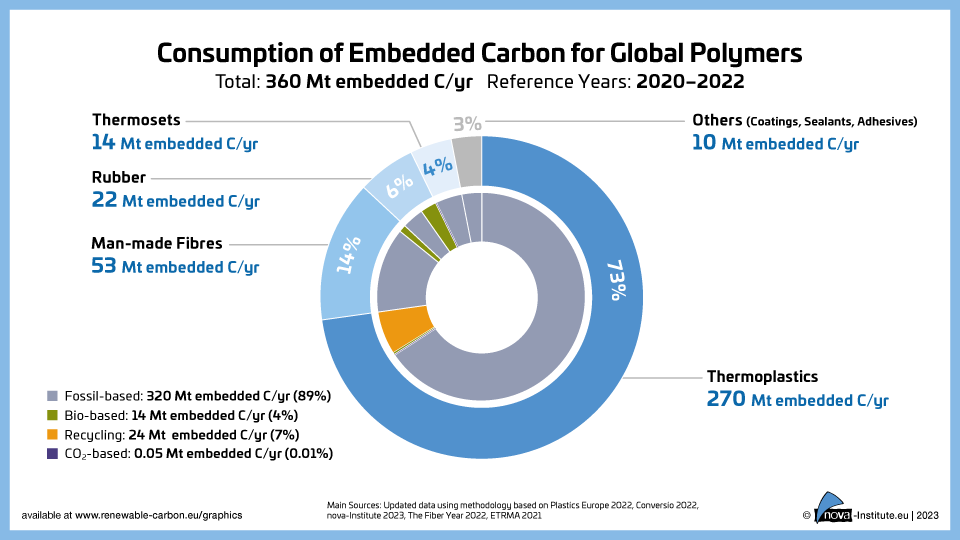

Consumption of Embedded Carbon for Global Polymers (PNG)

Markets & Economy, Policy

1 Page

134 Downloads

134 Downloads

2023-07

FREE

Free Shipping134

DownloadsFigure from the RCI Carbon Flows Report 2023

-

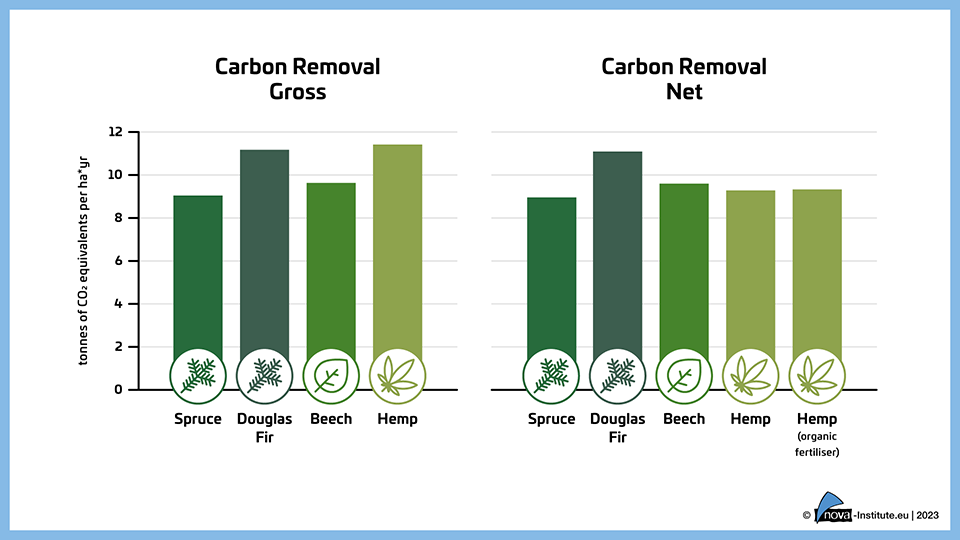

Gross and net carbon removal of hemp and wood per hectare and year (PNG)

Sustainability & Health

1 Page

86 Downloads

86 Downloads

2023-07

FREE

Free Shipping86

Downloads -

1378 Downloads

2023-07

FREE

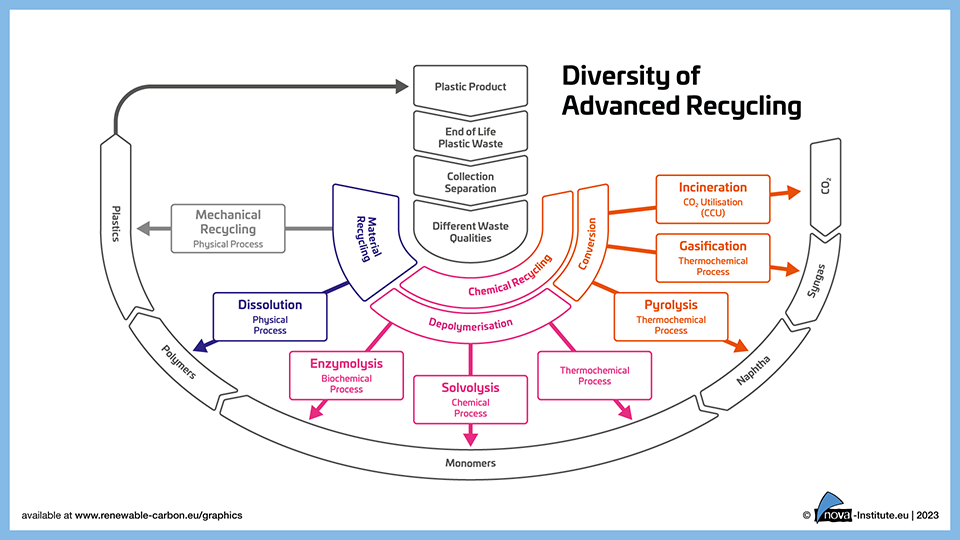

Free Shipping1378

DownloadsFull spectrum of available recycling technologies divided by their basic working principles and their products.

-

564 Downloads

2023-07

FREE

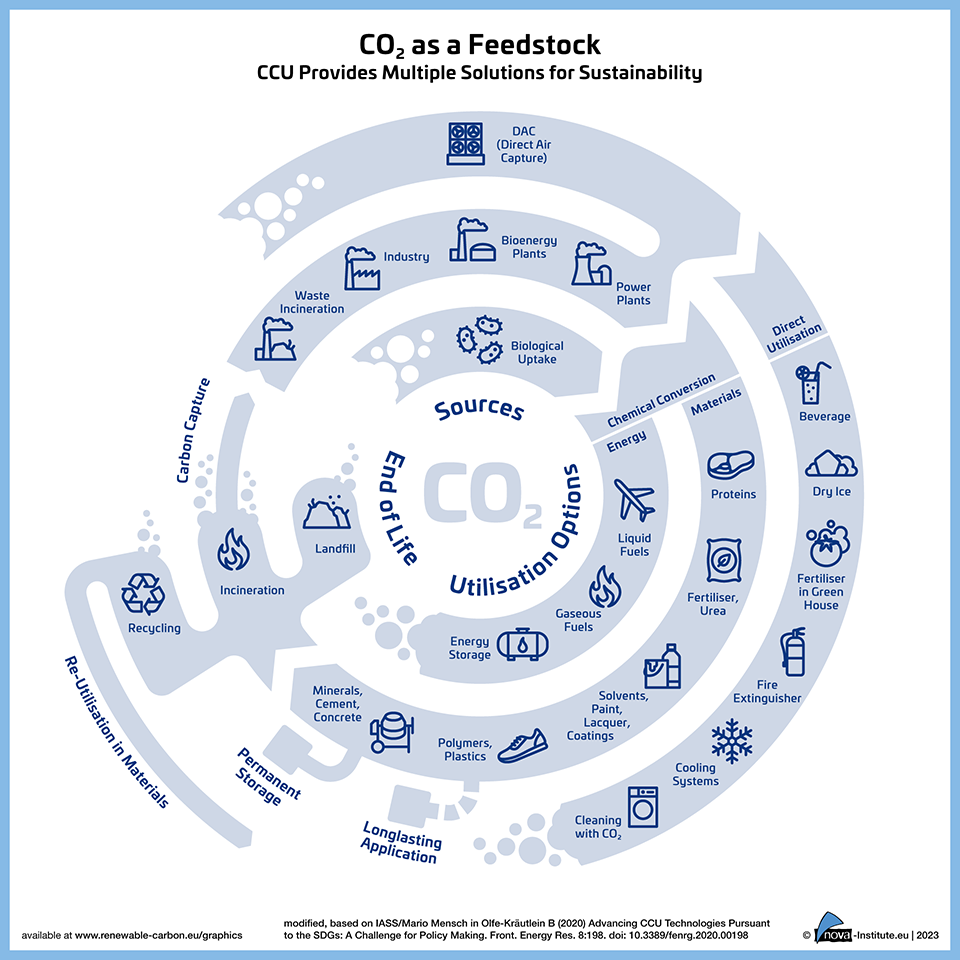

Free Shipping564

DownloadsCarbon Capture and Utilization (CCU) provides multiple solutions for sustainability

-

385 Downloads

2023-07

FREE

Free Shipping385

DownloadsThis poster shows examples of CO2-based products.

-

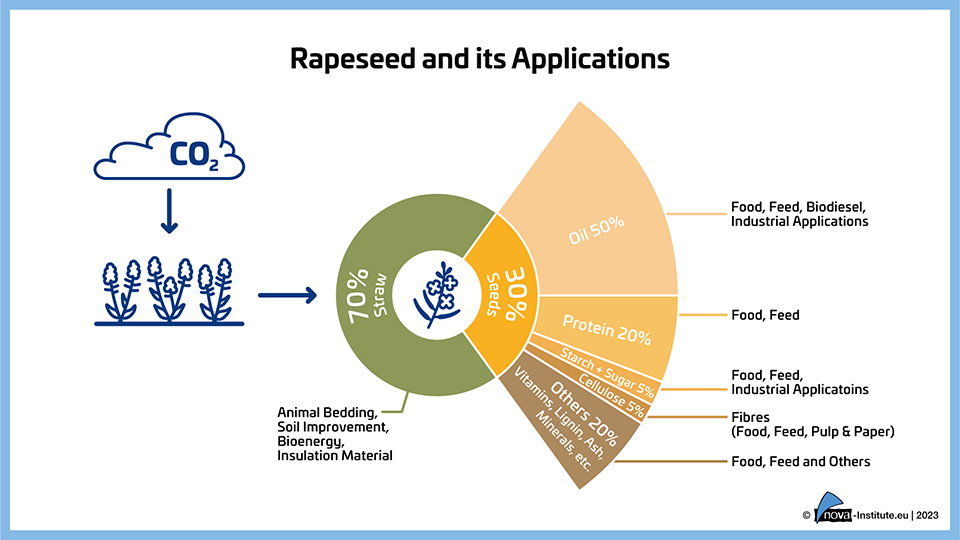

Rapeseed and its Applications (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

98 Downloads

98 Downloads

2023-06

FREE

98

Downloads -

Yield of Fermentable Sugars (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

153 Downloads

153 Downloads

2023-06

FREE

153

Downloads -

Graphic of the scientific paper „The Use of Food and Feed Crops for Bio-based Materials and the Related Effects on Food Security“ (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

116 Downloads

116 Downloads

2023-06

FREE

116

DownloadsPromoting Evidence-based Debates and Recognising Potential Benefits

The graphic shows the multiple potential benefits of using food and feed crops for bio-based materials, in terms of climate, land productivity, environment, farmers, market stability, feed security and food security.

- The climate wins – Bio-based materials are part of the solution to achieve climate change mitigation.

- Land productivity wins – The competition between applications is not for the type of crop grown, but for the land

- The environment wins – due to increased resource efficiency and productivity of food and feed crops.

- Farmers win – because they have more options for selling stock to different markets.

- Market stability wins – due to increased global availability of food and feed crops.

- Feed security wins – due to the high value of the protein-rich co-products of food and feed crops.

- Food security wins – due to the increased overall availability of edible crops that can be stored and flexibly distributed.

-

Wholesale Prices of Bioethanol and Wheat (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

85 Downloads

85 Downloads

2023-06

FREE

85

Downloads -

Global Harvested Agricultural and Grazed Biomass Demand by Sectors (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

152 Downloads

152 Downloads

2023-06

FREE

152

Downloads -

Embedded Carbon Demand for Main Sector (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

143 Downloads

143 Downloads

2023-06

FREE

143

Downloads -

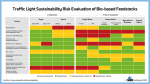

Traffic Light Sustainability Risk Evaluation of Bio-based Feedstocks (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

303 Downloads

303 Downloads

2023-06

FREE

303

Downloads -

Corn and its Applications (PNG)

Markets & Economy, Policy, Sustainability & Health, Technology

1 Page

126 Downloads

126 Downloads

2023-06

FREE

126

Downloads -

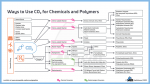

Ways to Use CO₂ for Chemicals and Polymers – Graphic (PNG)

Markets & Economy, Technology

1 Page

1110 Downloads

1110 Downloads

2023-04

FREE

Plus 19% MwSt.1110

Downloads -

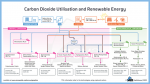

Carbon Dioxide Utilisation and Renewable Energy − Graphic (PNG)

Markets & Economy, Technology

1 Page

1538 Downloads

1538 Downloads

2023-04

FREE

1538

Downloads -

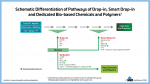

560 Downloads

2023-02

FREE

560

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

190 Downloads

2023-02

FREE

190

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323

-

Shares of the produced bio-based polymers in different market sements in 2022 (PNG)

Markets & Economy

1 Page

317 Downloads

317 Downloads

2023-02

FREE

317

DownloadsReport on the global bio-based polymer market 2022 – A deep and comprehensive insight into this dynamically growing market

The year 2022 was a promising year for bio-based polymers: Bio-based epoxy resin production is on the rise, PTT regained attractiveness after several years of constant capacities and PE and PP made from bio-based naphtha are being further established with growing volumes. Increased capacities for PLA are ongoing, after being sold out in 2019. Current and future expansions for bio-based polyamides as well as PHAs are on the horizon. And also, bio-based PET is getting back in the game.

DOI No.: https://doi.org/10.52548/CMZD8323