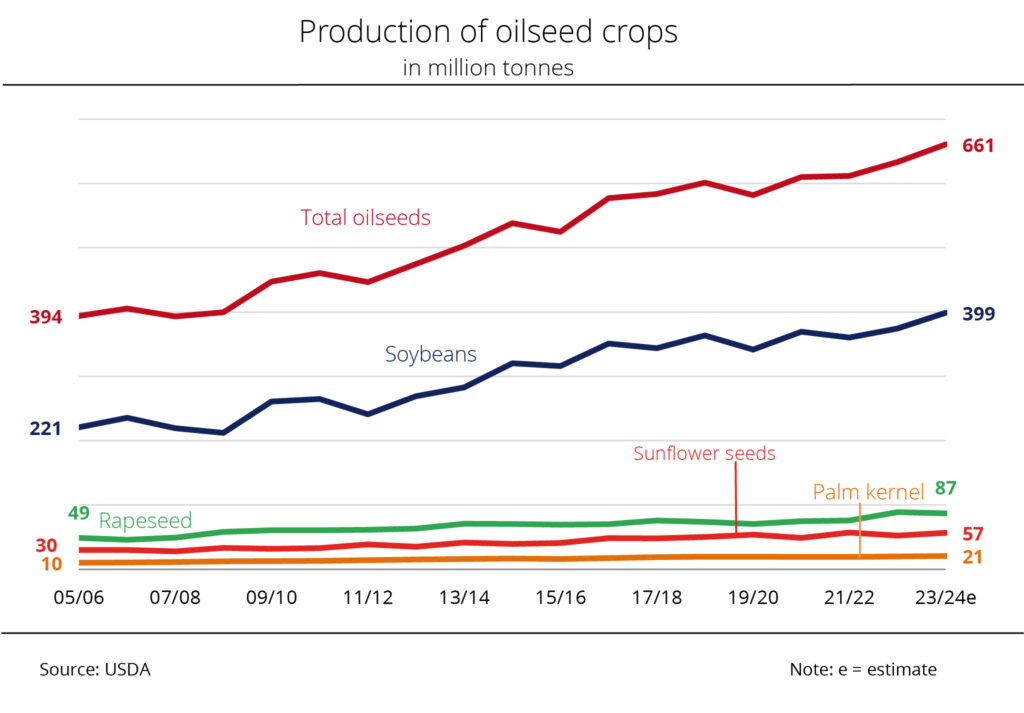

According to current USDA estimates, global production of oilseeds in the crop year 2023/24 is set to hit a peak of around 661.0 million tonnes, which would be up around 4 per cent year-on-year.

Global processing of oilseeds is also set to rise to a record high of 542.5 million tonnes, according to the most recent USDA outlook. This would be up around 19.1 million tonnes on the crop year 2022/23. Global ending stocks will presumably amount to 131.7 million tonnes, which would exceed the previous year’s level by 11.5 tonnes. Nevertheless, ending stocks are seen to be clearly below the 2018/19 season’s 134.0 million high. World trade in oilseeds will presumably drop 5 million tonnes to 196.8 million tonnes.

At 398.9 million tonnes, the current crop year’s soybean harvest is expected to be larger than ever before. Global output of sunflower seed is also seen to increase on the year, 8 per cent to 56.8 million tonnes. By contrast, world rapeseed production is expected to decline 2 per cent to 87.0 million tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), this outlook is based on declines in key rapeseed-producing countries, especially Australia. It should be noted that the USDA oilseed estimate also includes peanuts (approximately 50.4 million tonnes) and cottonseed (approximately 41.4 million tonnes), among other oilseeds.

The adequacy of global supply with soy protein is limited by the availability of cropland. China alone imported more than 100 million tonnes in 2022, which was one fourth of the global harvest and translates to a virtual area import of approximately 29 to 30 million hectares. In the same period, Germany imported approximately 3.4 million tonnes, mainly from the US. The increase in soybean production and the associated rise in forest clearings, especially in Brazil, led the EU to the introduce the EU regulation on deforestation-free products. The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has welcomed this regulation as a further step towards improving requirements relating to biotope conservation and climate protection. The UFOP has emphasised that the new regulation should, however, not lead to shift effects to other regions, such as the Cerrado, a region vital for biodiversity and climate change mitigation.

According to the UFOP, proof of deforestation-free sourcing was already introduced in the Renewable Energy Directive (2009/28/EC – Red I) in 2009, based on the status land had in 2008. The association regrets that these documentation obligations for biofuels were not used at the time to define limits on arable farming in tropical rain forests irrespective of final uses. After all, it is not the production of soybean oil for biofuel production that is driving the expansion in area, but the 80 per cent share of soybean meal which is the decisive factor for pricing. From this perspective, if the EU Commission were to classify soybean oil, like palm oil, as an iLUC feedstock, cause and effect of the iLUC impact (iLUC = indirect land use changes) would be negligently ignored. The UFOP has emphasised this as the review by the EU Commission is currently underway.

The regulation on deforestation-free supply chains, which came into force on 30 June 2023, has a transition period of 18 months. This means that the farms in question are required to implement the regulation a year from now – from 30 December 2024 onwards. Small farms are allowed a transition period of 24 months. The UFOP has reminded that the required proof of crop area origin also applies to soybean production in the EU.

Source

UFOP, Chart of the week 51, press release, 2023-12.

Supplier

European Commission

European Union

Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP)

US Department of Agriculture (USDA)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals