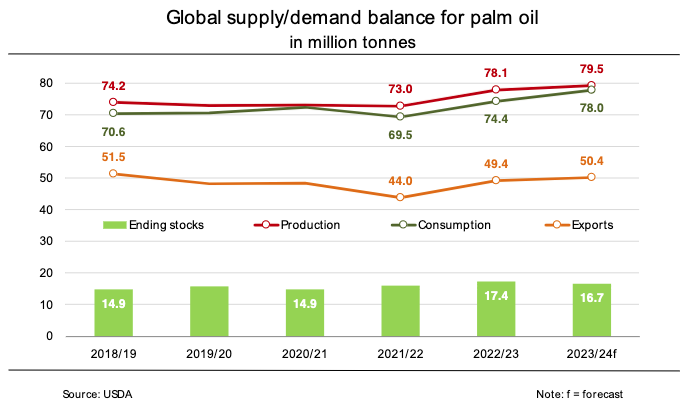

According to up-to-date information published by the US Department of Agriculture (USDA), global palm oilproduction in 2023/24 is set to rise to a record high of 79.5 million tonnes, exceeding the previous year’s level by just under 2 per cent. The main reason for this forecast is anticipated production increases in Malaysia and Indonesia. Although Malaysian production was seasonally strongly curbed, the USDA currently projects an output of 19 million tonnes, which would be up 613,000 tonnes on the previous year.

It remains to be seen whether and to what extent the prognosis will be revised downwards in the coming months. The possibilities of increasing palm oil output in the short term are limited. Even if new plantings are expedited, appreciable yields cannot be expected for another 3-4 years. Oil palm plantations have an economic life cycle of approximately 25 years.

According to the Agrarmarkt Informations-Gesellschaft (mbH), this means that output is initially reduced even further when new plantations are created on existing land. Annual growth of production is therefore likely to progress slowly, at least in the coming years – provided, however, that the palm oil area will not be expanded further either by changing the use of existing land or, in the worst case, by clearing primeval forest.

This is precisely what the provisions of the Renewable Energy Directive (RED II) are intended to prevent. The directive stipulates that by 2030 at the latest, biofuels (biodiesel/HVO) from palm oil can no longer be counted towards national quota obligations. However, member states have been authorised to advance the exclusion.

Some member states, such as France and Germany, have made use of this authorisation. The provision was subject of a case Malaysia brought before the World Trade Organisation (WTO). In last week’s ruling, the WTO acknowledged that sustainability requirements as laid down in the RED II justify the exclusion palm oil.

From the perspective of the UFOP, the ruling is pointing the way forward on a global scale. The association assumes that the WTO will rule the pending case brought by the Indonesian government in the same way.

Trade in palm oil also increased over recent years. Around 50.4 million tonnes will likely be shipped across the world’s oceans in 2023/24. This quantity exceeds the previous year’s volume of 49.4 million tonnes by just less than 2 per cent. Global consumption of 78.0 million tonnes, up around 5 per cent on the past season, is expected to be fully met by global output this season. However, demand is rising much more strongly than production. Because of this, a reduction in stocks is to be expected to occur in the near future. By the end of this marketing season, stocks are seen to have decreased around 4 per cent to approximately 16.7 million tonnes.

About UFOP

The Union for the Promotion of Oil and Protein Plants e.V. (UFOP) represents the political interests of companies, associations and institutions involved in the production, processing and marketing of domestic oil and protein plants in national and international bodies. UFOP supports research to optimise agricultural production and for the development of new recycling opportunities in the food, non-food and feed sectors. UFOP public relations aim to promote the marketing of domestic oil and protein plant end products.

Source

UFOP, press release, 2024-03-07.

Supplier

AMI Agrarmarkt Informations-Gesellschaft mbH

Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP)

US Department of Agriculture (USDA)

World Trade Organization (WTO)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals