Creating a circular economy is an essential sustainability target for governments, brands, materials suppliers, and the public. Key to pushing these sustainability efforts, which range from sustainability roadmaps developed by chemical and material companies to sustainable material usage targets adopted by brands, is the danger that growing global plastic consumption poses to the environment. The OECD estimates global plastic consumption to double globally by 2050, and this plastic is not only overflowing in landfills, but a significant portion is mismanaged and leaks into the environment.

As such, the need for more sustainable polymer options has never been more evident, with four major groups driving this progression to greater sustainability across the polymer industry: governments, retailers or brands, non-governmental organizations (NGOs) or similar activist groups, and the public. Lobbying, investments, pledges, consumer spending habits, and more all play a role, but it is likely regulation and how they are monitored and enforced that will be the most significant. Most notably, in 2023, United Nations delegates from 180 countries convened in Paris, France, to discuss a treaty to end global plastic pollution, with intentions to develop a 1st draft of the treaty by the end of the year. Regional and national announcements to curtail plastic usage and pollution are also stacking up, with additional bans on single-use plastic being introduced in countries like the UK, Netherlands, and elsewhere.

Answering this demand for more sustainable plastics to support the circular economy requires innovations from all stakeholders in the polymer value chain, from the chemical suppliers to the end-users to the recyclers. IDTechEx covers these innovations in-depth through an industry-leading portfolio of sustainability research. For polymers, alternative feedstocks such as CO2 and other biobased inputs and production processes, like white biotechnology, are highlighted to showcase the diverse technical approaches to decreasing reliance on fossil fuel resources for plastic production. Just as important as the polymer feedstock is the application of these more sustainable polymers, especially in sectors of high plastics demand like packaging, which accounts for 1/3 of annual plastic production. Lastly, the end-of-life recycling of these plastics, through both well-established mechanical recycling and the more emerging advanced recycling, is critical to establishing a truly circular economy.

Each of these innovative areas has a range of technical challenges, as well as challenges affecting economic viability; the success and outlook for each will depend on product properties, the “green premium”, and the ability to decouple pricing from incumbent raw materials, like crude oil. In this article, IDTechEx considers some of the technology developments, challenges, and the outlook of the innovations affecting each part of the polymer value chain.

Biobased feedstocks for sustainable polymers: Carbon dioxide, bacteria, and more

Shifting away from petroleum-derived feedstocks for plastic production towards biobased feedstocks is of the highest priority to make the polymer industry more sustainable. One of the most interesting feedstocks is carbon dioxide (CO2); the rise of carbon capture and utilization (CCU) technologies would enable CO2 captured from industrial point sources or ambient air to be used as a carbon source for chemical and polymer production. These technologies, as discussed in IDTechEx’s “Carbon Dioxide Utilization 2022-2042: Technologies, Market Forecasts, and Players” report, have the potential to turn polymer production from a carbon-polluting industry into a carbon-negative industry that helps to decrease the impact of carbon dioxide emissions in the atmosphere. Of course, this is a lofty long-term goal that requires continued technology development, government support, and investments to make possible; for example, to the latter point, the US government announced in 2023 that they plan to invest $100 million in carbon utilization projects. Other issues to address are the need for affordable and abundant sources of captured CO2 to meet industry demand and how to achieve cost-competitiveness with petroleum-based incumbents. Still, this is a key area to watch, as the prospect of utilizing CO2 is bringing many notable materials and chemical players to the table.

Other biobased feedstocks, like corn sugar, vegetable oil, or lignocellulosic biomass, used in bioplastic production are also receiving increasing interest. The technologies that enable the conversion of these feedstocks into commodity biobased plastics, like polyethylene terephthalate (PET), polyethylene (PE), etc. as well as more novel plastics like polyethylene furanoate (PEF), are relatively well-developed; however, critical issues affecting their cost-competitiveness that subsequently affect the scale of production have kept their presence in the overall plastics market quite limited.

With governments forcing brands and retailers to have increasing amounts of biobased content in their products and bioplastics manufacturers scaling production rapidly to meet that demand, IDTechEx expects the bioplastic industry to grow by 10.1% CAGR over the coming decade. Alongside the more straightforward replacements to petroleum-derived commodity plastics in the bioplastics market are the innovative plastics looking to carve their own niche, like polyhydroxyalkanoates (PHAs). These plastics, though much smaller in production scale currently, are quickly scaling to meet customer demand, which is forecast in IDTechEx’s “Bioplastics 2023-2033: Technology, Market, Players, and Forecasts” report, and they are beginning to reach important milestones. For example, the past year saw the debut of the world’s first biodegradable water bottle, made by Cove, which consisted of PHAs. Expect to see more of these milestones and announcements as the bioplastics industry, induced by sustainable polymer demand, grows to become a more competitive alternative to incumbent plastics.

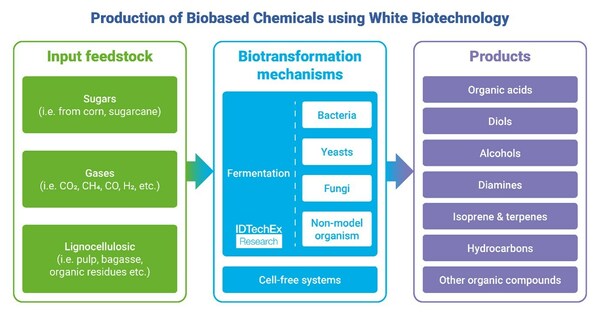

One emerging area that looks to convert such biobased feedstocks into commodity chemicals and materials is that of white biotechnology, also called industrial biomanufacturing. White biotechnology, as defined and described in IDTechEx’s “White Biotechnology 2024-2034” report, is the industrial production and processing of chemicals, materials, and energy using living cell factories, like bacteria, yeast, and fungi. The value proposition of white biotechnology extends beyond its use of biobased feedstock, as biomanufacturing processes can use less energy, generate less waste, and potentially create biodegradable products that are better for the environment. While this area isn’t necessarily “new”, with industrial production of lactic acid (used to produce biodegradable polymers like polylactic acid (PLA)) dating back decades, there is a recent influx of technology enablers, namely the tools and techniques offered by synthetic biology, that is making the industrial production of commodity chemicals and precursors to plastics much more achievable than before. Synthetic biology offers the potential to bypass the natural limitations of cell factories like E.coli to make them technically more efficient and thus economically more competitive. Numerous chemical companies, from BASF to Covestro and others, have highlighted their interest in using white biotechnology to grow their sustainable polymers portfolio.

Still, this is a field littered with prior failed attempts at making commercial production of industrial chemicals via biotechnology technologically feasible and economically viable. In fact, 2023 saw an early trailblazer in synthetic biology for chemicals and fuels, Amyris, file for bankruptcy. It is difficult to overcome the biological and process challenges to making industrial production of chemicals through biotechnology feasible, on top of the need of making biotechnology products competitive within the overall chemicals market.

IDTechEx expects that this field will see further fluctuations, as companies attempt to scale their production to profitability with varied success. Still, depending on the end product being considered, the biomanufacturing process, technical parameters of the process, and the status of the end market being targeted, novel chemicals produced through white biotechnology could very well find success in the long term. IDTechEx will closely monitor white biotechnology’s progress to understand its impact in the broader chemical and polymers sectors.

Applying biobased polymers in end-markets: sustainable packaging

The application of such sustainable polymers in end markets and the unique challenges faced by biobased competitors in these markets, like packaging, are also important to understand, as they give insight into the growth potential for different sustainable polymers. One such end-market is packaging, which is covered in detail in IDTechEx’s “Sustainable Packaging Market 2023-2033” report. This particular field is facing the brunt of increasing regulations on single-use plastics, prompting the growing usage of recycled and biobased plastics to increase the sustainability of packaging by brands.

While this area is seeing significant progress in specific application areas like food service, personal care, home care, pet care, etc., there are still technical barriers to overcome to achieve 100% biobased packaging in most applications. For example, many biobased PET bottles currently on the market are not 100% biobased, as only one (monoethylene glycol (MEG)) of their two core constituents (the other being terephthalic acid (TPA)) is currently being manufactured at scale from biobased sources. To address the unmet need for biobased TPA, several companies, like Origin Materials, are developing different approaches to produce biobased precursors to TPA. More recently, Mitsubishi Corporation, Suntory Holdings, Eneos, and Neste are collaborating to produce biobased paraxylene, which will then be converted to TPA; that will then be used to manufacture PET bottles starting in 2024. IDTechEx expects to see more partnerships for such material and technology development in this space as companies across the polymer value chain collaborate to ensure their ability to develop sustainable polymers that can actually be applied in key markets like packaging.

Increasing the value of end-of-life plastics through chemical recycling

Recycling will always be a key part of making a circular plastics economy, as it ensures that any carbon captured by using the aforementioned biobased feedstocks stays sequestered. Mechanical recycling in the short and medium-term will continue to be the main recycling process, but there has been and will continue to be significant industrial activity surrounding chemical recycling and dissolution of plastics. Advanced recycling addresses many of the shortcomings of mechanical recycling, like the degradation of plastic through recycling cycles, to produce recycled plastic that approaches the quality of virgin plastic. With that value proposition, numerous chemical companies, like ExxonMobil and Eastman Chemical, have entered the market with their own chemical recycling plants and processes; the former recently opened a large-scale chemical recycling plant in Texas this year.

Chemical recycling remains controversial, with questions swirling around the actual environmental benefits of chemical recycling as numerous NGOs have accused the petrochemical giants pursuing chemical recycling of “greenwashing” the real environmental impact of these technologies. IDTechEx discusses these claims in its “Chemical Recycling and Dissolution of Plastics 2023-2033” report, but ultimately IDTechEx thinks that there is a beneficial role for these processes, although perhaps overstated by many. The tailwinds are so great that significant mid-term growth is inevitable, though still modest relative to the full scale of the annual plastic waste production.

Outlook for sustainable polymer technologies

Going back to the key issue of plastic consumption and the key driver of government regulation, the climate benefits of these sustainable solutions make them very interesting for future applications, though these technologies need to be assessed on a case-by-case basis to determine their sustainability benefits and economic viability. Still, the market potential for sustainable polymers is massive and has significant momentum behind it. As single-use plastic bans and carbon zero pledges grow in tandem with plastic consumption, the pressure is ever-increasing for materials producers and consumers to transition to more sustainable practices. IDTechEx expects the plastic circular economy to continue gaining traction as sustainability increasingly becomes a corporate and consumer priority, though it still has numerous challenges to overcome to majorly impact the incumbent petrochemical market.

For the full portfolio of IDTechEx research on sustainability, please visit www.IDTechEx.com/Research/Sustainability, and for the portfolio of advanced materials research please see www.IDTechEx.com/Research/AM.

IDTechEx also offers expert-led data and analysis on these and other related topics as part of a market intelligence subscription – see www.IDTechEx.com/Subscriptions for more information.

This article is from “Technology Innovations Outlook 2024-2034”, a complimentary magazine of analyst-written articles by IDTechEx providing insights into a number of areas of technology innovation, assessing the landscape now and giving you the outlook for the next decade. You can read the magazine in full at www.IDTechEx.com/Magazine.

Upcoming Free-To-Attend Webinar

Creating a Circular Economy: Emerging Sustainable Materials to Watch in 2024

IDTechEx will be hosting a free-to-attend webinar on the topic on Tuesday 21 November 2023 – Creating a Circular Economy: Emerging Sustainable Materials to Watch in 2024.

The technology areas covered in this webinar include:

- White Biotechnology

- Sustainable Plastic Packaging

- CO2 Utilization for Chemicals and Materials

- Emerging Alternative Leathers

Click here to find out more and register for one of the three sessions.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies.

Source

IDTechEx, press release, 2023-11-14.

Supplier

Amyris

BASF Corporation (US)

Cove Plastics

Covestro AG

IDTechEx

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals