- 200+ large-scale projects have been announced across the value chain, with a total value exceeding $300 billion

- 30+ countries have national hydrogen strategies in place, and public funding is growing

A new report released by the Hydrogen Council shows rapid acceleration of hydrogen projects in response to government commitments to deep decarbonisation. Developed in collaboration with McKinsey & Company, “Hydrogen Insights 2021: A Perspective on Hydrogen Investment, Deployment and Cost Competitiveness” offers a comprehensive perspective on market deployment around the world, investment momentum as well as implications on cost competitiveness of hydrogen solutions.

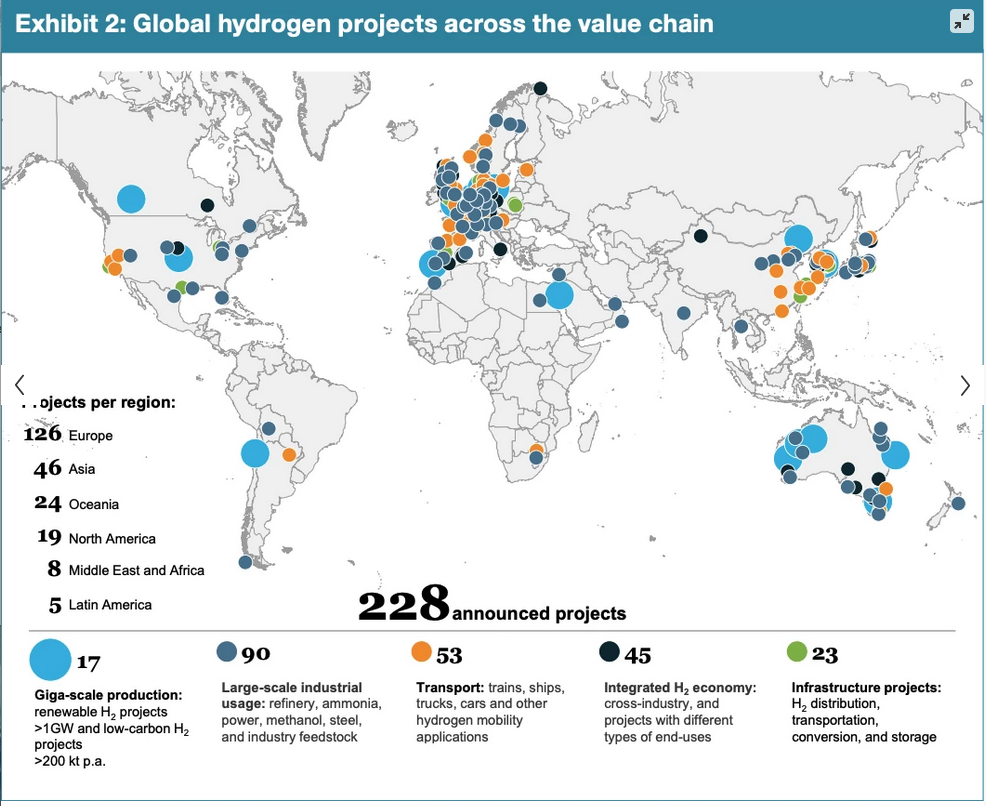

As of early 2021, over 30 countries have released hydrogen roadmaps and governments worldwide have committed public funding in support of decarbonisation through hydrogen technologies. No less than 228 large-scale projects have been announced along the value chain, with 85% located in Europe, Asia, and Australia. These include large-scale industrial usage, transport applications, integrated hydrogen economy, infrastructure, and giga-scale production projects. If all announced projects come to fruition, total investments will reach more than $300 billion in spending through 2030. Of this investment $80 billion can currently be considered “mature” – meaning that these projects are in the planning stage, have passed a final investment decision (FID), or are under construction, already commissioned, or operational.

Anticipating continued growth in scale, the report confirms that – from a total cost of ownership (TCO) perspective – hydrogen can become the most competitive low-carbon solution in more than 20 applications by 2030, including long haul trucking, shipping and steel. Two factors will be critical in achieving this result: first, it is essential that governments sustain their commitments to deep decarbonisation, backed by financial support, regulation and clear hydrogen strategies and targets, and translate these into long-term regulatory frameworks. Second, deployment approaches must target key “unlocks” such as reducing the cost of hydrogen production and distribution that will have the most significant impact on the rest of the industry.

Deployment through clusters with strong off-takers will help suppliers share both investments and risks while establishing positive reinforcing loops. Three cluster types are already gaining traction: 1) Industrial centres that support refining, power generation, and fertiliser and steel production; 2) Export hubs in resource-rich countries; and 3) Port areas for fuel bunkering, port logistics, and transportation. The reduced costs from clusters will enable global trade in hydrogen, connecting future major demand centres such as Japan, South Korea, and the European Union to regions of abundant low-cost hydrogen production means like the Middle East, North Africa, South America, or Australia.

“A huge step in the fight against climate change has been taken, as both governments and investors now fully grasp the role hydrogen can play in the energy transition. Now, to bring this potential to its full fruition, governments, investors and industrial companies must work together to scale up the hydrogen ecosystem around the world. Their collaboration in the coming months will allow for many of the projects around the world to become a reality and to turn hydrogen into a new, clean, abundant and competitive energy carrier,” said Benoît Potier, Chairman and CEO of Air Liquide and Co-chair of the Hydrogen Council.

“Hydrogen can help to unlock deep decarbonisation and achieve global climate targets. The Hydrogen Council is proud to provide comprehensive global data and serve as a knowledge partner not only to the industry but also governments, investors, think tanks, civil society and other key stakeholders working towards a clean energy transition around the world,” said Takeshi Uchiyamada, Chairman of the Board of Toyota Motor Corporation and Co-chair of the Hydrogen Council.

“We are seeing a new level of maturity for the hydrogen industry, and this is only set to accelerate. Hydrogen Council members collectively are planning a sixfold increase in total hydrogen investments through 2025 and a 16-fold increase through 2030. The plan is to direct most of this investment toward capital expenditures, while collaborations, consolidations and innovation will also be a key focus,” said Daryl Wilson, Executive Director of the Hydrogen Council.

“In the scale-up of the hydrogen ecosystem, we see interesting patterns emerge: short-term, around 40% of investments flow into hydrogen production, and most projects target heavy transport and industrial clusters such as ammonia, refineries and steel,” said Bernd Heid, Senior Partner at McKinsey & Company. “We are excited to collaborate with the Hydrogen Council in this journey to realise hydrogen’s full potential.”

Linked to this new report, the Hydrogen Council is launching Hydrogen Insights, a subscription-based product in collaboration with McKinsey & Company that provides granular insights and data and detailed analysis on hydrogen investment momentum, market development, and cost competitiveness. The paid service will be made available for non-members of the Hydrogen Council. More information here.

About the Report

This report was authored by the Hydrogen Council in collaboration with McKinsey & Company. It aims to help guide regulatory and investment decision-making to accelerate hydrogen deployment. The updated data in the report is built on previous works by the Hydrogen Council and McKinsey & Company, including the Scaling Up report (2018) and the Path to Competitiveness report (2020). See full report here.

About the Hydrogen Council

The Hydrogen Council is a global CEO-led initiative that brings together leading companies with a united vision and long-term ambition for hydrogen to foster the clean energy transition. Using its global reach to promote collaboration between governments, industry and investors, it provides guidance on accelerating the deployment of hydrogen solutions around the world. The Council believes that hydrogen has a key role to play in the global energy transition by helping to diversify energy sources worldwide, foster business and technological innovation as drivers for long-term economic growth and decarbonise hard-to-abate sectors.

The Council acts as a business marketplace, bringing together a diverse group of 109 companies based in 20+ countries and across the entire hydrogen value chain, including large multinationals, innovative SMEs, and investors. The Hydrogen Council serves as a resource for safety standards and an interlocutor for the investment community, while identifying opportunities for regulatory advocacy in key geographies.

Source

Hydrogen Council, press release, 2021-02-17.

Supplier

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals