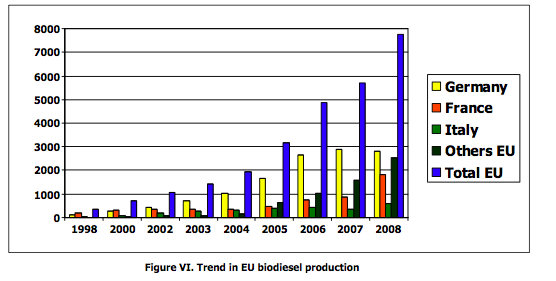

In line with the trend initiated in 2007, the year 2008 saw a relatively low increase in EU biodiesel production, and even a reduction in two major producing Member States, Germany and Austria. A clear stagnation of biodiesel output is also to be noticed in a number of EU countries.

With 7,7 million tonnes, 2008 production increased by only 35,7% compared to 2007 level (up from 5,7 million tonnes). 2007 already saw a reduced 16,8% increase compared to 2006. This has to be compared with 2005 and 2006 biodiesel production, which increased by 65% and 54% respectively.

The increase of biodiesel production in 2007 and 2008 is still not in line with the ambitious EU objective for climate change mitigation outlined in the recently published Renewable Energy Directive 2009/28. This situation has to be understood primarily against the background of unfair international trade competition which has severely affected the profitability of EU biodiesel producers since early 2007.

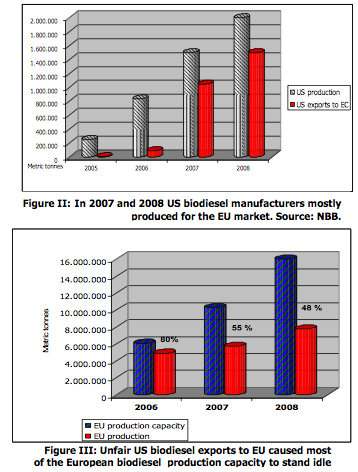

For more than two years, EU biodiesel producers had to compete with heavily subsidized and dumped biodiesel from the US (known as “B99”). US B99 has been sold in the EU with a considerable discount, even at lower price than the raw material soybean oil. Following the complaints lodged by EBB in 2008, the European Commission’s investigation established that unfair US B99 caused significant damage to the EU biodiesel industry, particularly in terms of profitability and return on investments.

In March 2009, EBB strongly welcomed the imposition of provisional anti-dumping and countervailing measures against unfairly traded US biodiesel. Last July 7th, these measures have been extended for 5 years following the approval of EU Ministers. EBB applauds the EU decision to adopt robust measures against an unfair trade practice clearly breaching WTO principles. This decision will help re-establishing EU producer’s legitimate right to operate in a level-playing field. In spite of degraded market conditions, the EU biodiesel industry showed in 2008 some relative resilience, allowing a moderate production increase compared to 2007. This however stands far below what EU biodiesel producers could achieve in a more favorable environment.

In March 2009, EBB strongly welcomed the imposition of provisional anti-dumping and countervailing measures against unfairly traded US biodiesel. Last July 7th, these measures have been extended for 5 years following the approval of EU Ministers. EBB applauds the EU decision to adopt robust measures against an unfair trade practice clearly breaching WTO principles. This decision will help re-establishing EU producer’s legitimate right to operate in a level-playing field. In spite of degraded market conditions, the EU biodiesel industry showed in 2008 some relative resilience, allowing a moderate production increase compared to 2007. This however stands far below what EU biodiesel producers could achieve in a more favorable environment.

Substantial EU production capacity is available to meet the 10% target by 2020

The situation outlined above is all the more illogical if one considers that, with close to 21 million tonnes of installed production capacity in 2009, the EU biodiesel industry stands ready to deliver much higher volumes than it has done in 2007 and 2008.

In 2009, production capacity has increased by 31% compared to 2008. The number of biodiesel plant as of July 2009 stands at 276. This is the result of considerable investment, committed well before the rise of unfair US B99 on the EU market.

EBB statistics for 2008 and 2009 however show that at least 50% of existing plants remain idle. Unfair international competition has been the main driver of this trend, while the political discussions in 2008 on adoption of the Renewable Energy Directive have added to market uncertainty. This situation means that the important investment from the industry has so far not been mirrored by the corresponding market deployment. Yet, it is important to underline that the existing biodiesel production capacity is an asset to cover an important part of the 10% binding target for renewables consumption in the transport sector, which has been established by Directive 2009/28. The 10% target will indeed require the production of at least 30-35 million tonnes of biodiesel by 2020.

The entry into force of the Renewable Energy Directive last month, as well as the already well established support schemes at Member States level shows that, contrary to the situation prevailing in the US until now, the EU and its Member States have been able to create a genuine framework supporting the deployment of biodiesel and biofuels, notably in the form of mandatory blending targets.

In addition, it should be reminded that EU demand for biodiesel is structurally supported by the growing EU mineral diesel deficit (32 million tonnes imported in 2006, mainly from Russia), a trend that is expected to continue beyond 2030. Biodiesel plays and will continue to play a decisive role for EU’s security of energy supply.

A continued EU and international leadership

The EU biodiesel industry continues to play a major role both at EU and international level, be it in terms of production and capacity.

In 2008, biodiesel accounted for 78% of the biofuels consumed in the EU (EU bioethanol production in 2008 was 2,2 million tonnes) and is likely to remain the main biofuel in meeting the target of 10% transport fuels by 2010. The EU still holds the leading position at worldwide level in terms of biodiesel production, with close to 65% of world’s biodiesel output.

As outline above, the rapid development of US biodiesel production has been artificially driven by unfairly designed subsidies, without being matched by a corresponding domestic demand.

Even more than in 2008, Argentina stands out as a newly emerging player on the international biodiesel market. This growth has been so far largely driven by the existing DETs scheme, which creates unjustified advantages, and as result of which most of Argentinean biodiesel is exported outside the country. Argentina, Malaysia and Indonesia continue to feature amongst major biodiesel producing regions, all enjoying a disputable preferential access to the EU market under the Generalized System of Preferences.

The need for a coherent legislative framework at EU and Member States level

In 2009, the EU biodiesel industry is more than ever in a position to supply the EU market with increasing volumes of biodiesel, responding to an important part of the 10% target set in the RE-D. This has been critically acknowledged in the 2009 Biofuels Progress Report released by the European Commission in May this year.

The EU biodiesel industry will as well continue to invest in meeting the highest quality and sustainability requirements.

However, now that the EU has established a robust framework for biofuels deployment, in particular via the mandatory 10% target for 2020, a number of crucial steps needs to be secured:

- The national transposition of the Renewable Energy Directive should fully respect the scope and the spirit of the Directive, especially when it comes to the biofuels sustainability scheme. The EU cannot afford to see the development of uncoordinated sustainability requirements at Member States level. This would be disruptive for the EU biofuels industry and incompatible with both the EC internal market rules and WTO principles. Let us not lose sight of the fact that EU biodiesel is already today produced in a sustainable way. Equally, progress by Member States in implementing the new Directive and in reaching the 10% biofuels target should be closely monitored by the European Commission and infringement proceedings should be launched in case sufficient progress is not achieved. This is particularly true when it comes to setting a reasonable pathway towards the 10% target over the next 10 years. The drafting of the National Action Plans by June 2010 should send a positive signal in terms of Member States commitment to the development of renewables in the transport sector.

- The further development of the provisions contained in the RE-D, via comitology or via new legislative proposals, should not lead to overburden economic operators. This is particularly true concerning the future Commission proposals on indirect land use change (ILUC). In the view of EBB, including an ILUC factor at this stage is neither scientifically grounded nor economically justifiable. Public policies cannot be based on inconsistent and questionable science. Instead, the correct approach to alleged ILUC effects should be to apply simple and transparent sustainability requirements to all biomass regardless of its final use (food, feed, bioenergy).

- In terms of standardization, the CEN has only recently lifted the restrictive ceiling of 5% FAME in EN590 diesel. In accordance with the European Commission mandate received by CEN already in October 2006, EBB strongly believes that the work towards the 10% threshold should be completed as soon as possible. This is not only necessary for those Member States where biodiesel incorporation has already reached 7%, but it will be as well absolutely essential in order to reach the 10% binding target foreseen under the Renewable Energy Directive.

Looking back at the important achievements of the EU biodiesel industry to date, EU biodiesel represents more than ever a major asset to reach the EU’s objectives in terms of climate change, rural development and security of energy supply.

To reap the benefits of EU biodiesel, clear, fair and pragmatic rules should prevail on the market. EBB is confident that these principles will guide the future implementation of the EU Renewable Energy Directive.

Further information

Press release (PDF-document) including the following tables and graphs:

- Figure I: EU 2007 and 2008 biodiesel production estimates

- Figure II: In 2007 and 2008 US biodiesel manufacturers mostly produced for the EU market. Source: NBB.

- Figure III: Unfair US biodiesel exports to EU caused most of the European biodiesel production capacity to stand idle

- Figure IV: The growing EU dependence on imported mineral diesel. Source: OECD.

- Figure V: EU 2008 and 2009 biodiesel capacity estimate

- Figure VI. Trend in EU biodiesel production

Source

European Biodiesel Board (EBB), press release, 2009-07-15.

Supplier

European Biodiesel Board (EBB)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals