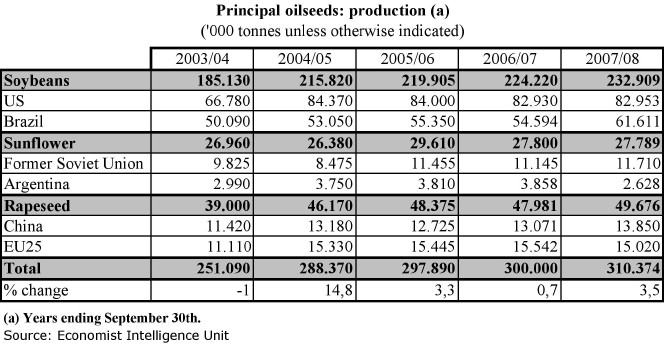

World Commodity Forecasts Food Feedstuffs and Beverages: Our estimate of global oilseeds production in 2005/06 has been lowered to 297.8m tonnes, mainly to allow for lower output of soybeans in South America. Oilseeds production in 2006/07, on current assessments, is likely to show only small growth to around 300m tonnes.

Soybeans

Argentina’s soybean harvest was delayed by a shortage of fuel at farms and by wet conditions in some areas, and around 0.25m ha is thought to have been abandoned. Output is now put at 40.4m tonnes, higher than the 2004/05 output of 39.6m tonnes but some 200,000 tonnes below our previous forecast. In spite of this setback the area planted to soybeans is likely to increase, if more slowly: a planted area of 15m ha is forecast in 2006/07, which would allow a harvest of 40m tonnes.

Output estimates for 2005/06 have been lowered

Brazil’s soybean harvest has also turned out smaller than expected. The planted area is smaller by around 1m ha, and we forecast a crop of 55.4m tonnes. Yields are reported to have recovered from last year’s setback, but they are still poor, owing to adverse weather and some damage from Asian rust fungus. The most recent estimate from the commodities agency, CONAB, which local sources consider too low, puts the crop at 53.8m tonnes.

Brazil’s soybean planted area will decline

At the end of May the government announced measures to improve rural credit availability and raise support prices. Also, a weakening of the Real has helped farm-gate prices. However, the measures are unlikely to prevent a reduction in cultivation of grains and oilseeds (the government is expecting a 4% reduction). Our forecast assumes a 2.5-3% reduction in soybean area, giving a crop of around 55m tonnes in 2006/07, assuming normal weather.

US farmers have expanded soybean plantings despite high stocks

The 2006/07 US soybean crop, which will reach the market from September 2006, will be a good one, if slightly smaller than the 84m tonnes estimated for 2005/06. Crop development was delayed by above-normal temperatures, but conditions have since been favourable and better than last year. US farmers have increased soybean plantings despite high stocks. The March plantings intentions report suggested an increase in area of 6.6% (the actual increase may be smaller than this). We have assumed an area of 30.5m ha, which, with normal yields, would give a crop of about 83m tonnes.

Prospects in China, the other major northern hemisphere soybean producer, remain unclear. A further small increase in planted area is likely. With normal yields this will provide a crop of 17.3m tonnes, much the same as in the past two seasons.

Global 2005/06 production of soybean still exceeds consumption

Elsewhere, outturns in Paraguay and India are expected to come in lower than previously expected. Even so, global soybean production will exceed consumption in 2005/06, and opening stocks in 2006/07 will stand at a record 57m tonnes.

A global soybean crop of 224.2m tonnes is the most likely prospect for 2006/07. This would more than meet demand and lead to a further increase in stocks.

Sunflowerseed

We have made only small changes in our forecast of sunflowerseed supply in 2005/06. Global output has been lowered by just 100,000 tonnes, with lower output in the US and China being partly offset by higher expectations of production in Argentina.

Global 2006/07output estimated slightly lower from previous season

For 2006/07, current assessments point to a harvested area similar to that of 2005/06. Assuming normal yields (yields were high in 2005/06), we would expect a global sunflowerseed crop of 27.8m tonnes compared with the 29.6m tonnes of 2005/06.

In Russia and Ukraine, plantings have progressed rapidly and earlier than last year. With prices recovering, sunflowerseed remains one of the most profitable crops. A new record level of plantings is expected for the 2006/07 season, especially in Ukraine.

Sunflowerseed remains one of the most profitable crops

We take a conservative view of prospects of further growth in Argentina’s sunflowerseed area in 2006/07, given recent reports of difficulties in planting wheat.

Rapeseed

Our expectation of world rapeseed production in 2005/06 has been raised by more than 400,000 tonnes to a new total of 48.4m tonnes, reflecting an upward revision of China’s output. A slight reduction in global output of rapeseed is indicated in 2006/07 despite an increase in planted area. At 48m tonnes, this will fall short of demand.

EU25 rapeseed production may only reach 15.5m tonnes

In the EU25, rapeseed production is expected to reach 15.5m tonnes, or 100,000 tonnes more than in 2005/06. Despite another expansion of area, yields are likely to be lower than in 2005/06 as a result of unfavourable weather, disease and pest infestation. German, Polish and Czech Republic yields have been affected the most, although there has been some impact in France and the UK.

Strong prices have encouraged more planting in Canada

In Canada, weather for the production of canola (rapeseed) has been almost ideal throughout the Prairies. The harvested area is now thought likely to total 5.09m ha, a decline of about 4%. Planting intentions reports in April suggested an area reduction of 15%, reflecting the high level of Canadian stocks. However, improving prices and good export prospects to Europe have encouraged farmers to plant more than originally intended. Normal yields should give a crop of 8.3m tonnes but many expect yields to be high.

Australian plantings of canola began in June but have been impeded by lack of rain. This is likely to affect the intended outturn increase in 2006/07.

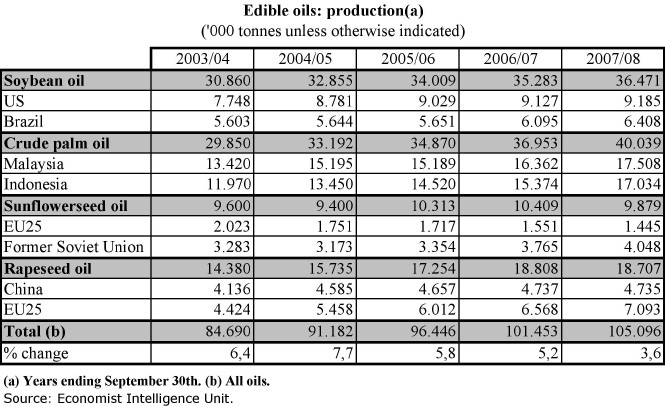

Edible oils

Our estimate of global output of edible oils in 2005/06 has been lowered from 97.1m tonnes to 96.4m tonnes. Higher outputs of rapeseed and palm oil have been insufficient to offset lower soybean and sunflowerseed production.

Indonesia’s palm oil exports have risen sharply

We have lowered our estimate of Indonesian palm oil production in 2005/06. Even so, it will be 8% higher than in 2004/05, and exports have been rising. Some deceleration, to about 6%, will occur in 2006/07, but we continue to forecast that growth will accelerate to almost 11% in 2007/08.

Our expectation of Malaysian palm oil output in 2005/06 has been raised slightly, but output will still be no higher than in 2004/05. An acceleration to almost 8% is foreseeable in 2006/07, followed by slight easing in 2007/08.

Total oils output in 2006/07 to rise by 5%

Allowing for the slowdown in Indonesian production, we expect global production of palm oil output in 2006/07 to grow by about 6%. There will be similar growth in seed oil output. We expect global production of vegetable oils in general to reach about 101.5m tonnes in 2006/07, slightly more than previously expected. We expect this to be followed by growth of less than 4% in 2007/08.

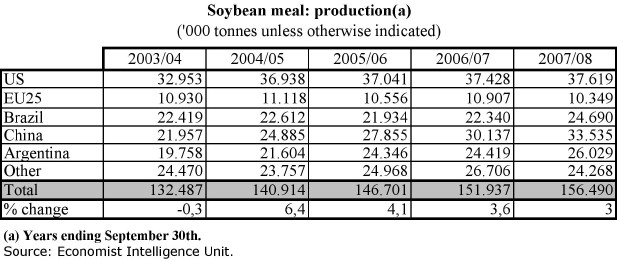

Oilmeals

Our expectations of global production of soybean meal in 2005/06 and 2006/07 have been lowered. Three months ago, a build-up of soybean meal stocks threatened to depress crushing activity and profitability. There are also concerns over availability of crushing capacity‚ specially in Europe, where plants are being converted to rapeseed to meet the demand for biodiesel feedstock.

Source

Soyatech.com Aug. 17, 2006.

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals