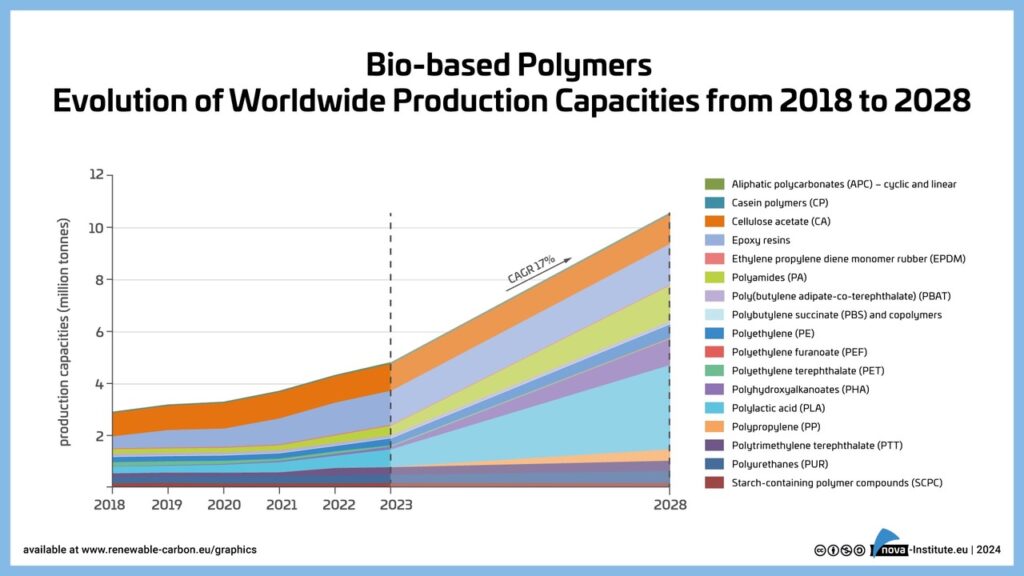

The year 2023 was a promising year for bio‑based polymers: PLA capacities have been increased by almost 50% and at the same time polyamide capacities are steadily increasing, as well as epoxy resin production. Capacities for 100% bio-based PE have been expanded and PE and PP made from bio‑based naphtha are being further established with growing volumes. Current and future expansions for PHAs are still on the horizon.

In 2023, the total production volume of bio‑based polymers was 4.4 million tonnes, which is 1% of the total production volume of fossil‑based polymers. The CAGR of bio-based polymers is, with 17%, significantly higher than the overall growth of the polymer market (2–3%) – this is expected to continue until 2028 (Figure 1).

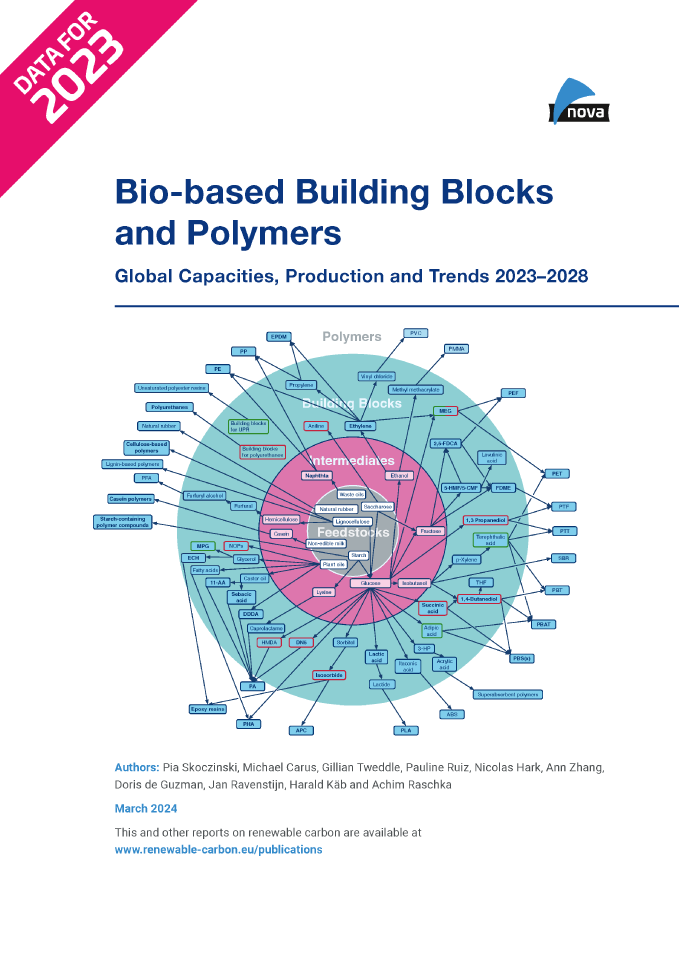

The new market and trend report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2023–2028”, written by the international biopolymer expert group of the nova-Institute, shows capacities and contains production data for 17 commercially available, bio‑based polymers in the year 2023 and a forecast for 2028. The report is now available in full length as well as a freely available short version here: https://renewable-carbon.eu/commercial-reports.

Several global brands are already expanding their feedstock portfolio to include sources of renewable carbon, CO2, recycling and, in particular, biomass, in addition to fossil-based sources, thereby increasing the demand for bio‑based and biodegradable polymers. At the same time, however, there is a lack of political support in Europe, which still only promotes biofuels and bioenergy. By contrast, supportive legislation is in place in Asia and particularly in the US drives demand.

For 2023, the updated market report includes the following features on 438 pages: Coverage of 16 bio-based building blocks and all 17 commercially available bio-based polymers, comprehensive information on the capacity development from 2018 to 2028, production data for the years 2022 and 2023 per bio-based polymer and analyses of market developments and producers per building block and polymer, so that readers can quickly gain an overview of developments that go far beyond capacity and production figures. Additionally, the market study offers a statistical overview on “Mass Balance and Free Attribution (MBFA)” products available worldwide based on an extensive analysis of the ISCC database, a detailed elaboration on the current European policy for bio-based polymers as well as a comprehensive summary on biodegradability and biodegradable polymers. This information is supported by over 70 figures, over 50 tables and 232 company profiles.

Global Production Capacities of Bio-based Polymers by Region

Asia, the leading continent in 2023, has the largest installed bio‑based production capacities in the world with 55%, with the largest capacities for PLA and PA. North America has 19%, with large installed capacities for PLA and PTT, and South America has 13%, mainly based on PE. In contrast to 2022, European shares in worldwide bio-based polymer capacities has decreased to 13%. This is mainly based on the updated data for PE and PP being produced in Europe, where only 10% of the total volume is known to be bio-based and 90 % are bio-attributed based on mass balance and free attribution (MBFA). The European share is mainly based on installed capacities for SCPC and PA. Less than 1% share of Australia / Oceania was based on SCPC (Figure 8). With an expected CAGR of 35% between 2023 and 2028, Asia displays by far the highest growth of bio‑based polymer capacities compared to other regions in the world. This increase is mainly due to extended production capacities for PA, PHA and PLA.

The data published annually by European Bioplastics and the data published by Plastics Europe for 2022 are taken from the market report published by the nova-Institute, albeit with a smaller selection of bio-based polymers and application areas in each case.

Please find the full and short version of the report here: https://renewable-carbon.eu/commercial-reports.

About nova-Institut

nova-Institut GmbH has been working in the field of sustainability since the mid-1990s and focuses today primarily on the topic of renewable carbon cycles (recycling, bioeconomy and CO2 utilization/CCU).

As an independent research institute, nova supports in particular customers in chemical, plastics and materials industries with the transformation from fossil to renewable carbon from biomass, direct CO2 utilization and recycling.

Both in the accompanying research of international innovation projects and in individual, scientifically based management consulting, a multidisciplinary team of scientists at nova deals with the entire range of topics from renewable raw materials, technologies and markets, economics, political framework conditions, life cycle assessments and sustainability to communication, target groups and strategy development.

50 experts from various disciplines are working together on the defossilization of the industry and for a climate neutral future. More information at: nova-institute.eu – renewable-carbon.eu

Source

nova-Institute, press release, 2024-03-07.

Supplier

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals