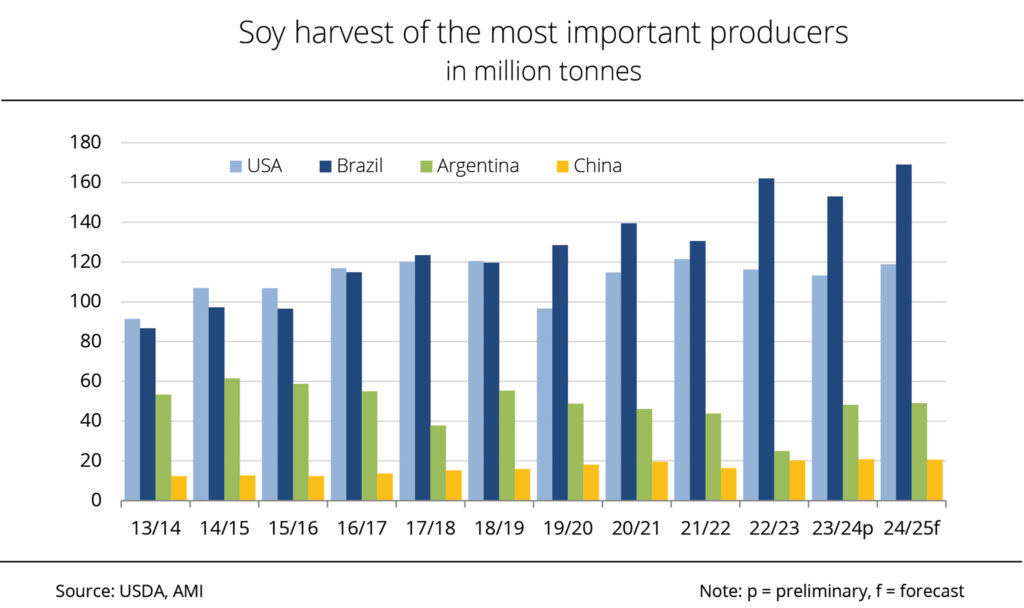

Brazil and Argentina continue to consolidate their shares in the global soybean market this marketing year, with Brazil expecting another bumper crop. Brazil, the US and Argentina are the world’s main producers of soybeans, collectively accounting for 80 per cent of global production. China follows a long way behind with a market share of 5 per cent. According to estimates from the US Department of Agriculture (USDA), Brazil is set to harvest a record volume of around 169 million tonnes of soybeans in the current crop year.

This figure compares to 153 million tonnes a year earlier. Based on a 1.3 million hectare expansion in soybean area to 47.4 million hectares, Brazil consolidates its position as the world’s number one soybean producer ahead of the US. The Brazilian soybean harvest is currently in full swing. As of 7 February 2025, the harvest was approximately 15.1 per cent complete, the long-standing average for the same date being 18.4 per cent. Yields have previously been reported as more than satisfactory. In the US, the soybean harvest was already complete by the end of the year 2024, totalling around 118.8 million tonnes. This translates to an almost 5.6 million tonne increase over the previous year and is presumably the largest crop in three years.

Argentina, which ranks third among the world’s most important producers, is also projected to see a slightly larger harvest compared to the previous year. According to research by Agrarmarkt Informations-Gesellschaft (mbH) the country is expected to harvest 49 million tonnes, around 790,000 tonnes more than the previous year. In contrast, latest USDA estimates indicate that China’s harvest will decline around 190,000 tonnes from the past year, falling to 20.7 million tonnes.

In view of the unabated rise in Brazil’s soybean area, the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has questioned the potential regulatory effect of the EU Deforestation Regulation (EUDR). The UFOP fears that the soybean marketing chain from Brazil will be split into two streams – one flowing to the European Union, with proof of land use as of January 2020, and another serving Brazil’s primary soybean market China.

According to information published by Statista, China imported approximately 106 million tonnes of soybeans in 2023. With an average yield of approximately 3.3 tonnes per hectare, this translates to a land area requirement of approximately 32 million hectares. For comparison: Ukraine’s total cropland extends over 33 million hectares.

In view of the extension of the implementation period of the EUDR until the end of 2025, the UFOP has said that it remains to be seen whether the EUDR and companies’ voluntary commitment to protect primeval forests will create a positive impact on the environment, adding that the effectiveness of such measures will be limited unless rules are agreed to protect primeval forests and biodiversity across all global commodity flows.

Source

UFOP Chart of the week 08/2025, 2025-02-19.

Supplier

Agrarmarkt Informations-GmbH (AMI)

European Union

Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP)

US Department of Agriculture (USDA)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals