Avantium N.V. (Euronext Amsterdam and Brussels: AVTX), a leading innovative chemical technology company dedicated to developing and commercialising proprietary technologies for the production of chemicals from renewable sources, today reports its 2022 half year results.

Key Business Developments in the First Half of 2022

Avantium Renewable Polymers recorded a number of important milestones:

- The financial conditions were met (Financial Close) which allowed us to initiate theconstruction of the FDCA Flagship Plant.

- Five additional offtake agreements were signed in the first half of 2022, bringingthe total of such contracts to ten:

- Avantium announced this morning that it has signed additional offtakeagreements with LVMH and AmBev.

- Construction of the Flagship Plant at the Chemie Park Delfzijl site is progressing according to plan.

- In the first half of 2022, Avantium Renewable Chemistries successfully restarted operations at its Ray TechnologyTM demonstration plant.

- Avantium Catalysis recorded revenues in the first half of 2022 of €4.5 million, compared to €4.3 million in the first half of 2021.

Key Financial Developments in the First Half of 2022

- Total revenues increased in the first half of 2022 by 5% to €5.0 million (HY 2021: €4.7 million). Other income from government grants decreased by 3% to €3.2 million (HY 2021: €3.3 million).

- Direct costs increased as planned by €4.1 million in the first half of 2022 to €19.2 million (HY 2021: €15.1 million). Of the increase, €1.8 million is related to non-recurring items.

- The loss for the first half year of 2022 was €17.3 million (HY 2021: €10.9 million); the increase is predominantly the result of the initiation of the FDCA Flagship Plant construction.

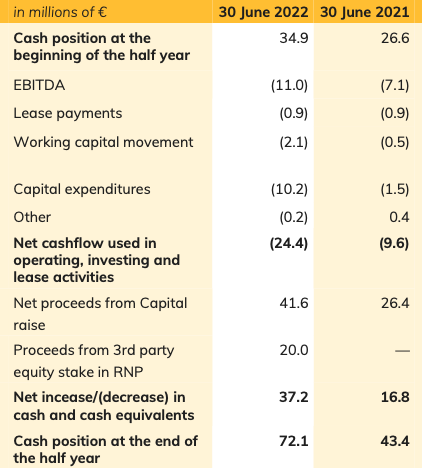

- The cash position was €72.1 million on 30 June 2022 (31 December 2021: €34.9 million):

- Of the €72.1 million cash position, €20.7 million is ringfenced cash for the Avantium Renewable Polymers business unit to utilise for its operations andconstruction of the Flagship Plant.

- The net cash outflow resulting from operating, investing and lease activities in the first half of the year was €24.4 million (HY 2021: €9.6 million). The increase in cash outflow predominantly relates to higher CAPEX expenditure and higher direct costs.

- The improved overall cash position is primarily due to the successful €45 million capital increase by means of a public offering in April 2022. The net proceeds from the capital increase after bank, legal and consultancy fees were €41.6 million.

Tom van Aken, Chief Executive Officer of Avantium, comments: “We have made significant positive strides across our business over the last six months. We are very pleased that we have started constructing the world’s first commercial facility for the production of FDCA, the key building block of PEF. This will allow us to accelerate commercialisation of our technology and make PEF widely available. We have also expanded our commercial partnerships, reinforcing both the value and huge potential of PEF.

We remain committed to demonstrating the commercial potential of all of our technologies. The equity offering in April 2022 has allowed us to invest further in delivering rapid progress across our business.”

Business Overview

Avantium Renewable Polymers

Avantium Renewable Polymers aims to commercialise its proprietary YXY® Technology, used to produce FDCA (furandicarboxylic acid), the main building block of the plant-based, high-quality, recyclable polymer PEF (polyethylene furanoate).

On 9 December 2021, Avantium announced that it had taken a positive Final Investment Decision (FID) to construct the FDCA Flagship Plant in Delfzijl, the Netherlands. This world’s first commercial FDCA factory is set to produce 5 kilotonnes of FDCA per annum. At an Extraordinary General Meeting of Shareholders on 25 January 2022, Avantium received support from its shareholders for this positive FID. This support enabled Avantium to execute all the relevant investment and debt financing documentation necessary to complete the transaction. Financial Close for the investment project related to the FDCA Flagship Plant was on 31 March 2022. With Financial Close, engineering company Worley Nederland B.V. and Bio Plastics Investment Groningen B.V.1 have become minority shareholders in the Avantium subsidiary, Avantium Renewable Polymers, responsible for the FDCA Flagship Plant. Worley and Bio Plastics Investment Groningen together have acquired a 22.6% shareholding in Avantium Renewable Polymers, while Avantium holds 77.4% of the equity. Furthermore, a €90 million debt financing package has been signed with a consortium of Dutch banks, comprising ABN AMRO Bank, ASN Bank, ING Bank and Rabobank, as well as with the Dutch government-backed impact investment fund Invest-NL.

On 20 April 2022, Avantium celebrated the First Piling Ceremony for its FDCA Flagship Plant at the Chemie Park Delfzijl site in the Netherlands, representing the start of the construction of the FDCA Flagship Plant. Construction is planned to be completed by the end of 2023, enabling the commercial launch of PEF from 2024 onwards. For the construction phase, Avantium and Worley agreed on the terms of an EPC (Engineering, Procurement and Construction) contract for the FDCA Flagship Plant. The EPC contract includes a 50-50% risk-sharing agreement. The risk sharing agreement ensures that cost overruns incurred on the agreed EPC contract will be shared with Worley. This risk sharing mechanism excludes any scope changes made to the Flagship Plant design.

Over the past months, the construction of the FDCA Flagship Plant has progressed according to plan. By the end of June 2022, approximately 700 piles had been driven into the ground to prepare the foundation. In July 2022, subcontractors started laying the pipes and pouring the concrete for the ground floor.

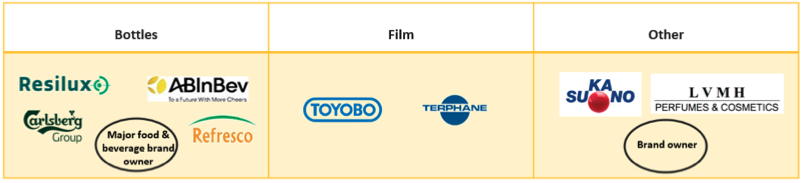

In the first half of 2022, Avantium secured five additional offtake commitments for the Flagship Plant, bringing the total of such contracts to ten, across a variety of product applications and locations. Over the past months, contracts were signed with: Sukano AG, a company expert in additive and colour masterbatches and compounds for polyester and speciality resins (Switzerland); Carlsberg Group, one of the leading brewery companies in the world (Denmark); LVMH Group (Moët Hennessy Louis Vuitton), an international leader in luxury goods (France); AmBev, the Brazilian company, which is part of the AB InBev Group, the largest brewing company in the world (Brazil); and another undisclosed global brand owner. Those five offtake agreements were in addition to the already signed offtake commitment with specialty chemical company Toyobo (Japan), specialty polyester film producer Terphane (US), the beverage bottling company Refresco (Netherlands), international rigid packaging supplier Resilux (Belgium), and an undisclosed major global food & beverage brand owner. The partners will purchase Avantium’s FDCA at agreed price levels for a period of at least five years.

Carlsberg Group, a member of the PEFerence consortium2, announced in June 2022 that it has launched a trial of its latest Fibre Bottle, which contains an inner layer of PEF produced in Avantium’s current Pilot Plant. Carlsberg is sampling the Fibre Bottle with 8,000 consumers and other selected stakeholders in eight pilot markets in Western Europe throughout the summer. This is the very first time that a PEF-lined beer bottle has been trialled with consumers and their reactions and comments will be closely monitored.

Another important commercial milestone in the first half of 2022 was the formation of the PEF Textile Community in June 2022 with five reputable global companies: Antex, BekaertDeslee, Chamatex, Kvadrat and Salomon. Antex has produced yarns made from PEF and a PEF-based TiO2 Masterbatch developed and produced by Sukano. From the initial developments, Antex has validated that PEF yarns can be produced by using existing PET spinning and texturing lines, which will facilitate market adoption. Antex intends to further validate PEF as a sustainable material for yarn production. The other PEF Textile Community members are now using the PEF yarn samples to explore the potential of PEF fabric for their particular applications.

Avantium Renewable Chemistries

With its proprietary sugars-to-glycols Ray TechnologyTM, Avantium produces mono-ethylene glycol (MEG) and mono-propylene glycol (MPG) from plant-based feedstock. MEG is a vital ingredient in the production of polyesters widely used in textiles and packaging. MPG is a valuable intermediate used in a wide variety of applications, such as anti-freeze products. Avantium announced in 2021 that it plans to form a joint venture with the Cosun Beet Company for the construction and operation of a commercial production plant to convert sugar beet to glycols on the basis of Avantium’s Ray Technology. The companies are in discussions with interested partners to prepare for commercial validation and to potentially establish offtake agreements, in parallel to conducting engineering studies and exploring financial support programmes.

In the first half of 2022, Avantium successfully restarted operations at the Ray TechnologyTM demonstration plant in Delfzijl, after activity at the demonstration plant had been halted due to an accident in 2021. Following the accident, Avantium conducted extensive safety assessments and implemented improved process safety measures, including adjustments to the design of the Ray TechnologyTM demonstration plant.

Avantium’s Volta Technology, a carbon capture and utilisation technology, is a cutting-edge electrocatalytic platform which converts carbon dioxide (CO2) via electrochemistry into high-value ingredients including formic acid, oxalic acid and glycolic acid.

Two of our ongoing Volta projects took important steps forward in the first half of 2022. In January 2022, as part of the OCEAN programme3, Avantium installed a mobile Volta Technology container unit at an RWE power plant in Germany. During a six-month period, the container operated for 1000 hours with the world’s largest gas diffusion CO2 conversion cell and successfully converted CO2, coming directly from the power plant, into potassium formate. As part of the RECODE programme4, Avantium also installed a second Volta unit at a Titan cement factory in Greece. During a three-month period, Avantium’s will convert CO2, coming directly from a capture facility located at the cement factory, into formate.

In May 2022, Avantium announced that it has been awarded a €3 million grant by the EU Horizon Europe programme to fund its participation in the 4-year research and development programme WaterProof5. The €3 million grant will be paid out in tranches to Avantium over a period of four years. Under the WaterProof programme, Avantium will convert CO2 from wastewater purification and waste incineration into formic acid, using its proprietary Volta catalytic electrochemistry platform, with demonstration campaigns at Waternet in Amsterdam and HVC in Alkmaar, the Netherlands.

Avantium Catalysis

Avantium Catalysis provides advanced catalysis R&D services, systems and testing to a broad range of global customers. The Services R&D business provides in-house customised contract research projects. The Systems business comprises Avantium’s unique and advanced Flowrence® and Batchington high-throughput catalyst testing systems, which are tailored to accelerate catalyst screening and to study catalyst deactivation.

The Catalysis business unit recorded revenues of €4.5 million in the first half of 2022 (HY 2021: €4.3 million). Despite the challenges caused by the disruption of the supply chains of key (sub)components and microchips, and the continuing travel restrictions (particularly in China) as a result of the COVID-19 pandemic, Avantium Catalysis received several new orders for Flowrence® systems and contract R&D projects from companies and academic institutions around the world. Order intake for H1 2022 was higher than in the first half of 2021, at €5.1 million (HY 2021: €4.2 million), a clear signal that the Catalysis business is recovering after the COVID-19 lockdown.

Equity capital raise

On 14 April 2022, Avantium successfully raised €45 million through a public offering of new Avantium shares, with a priority allocation period for its existing shareholders, a retail offering and a private placement. The equity offering comprised 11,250,000 new ordinary shares, representing approximately 36% of the Company’s issued share capital. The Offer Shares were placed at a price of €4.00 per new ordinary share. The proceeds will primarily be applied (i) to develop Ray TechnologyTM and to scale-up towards commercialisation via technology licensing, (ii) to further develop Dawn and Volta technologies, as well as to assess economic feasibility and scale-up towards commercialisation, and (iii) for general corporate purposes, working capital and overall funding.

Organisation

Supervisory Board composition

At the Extraordinary General Meeting of Shareholders (EGM) held on 25 January 2022, the shareholders approved the appointment of Nils Björkman as a member of the Supervisory Board for a term of four years, ending at the close of the Annual General Meeting to be held in 2026. In March 2022, Cynthia Arnold stepped down as Supervisory Board member due to personal circumstances. Avantium continues to have access to her valuable expertise and advice through a consultancy arrangement. Trudy Schoolenberg has notified the company of her decision, for personal reasons, to resign as Supervisory Board member effective as of 31 August 2022. The Supervisory Board will consist of: Edwin Moses (chairman), Margret Kleinsman, Michelle Jou and Nils Björkman. The Supervisory Board has started the selection process for additional Supervisory Board members.

Financial results

Income Statement

Total first half 2022 revenues increased to €5.0 million (HY 2021: €4.7 million). Other income decreased slightly to €3.2 million (HY 2021: €3.3 million). The grant income in the first half of 2022 is predominantly the result of the previously awarded grant programmes PEFerence, IMPRESS and DEI+.6 Avantium successfully secured an additional grant in the first half of 2022, to support its participation in the 4-year research and development programme WaterProof. In the first half of 2022, Avantium recorded higher “total revenues and other income”: €8.2 million compared to €8.0 million in HY 2021.

Direct costs increased by €4.1 million in the first half of 2022 to €19.2 million (HY 2021:€15.1 million.) Of the increase, €1.8 million is related to non-recurring items.

Employee costs increased by €2.1 million, as planned, due to an increase in staff employed to prepare for the scale-up in Avantium Renewable Polymers, higher salaries and recruitment and training fees. Headcount increased by 10 FTE compared to the first half of 2021. The employee costs of first half of 2021 also included a benefit of the 2020 bonus accrual which was released as this bonus was not paid out to employees.

Patent & Advisory costs increased by €0.9 million due to one-off legal and advisory fees incurred as part of Financial Close activities within Avantium Renewable Polymers. Raw materials increased due to higher sales in Avantium Catalysis and higher input costs. Housing and office expenses increased post-COVID due to the restart of office activities and rising utility costs.

Total EBITDA decreased from €-7.1 million in the first half of 2021 to €-11.0 million in the first half of 2022.

Finance costs increased to €1.3 million (HY 2021:€0.2) primarily due to €1.0 million in fees incurred relating to the debt financing.

The loss for the half year of 2022 is €17.3 million (HY 2021: €10.9 million).

Balance Sheet and Financial Position

The balance sheet as of 30 June 2022 increased to €146.8 million (31 December 2021: €77.7 million), with net equity of €93.9 million.

Cash and cash equivalents totalled €72.1 million as of 30 June 2022 (31 December 2021: €34.9 million). The improved cash position is primarily due to the successful €45 million capital increase by means of a public offering in April 2022. The net proceeds from the capital increase after bank, legal and consultancy fees were €41.6 million. In addition, Avantium Renewable Polymers received €20.0 million cash investment from Bio Plastics Investment Groningen for the equity stake it acquired in Avantium Renewable Polymers. The net cash used in operating, investing and lease activities in the first half was €24.4 million (HY 2021: €9.6 million).

Capital expenditure increased to €10.2 million (HY 2021: €1.5 million) as a result of investments in the FDCA Flagship Plant.

The working capital includes a receivable of €10 million recognised by Avantium RNP Flagship B.V. on 31 March 2022 from Worley as part of their contribution in kind. The receivable is payable equally over the next 24 months starting from April 2022. As of 30 June 2022, the remaining balance is €8.8 million. Working capital also includes a prepaid expense of €11.3 million recognised by Avantium N.V. The prepaid expense relates to the warrants issued, as part of the debt financing agreement, to the respective banks. The prepayment will be expensed as a finance cost at each drawdown of the facility on a pro-rata basis.

Working capital movements were €-2.1 million in the first half of 2022 versus €-0.5 million in 2021 due to the increased amount of payables settled in the first half of 2022.

A non-controlling interest was recognised on 31 March 2022, as there was a change in ownership of Avantium Renewable Polymers, a subsidiary of Avantium N.V. Worley Nederland B.V. and Bio Plastics Investment Groningen B.V. together acquired a 22.6% shareholding in Avantium Renewable Polymers, while Avantium continues to hold 77.4% of the equity. The initial recognition of the non-controlling interest amounted to €12.0 million.

Outlook

Avantium Renewable Polymers will focus on building the FDCA Flagship Plant. Inflation and supply chain disruptions, as a result of the Russia-Ukraine war, as well as the aftermath of the COVID-19 pandemic, are putting substantial pressures on costs and time schedules. Avantium anticipates that the Flagship Plant CAPEX will be materially higher, due predominantly to inflation as well as scope changes. The company is closely monitoring and managing the situation as effectively as possible. Avantium expects that construction of the Flagship Plant will be completed by the end of 2023 and that the plant will be fully operational during 2024. Avantium Renewable Polymers remains fully committed to securing additional offtake agreements in order to sell out the FDCA Flagship Plant capacity prior to start-up. As part of its commercialisation strategy, Avantium is exploring licensing opportunities for the future large-scale production of FDCA and PEF.

Avantium Renewable Chemistries will continue to conduct engineering studies with its Ray TechnologyTM. It will also focus on exploring commercial opportunities for plantMEGTM and plantMPGTM.

Avantium Catalysis will increasingly look for opportunities to grow its business in the field of renewable chemistries.

Auditor’s Involvement

This Interim Report for the six months ended 30 June 2022, and the condensed consolidated financial statements included herein have not been audited or reviewed by an external auditor.

Management Board compliance statement

The Management Board of Avantium N.V. declares that, to the best of its knowledge, the condensed consolidated financial statements give a true and fair view of the assets, liabilities, financial position and the result of Avantium N.V. and its subsidiaries and the interim report includes a fair review of the information required pursuant to section 5:25d, subsections 8 and 9 of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht)

1 Bio Plastics Investment Groningen’ (BPIG) was incorporated by Groningen Seaports and regional investment funds NOM (Investment and Development Agency for the Northern Netherlands), Investeringsfonds Groningen and Groeifonds.

2 The PEFerence consortium receives funding from the Circular Bio-based Europe Joint Undertaking (CBE JU) under the European Union’s Horizon 2020 research and innovation programme under grant agreement No 744409.

3 The OCEAN project aims to use CO2 emitted by power plants to produce oxalic acid (which is the basis for various high-value chemicals. The project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No 767798.

4 The RECODE project aims to recycle CO2 in the cement industry to produce added-value additives. It has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No 768583.

5 The WaterProof Project receives funding from the Horizon Europe Framework Programme under the Grant Agreement No 101058578.

6 PEFerence is a consortium of organisations aiming to replace a significant share of fossil-based polyesters with the 100% plant-based PEF. The PEFerence project has received funding under Bio Based Industries Joint Undertaking under the European Union’s Horizon 2020 research and innovation programme under grant agreement No 744409. IMPRESS (grant agreement No 869993) is a consortium of ten organisations aiming to demonstrate a new biorefinery concept based on integrating novel processes such as Avantium’s Dawn and Ray Technologies. Bio- MEG Proeffabriek is a grant project supported by the European Regional Development Fund (ERDF) through Samenwerkingsverband Noord Nederland (SNN). This grant aims to accelerate innovation in the quest for a low-carbon economy. With the Demonstration Energy and Climate Innovation (DEI+) scheme, the Netherlands Enterprise Agency (RVO – Rijksdienst voor Ondernemend Nederland) financially supports projects that contribute to a cost-effective reduction of CO2 emissions by 2030.

Source

Avantium, press release, 2022-08-17.

Supplier

ABN AMRO Bank

Ambev

ASN Bank

Avantium Technologies B.V.

Carlsberg Group

ING Bank

LVMH Group

RABOBank Group CSR

Refresco Gerber UK Limited

Resilux

Terphane

Toyobo Co. Ltd.

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals