The production capacities of bio-based polymers continue to grow at around 3 to 4% per annum, i.e. at about the same rate as petrochemical polymers. Therefore, the market share of bio-based polymers in the total polymer market remains constant at around 2%. But the individual development of different bio-based polymers varies considerably. While some are virtually collapsing compared to previous forecasts (e.g. bio-PET), many are showing constant or slightly increasing capacities and a few are even showing significant growth (such as PLA). Additionally, for some bio-based polymers such as PHA, PEF, bio-PE and bio-PP, the prospects for the future are quite positive. Overall, the market environment remains challenging with low crude oil prices, little political support and partially underutilized capacities. Until now, the biodegradability of some bio-based polymers has not yet been able to generate a real advantage globally.

Deutsche Fassung: https://renewable-carbon.eu/news/starkes-wachstum-bei-bio-basierten-building-blocks-moderates-wachstum-bei-bio-basierten-polymeren/

The new report is more than just an update, it differs from the previous versions in structure and content. It contains comprehensive information on capacity development from 2011 to 2022, per building block and polymer as well as information on 102 individual polymer producers. A total of 17 bio-based building blocks and 15 polymers are covered in the report. In addition, the new issue includes analyses of market developments per building block and polymer, so that readers can quickly gain an overview of developments that go far beyond capacity figures. For more details see at www.bio-based.eu/reports.

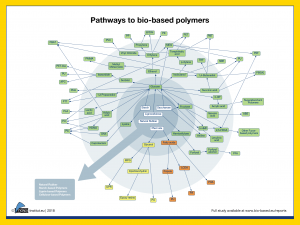

Figure 1 shows all commercially realized pathways from biomass via different building blocks and monomers to bio-based polymers. As in previous years, several pathways and some new intermediates have been added.

Figure 1 shows all commercially realized pathways from biomass via different building blocks and monomers to bio-based polymers. As in previous years, several pathways and some new intermediates have been added.

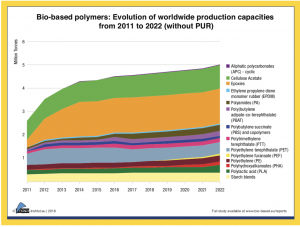

In 2017, the world-wide capacities for bio-based polymers reached 4.6 million tonnes (including hard-to-estimate bio-based PUR this number goes up to 6.4 million t). The forecast for 2022 shows 5 million tonnes – including bio-based PUR: 7.5 million t.

Figure 2 shows the development of the capacities based on data from 2011 to 2017 and includes a forecast for all bio-based polymers until 2022. All in all, after strong growth between 2011 and 2014, we see less growth with a CAGR of 3 to 4% from 2014 to 2017. According to the latest forecasts, this trend will continue until 2022 and is approximately in line with expected growth in the petrochemical polymer market. Only higher oil prices, better support from governments or technological breakthroughs will make it possible for growth to rise again.

Figure 2 shows the development of the capacities based on data from 2011 to 2017 and includes a forecast for all bio-based polymers until 2022. All in all, after strong growth between 2011 and 2014, we see less growth with a CAGR of 3 to 4% from 2014 to 2017. According to the latest forecasts, this trend will continue until 2022 and is approximately in line with expected growth in the petrochemical polymer market. Only higher oil prices, better support from governments or technological breakthroughs will make it possible for growth to rise again.

With a CAGR of 10% between 2017 and 2022, Europe has the highest growth of bio-based polymer capacities compared to other regions of the world.

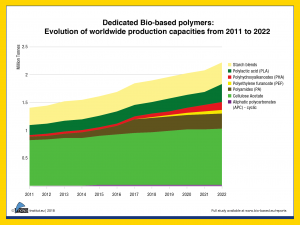

Figure 3 shows the capacity development for the sub-group of dedicated bio-based polymers. These polymers have no direct counterpart in the petrochemical world, therefore price pressure from cheap crude oil is lower than for other groups. Moreover, they are offering new properties and functionalities. The polymers in these groups show a higher CAGR compared to the drop-in groups, a trend already visible in 2011 that will probably continue to 2022. Bio-based polymers such as PLA become more and more established, additional capacities are created and new polymers such as PHA and PEF are introduced to the market.

Figure 3 shows the capacity development for the sub-group of dedicated bio-based polymers. These polymers have no direct counterpart in the petrochemical world, therefore price pressure from cheap crude oil is lower than for other groups. Moreover, they are offering new properties and functionalities. The polymers in these groups show a higher CAGR compared to the drop-in groups, a trend already visible in 2011 that will probably continue to 2022. Bio-based polymers such as PLA become more and more established, additional capacities are created and new polymers such as PHA and PEF are introduced to the market.

As a consequence, the highest innovation takes place in this group, and a number of new developments are still to be expected. Success also depends on how quickly the new polymers can be integrated into the marketplace and how quickly their new properties can become added value for politicians and society.

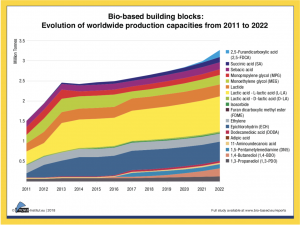

Figure 4 shows the development of capacities for bio-based building blocks, the core of the new bio-economy. Between 2017 and 2022, the CAGR of 5 to 6% is significantly higher than that of bio-based polymers (3 to 4%) as a whole. There are two main reasons for this development: Bio-based building blocks usually lead to dedicated bio-based polymers, which already show a higher growth rate, and the building blocks can be used in structural polymers as well as in functional polymers and also in many other applications.

Figure 4 shows the development of capacities for bio-based building blocks, the core of the new bio-economy. Between 2017 and 2022, the CAGR of 5 to 6% is significantly higher than that of bio-based polymers (3 to 4%) as a whole. There are two main reasons for this development: Bio-based building blocks usually lead to dedicated bio-based polymers, which already show a higher growth rate, and the building blocks can be used in structural polymers as well as in functional polymers and also in many other applications.

The market and trend report is written by the international biopolymer expert group headed by the nova Institute. The authors come from Asia, North America and Europe. The report is now available for 2,000 € at www.bio-based.eu/reports – in addition to further market studies on special areas of bio- and CO2-based economics.

Download press release as PDF file: 18-05-23 PR Biopolymer Market Study 2018

Source

nova-Institut GmbH, press release, 2018-05-22.

Supplier

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals