Agricultural production relies on technology for increased yield and strong yield stability. In the face of climate change and concerns over agriculture’s environmental impacts, alternative “greener” technologies emerge as potential routes to alleviate these concerns. Often these technologies are specific replacements for individual technologies.

Biopesticides are a “green” alternative for chemical synthetic pesticides. No-till farming is a “low-impact” alternative to intensive tilling agriculture. Biochar presents a biobased alternative to fertilization and soil amendment. While these approaches may be technologically promising, not all are legitimate financial opportunities. No-till farming is poised for growth, but the market opportunity is small, while biochar has potential, but needs a champion and a little luck. In contrast, while biopesticides have historically represented a small market, growth that will endure is already a reality, buoyed up by multiple factors.

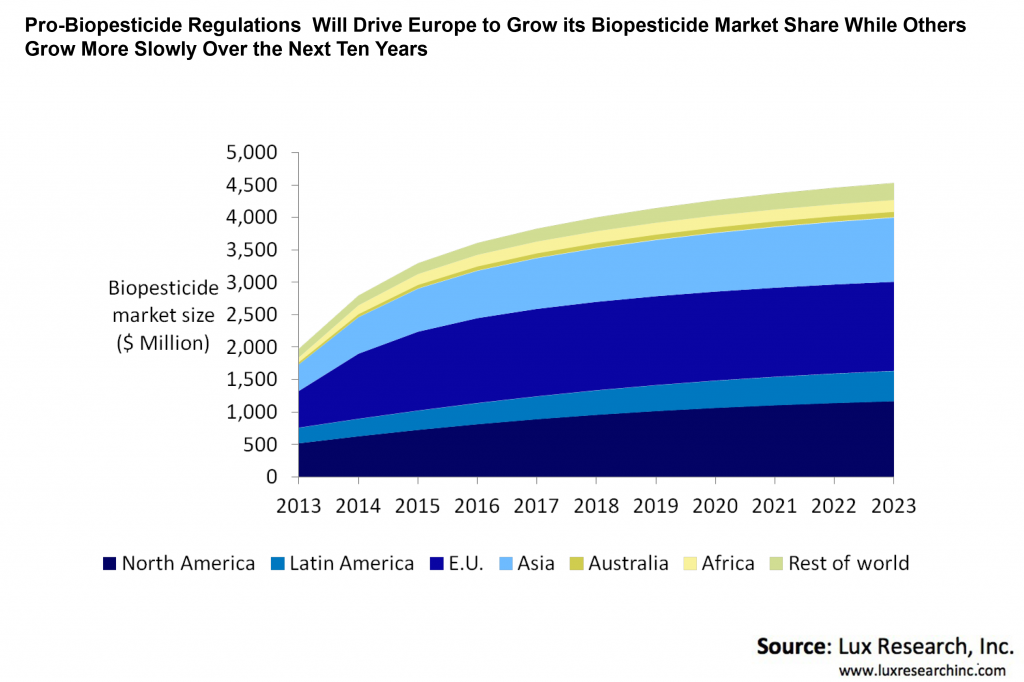

Recent legal changes are paving the way for biopesticide development and use over synthetic pesticides. From the EU to the U.S. and India, regulations and consumer sentiments are driving investment in biopesticides and adoption of those products. As an example, growth in the EU will occur most rapidly in the face of the neonicotinoid ban beginning in 2014. This regulatory pressure will drive adoption more rapidly than in other geographies, and the market will be larger by 2023 as a result. The environmental impacts of biopesticides are much smaller than their synthetic counterparts. Biopesticides enjoy very short re-entry intervals for treated areas and often require very small doses for effective treatment. As such, we expect this market to grow at more than 8% CAGR through at least 2023. Innovations in the field coupled with swelling consumer sentiments against synthetic pesticides will push more and more adoption of these products in the future. This creates growth opportunities for those looking to make a play here.

Vestaron is an excellent example of a multi-pronged approach that advances a biochemical biopesticide, a transgenic PIP, and a synthetic pesticide at one time. Others in the field should try similar multi-faceted approaches to be resilient to changing consumer demands. Other novel biopesticide varieties will also claim increasing market share. Specifically, biologically-sourced small molecules have a better ability to achieve specific control of individual insect pests, weeds, and even fungal diseases. Morflora’s technology, which uses nontransgenic approaches to impart resistance to myriad pathogens and pests via PIPs, is a model for future biopesticide development.

Biopesticide developers and aspiring market entrants should consider acquisitions now, not later, to get a piece of the opportunity. The existing market is flooded with small-scale developers; many of them offer a single product. As the industry matures, these small-scale developers will rapidly realize growth and success, increasing the potential purchase prices of these start-ups by significant margins. Those seeking to innovate externally should act now to make their selections, rather than waiting and having to pay more for new products.

(Source: Lux Research report “Green Dreams or Growth Opportunities: Assessing the Market Potential for “Greener” Agricultural Technologies” — client registration required.)

Source

Lux Research Analyst Blog, press release, 2014-03-15.

Supplier

European Union

Lux Research, Inc.

Morflora

Vestaron Corporation

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals