Electrification is widely regarded as a leading solution for decarbonizing the on-road transport sector. However, for certain industries, electrification may not be the most viable option, leading to the growing interest in alternative low-carbon fuels like hydrogen, ammonia, biofuels, and e-fuels. In the biofuel space, biodiesel and bioethanol have historically dominated the market, but concerns about their sustainability, particularly land-use change and competition with food production, have prompted sustainable fuel producers to explore more advanced fuels like renewable diesel and sustainable aviation fuel (SAF), derived from alternative (2nd generation) feedstocks and new process technologies.

This has influenced the rise of renewable diesel, especially in regions like the US, Europe, and parts of Asia, such as China, which supply these fuels to global markets. While renewable diesel was initially produced from virgin oils, there is now a strong shift toward more sustainable feedstocks like used cooking oil, waste oils, and animal fats. These alternative sources are also gaining traction in the production of sustainable aviation fuel (SAF), offering a lower environmental footprint.

Despite the variety of existing technologies, both the advanced biofuel and e-fuel markets are still in relatively early stages of development compared to bioethanol and biodiesel. A dominant factor driving the growth of this market is regulation and policy support in key regions like the EU and the US. However, the introduction of new or improved process technologies will also cause a significant shift in the future production landscape. This article will delve into some of the key market drivers and technological developments shaping the future of advanced biofuels and e-fuels using research from IDTechEx‘s new report, “Sustainable Biofuels & E-Fuels Market 2025-2035: Technologies, Players, Forecasts“.

Dominance of HEFA process

The most widely used process for producing renewable diesel and sustainable aviation fuel (SAF) is the hydro-treated esters and fatty acids (HEFA) process. This process mirrors the operations in a petroleum refinery, where various fuel fractions are synthesized from crude oil. Key steps in HEFA include hydrotreating, hydrocracking, isomerization (upgrading), and fractional distillation, all of which convert the triglycerides from oil-based feedstocks into branched hydrocarbons with the right properties to be used as drop-in fuels. Due to its commercial maturity and proven reliability, most biorefineries producing renewable diesel today rely on the HEFA process.

Emergence of alternative processes & interest in SAF as a key driver of growth

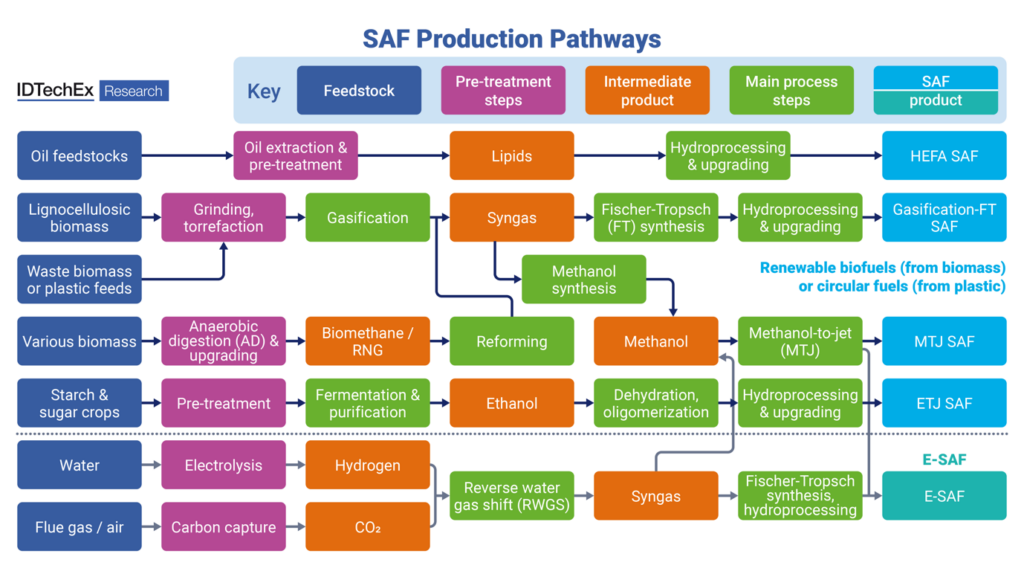

The sustainable fuel landscape is evolving, and innovative technologies are gaining ground. One such advancement is the combination of gasification with Fischer-Tropsch (FT) synthesis. This process transforms waste biomass – such as agricultural and forestry residues – into synthetic hydrocarbon fuels, including renewable diesel, SAF, and gasoline. Another exciting development is the conversion of methanol and ethanol into jet fuel or gasoline, commonly known as alcohol-to-jet (ATJ) and alcohol-to-gasoline (ATG) processes. Additionally, e-fuels, which have the potential to be carbon-neutral, are generated using CO2 from the air or biogenic sources, along with water and renewable energy. These emerging technologies promise to expand the range of sustainable fuel production methods, offering alternative pathways to provide more sustainable fuels to long-haul and heavy-duty transport sectors.

The growing interest in SAF has become a significant driver of innovation in the sustainable fuel industry. This surge in attention is largely attributed to the implementation of SAF mandates in key markets. In the EU, the ReFuelEU Aviation initiative mandates a gradual increase in SAF blending, starting with 2% in 2025 and reaching 70% by 2050. Similarly, the US has introduced the SAF Grand Challenge, aiming to produce 3 billion gallons of SAF annually by 2030. These regulatory frameworks have created a strong market pull, incentivizing airlines to invest directly in technology companies and SAF production facilities. For instance, British Airways partnered with LanzaJet to build one of Europe’s first commercial-scale alcohol-to-jet (ATJ) production facilities in the UK, investing £2.5 million in the project.

Source

IDTechEx, press release, 2024-10-15.

Supplier

British Airways

European Commission

European Union

IDTechEx

LanzaJet

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals