Showing 1–20 of 424

-

9 Downloads

2026-02

FREE

Free Shipping9

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

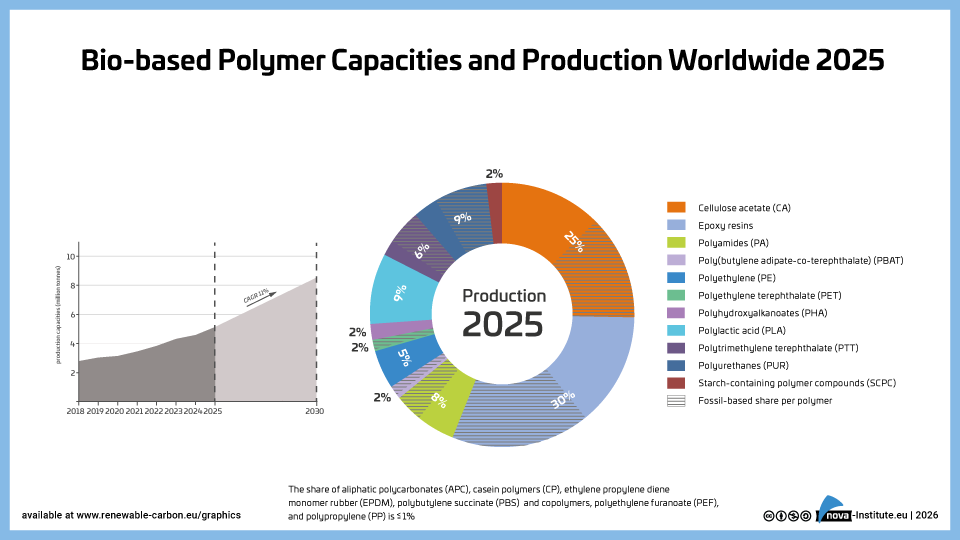

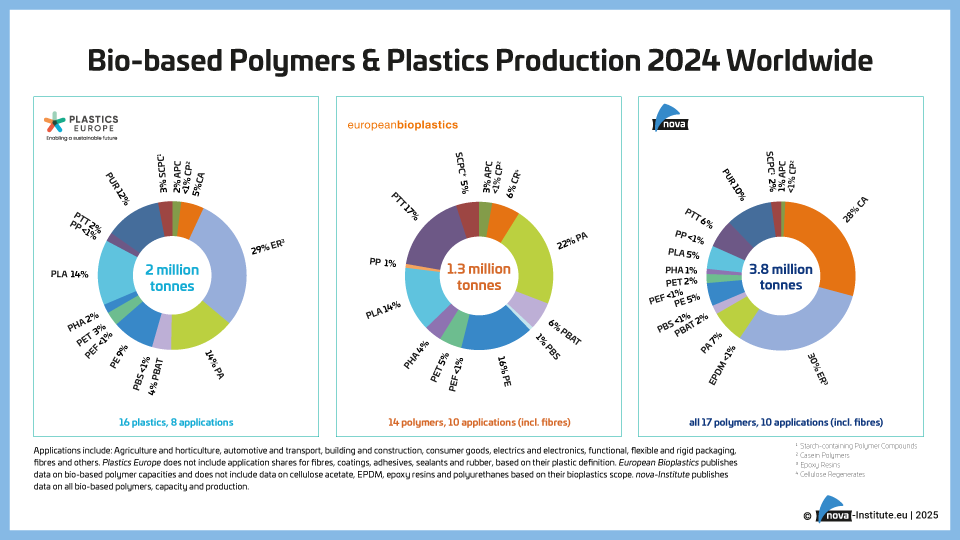

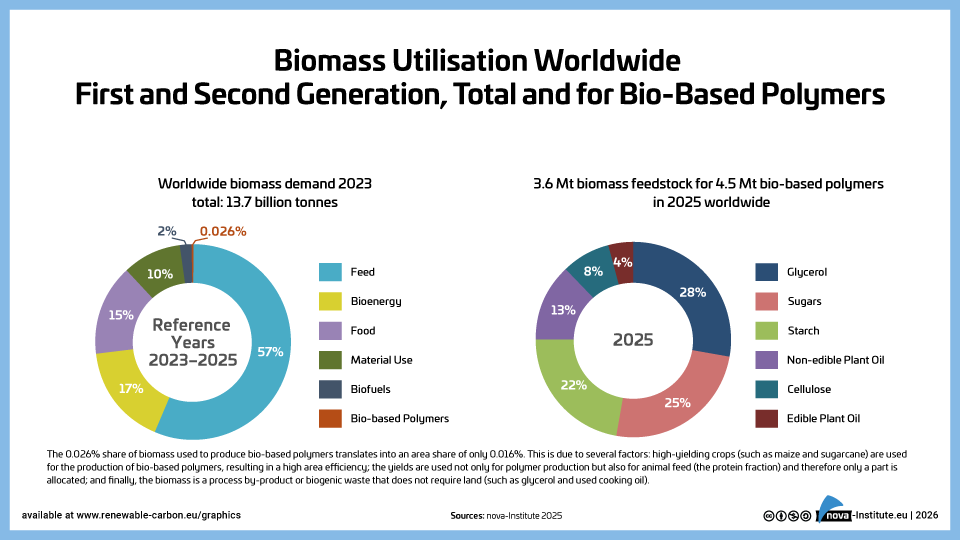

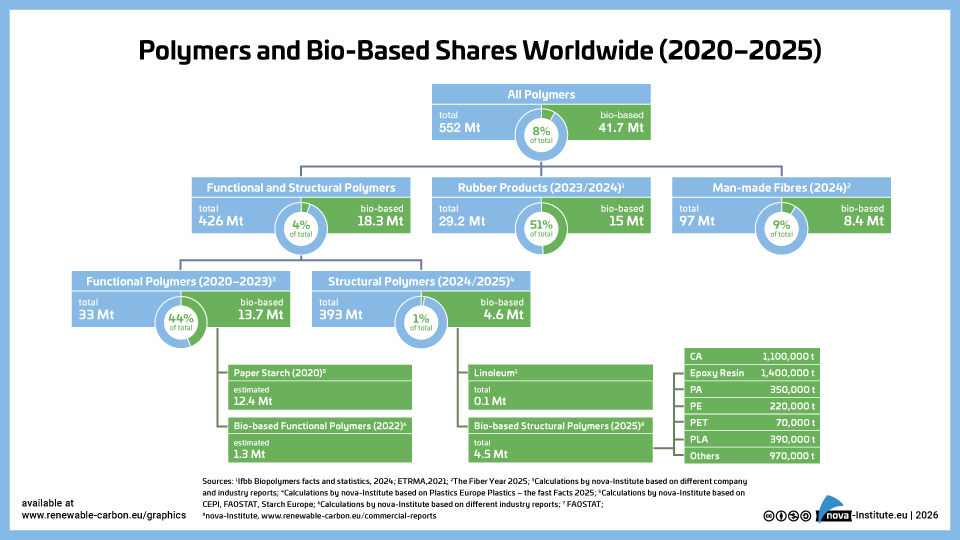

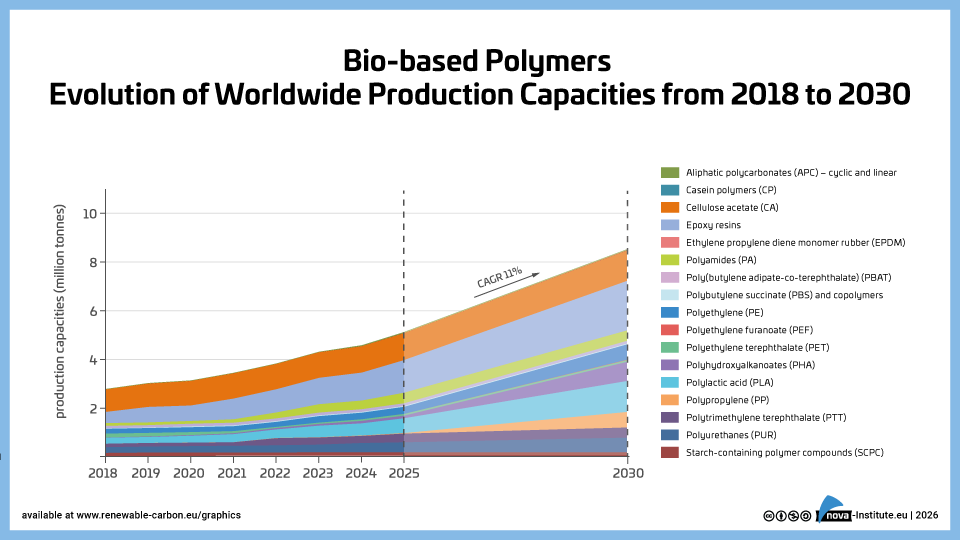

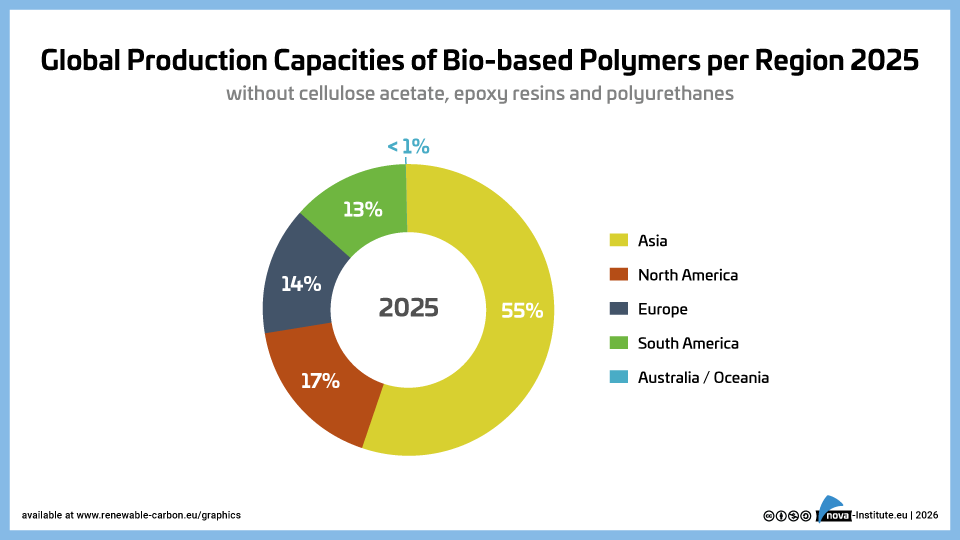

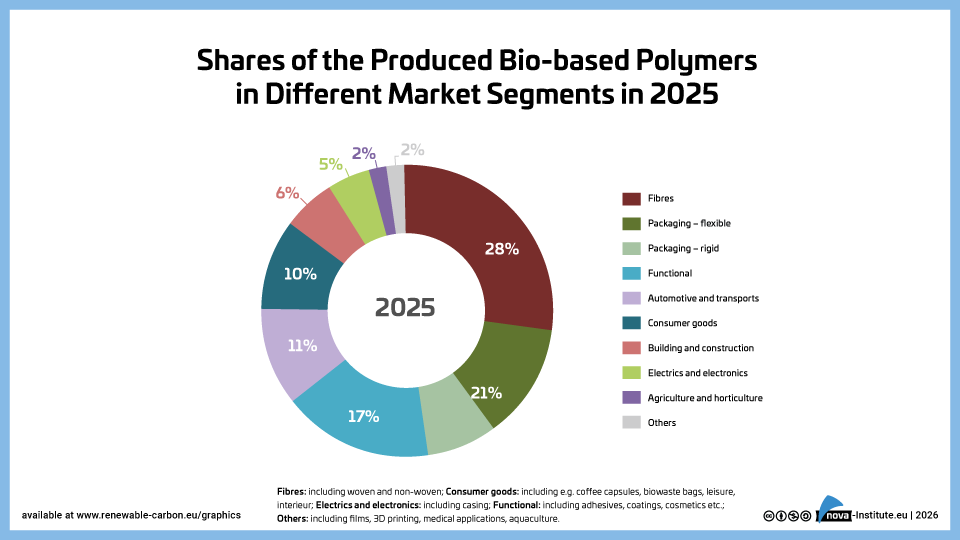

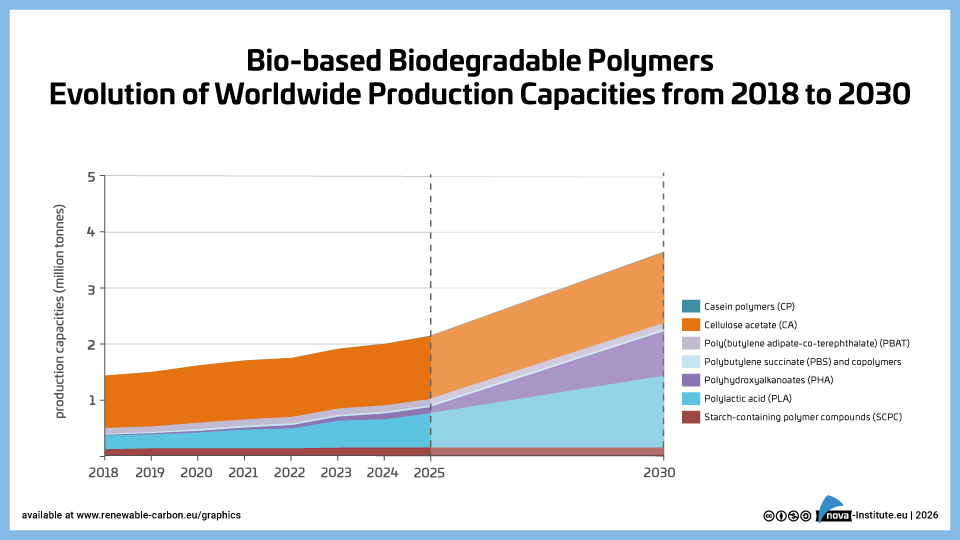

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Bio-based Polymer Capacities and Production Worldwide 2025 (PNG)

Markets & Economy

1 Page

9 Downloads

9 Downloads

2026-02

FREE

Free Shipping9

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

11 Downloads

2026-02

FREE

Free Shipping11

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

12 Downloads

2026-02

FREE

Free Shipping12

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

11 Downloads

2026-02

FREE

Free Shipping11

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Bio-based polymers – Evolution of worldwide production capacities from 2018 to 2030 (PNG)

Markets & Economy

1 Page

10 Downloads

10 Downloads

2026-02

FREE

Free Shipping10

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Global Production Capacities of Bio-based Polymers per region 2025 (PNG)

Markets & Economy

1 Page

14 Downloads

14 Downloads

2026-02

FREE

Free Shipping14

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Bio-based non biodegradable polymers Evolution of Capacities (PNG)

Markets & Economy

1 Page

8 Downloads

8 Downloads

2026-02

FREE

Free Shipping8

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Bio-based biodegradable polymers-Evolution Capacities to 2030 (PNG)

Markets & Economy

1 Page

8 Downloads

8 Downloads

2026-02

FREE

Free Shipping8

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

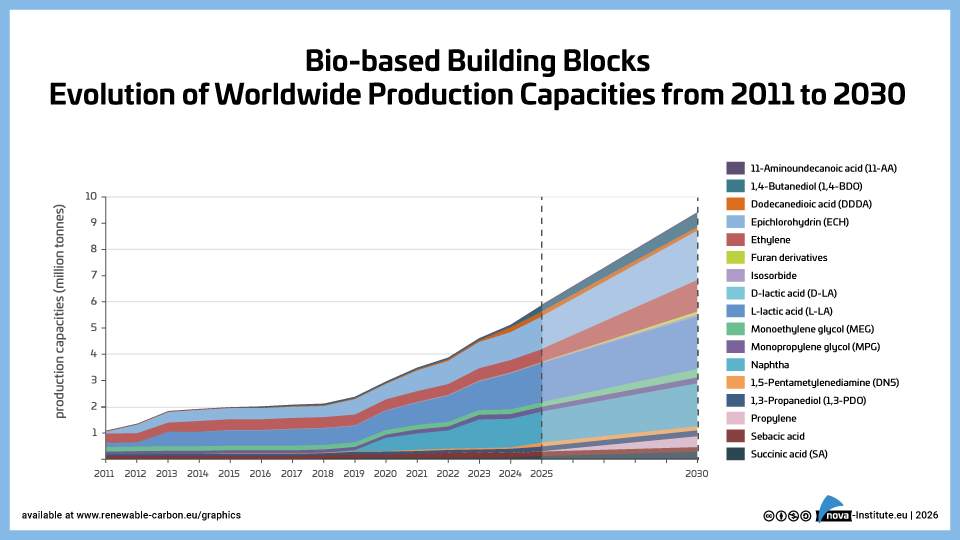

Bio-based building blocks – Evolution of capacities to 2030 (PNG)

Markets & Economy

1 Page

7 Downloads

7 Downloads

2026-02

FREE

Free Shipping7

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

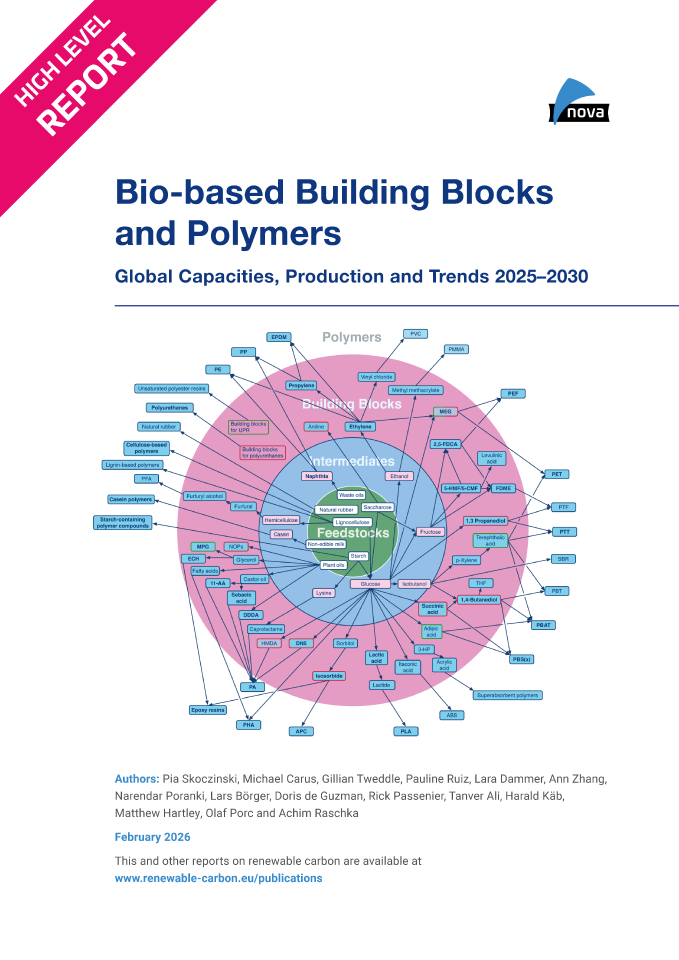

Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030 (PDF)

NewMarkets & Economy

23 Pages

344 Downloads

344 Downloads

2026-02

FREE

Free Shipping344

DownloadsThe new high-level report “Bio‑based Building Blocks and Polymers – Global Capacities, Production and Trends 2025–2030”, compiled by the international biopolymer expert group of the nova-Institute, provides an overview of the capacities and production data of 17 commercially available bio‑based building blocks and polymers in 2025, along with a forecast for 2030. Detailed market data is available via individual workshops and webinars with the biopolymer experts. This data includes capacity development from 2018 to 2030, production data for the years 2024 and 2025, and analyses of market developments per building block, polymer and producers, as well as a statistical analysis of “Mass Balance and Attribution (MBA)” products available worldwide.

2025 was a solid year for bio-based polymers, with an expected overall CAGR of 11 % to 2030 and an average capacity utilisation rate of 86 %. Overall, bio-based non-biodegradable polymers have larger installed capacities and higher utilisation rates than bio-based biodegradable polymers. While 58 % of the total installed capacities are from bio-based non-biodegradable polymers, 42 % are bio-based biodegradable polymers. Bio-based non-biodegradable have an average utilisation rate of 90 % whereas bio-based biodegradable polymers have an average utilisation rate of 81 %. The expected CAGR for both, bio-based non-biodegradable and biodegradable is similar with 10 % and 11 %, respectively.

Epoxy resin and PUR production is growing moderately at 9 and 8 %, respectively, while PE and PP are increasing by 17 % and 94 %. Also, capacities for the biodegradables PHA and PLA are expected to increase until 2030 by 49 % and 16 %, respectively. Commercial newcomers such as casein polymers and PEF have increased production capacity and are expected to continue to grow significantly until 2030.

DOI No.: https://doi.org/10.52548/PILO4285

-

Biorefineries in Asia and the EU – an Explorative Study (PDF)

NewMarkets & Economy, Policy, Technology

58 Pages

47 Downloads

47 Downloads

2026-01

FREE

Free Shipping47

DownloadsThe study aims to provide decision makers with a quick overview over the state of the bioeconomy in Europe and three selected countries in Asia, India, Thailand and Indonesia. Specific attention is placed on biorefineries, as they represent a key building block for the industry. Covered aspects include the political framework, technical pathways and existing infrastructure, alongside case studies. The study provides on-the ground insights from practioners in the field, includes a set of good-practice criteria to assess the prospects of biorefineries and offers a number of specific recommendations for future actions to expand the bioeconomy across continents.

-

Advanced Recycling Conference 2025 (Proceedings, PDF)

Markets & Economy, Policy, Sustainability & Health, Technology

2025-12

150 € ex. tax

Plus 19% MwSt.Press

release Add to

cartThe proceedings of the Advanced Recycling Conference 2025 (19-20 November, https://advanced-recycling.eu) contain 41 conference presentations, the conference journal, sponsor documents and the press release.

-

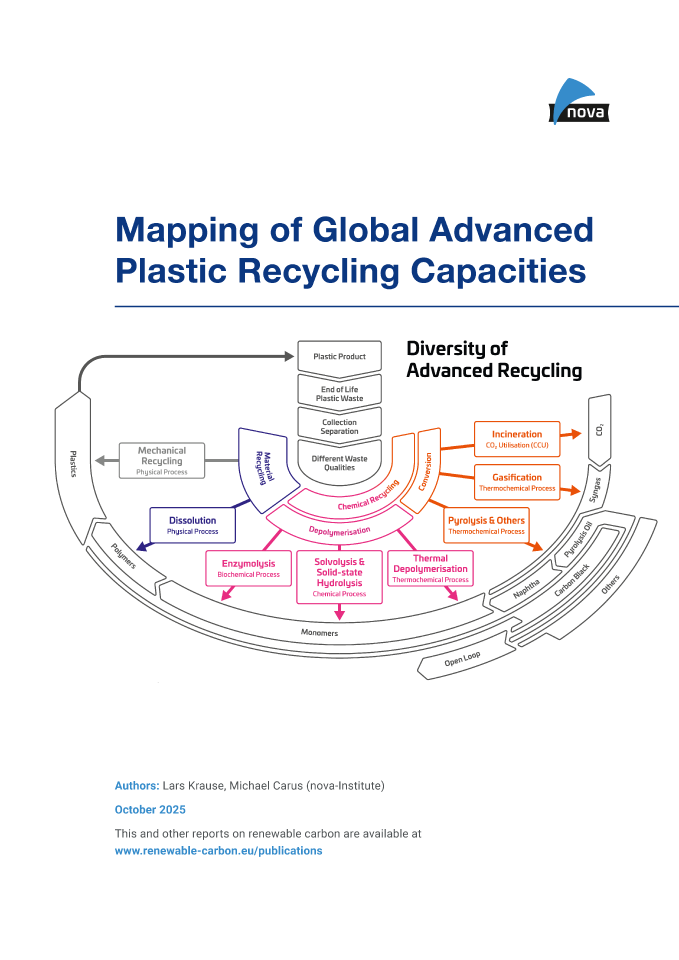

Mapping of Global Advanced Plastic Recycling Capacities (PDF)

NewMarkets & Economy, Policy, Technology

35 Pages

2025-11

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

licenceChemical and physical recycling are essential to keeping carbon in the loop and fully establishing a circular economy. Despite delays in policy regulations and investment, experts foresee a bright future for new capacity, both globally and in Europe.

The development of advanced recycling technologies is very dynamic and at a fast pace, with new players constantly appearing on the market, from start-ups to chemistry giants and everything in between. New plants are being built, and new capacities are being achieved. Due to these dynamic developments, it is difficult to keep track of everything. The nova report “Mapping of global advanced plastic recycling capacities” aims to clear up this jungle of information. A comprehensive evaluation of the global input and output capacities was carried out for which 390 planned as well as installed and operating plants including their specific product yields were mapped to provide an overview about global advanced recycling capacities in the past, present, and future.

Further information: The new report represents a short study updating the current and future Advanced Recycling input- and output-capacities for the year 2024-2031. The report does not include any technology- or company-profiles which are published in another study (https://doi.org/10.52548/WQHT8696).

DOI No.: https://doi.org/10.52548/YKWB6074

-

Renewable Materials Conference 2025 (Proceedings, PDF)

Markets & Economy, Policy, Sustainability & Health, Technology

2025-10

200 € ex. tax

Plus 19% MwSt.Press

release Add to

cartThe proceedings of the Renewable Materials Conference 2025 (22-24 September 2025, https://renewable-materials.eu) contain all released 68 presentations, the conference journal and the press release of the three winners of the Innovation Award “Renewable Material of the Year 2025″.

-

2025-08

500 € – 1,000 €Price range: 500 € through 1,000 € ex. tax

Plus 19% MwSt.Press

release Select

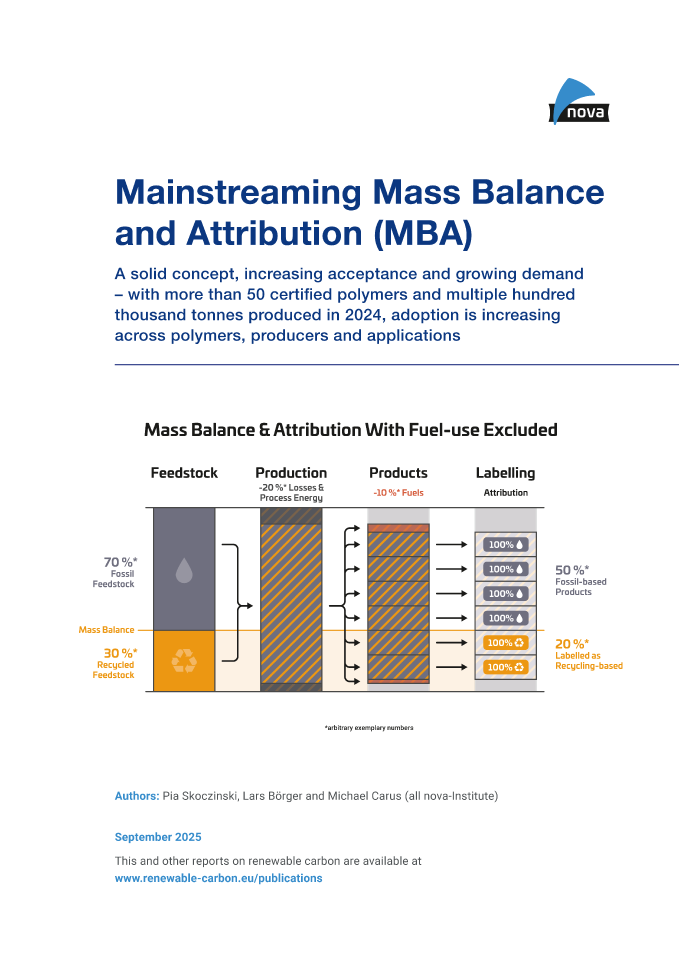

licenceA solid concept, increasing acceptance and growing demand – with more than 50 certified polymers and multiple hundred thousands of kilotonnes produced in 2024, adoption is increasing across polymers, producers and applications

The acceptance and accessibility of mass balanced attributed (MBA) chemicals, building blocks and polymers is a major issue for the chemical and plastics sectors, as well as for brand owners. MBA products could provide more options, better availability and reduced costs for the defossilisation compared to dedicated bio-based solutions.

However, both the MBA concept and the political regulations are crucial for scaling up, but difficult to understand. Furthermore, discussions about potentially misleading communication on the concept are confusing stakeholders. In addition, no production volumes are available.The new report “Mainstreaming Mass Balance and Attribution (MBA): A solid concept, increasing acceptance and growing demand – with more than 50 certified polymers and multiple hundred thousand tonnes produced in 2024, adoption is increasing across polymers, producers and applications” highlights this evolving landscape.

The first part of the report covers terminology, the historical development, the rationale and acceptance, and the latest regulatory environment in Brussels. The second part is dedicated to the underlying data.It covers feedstock used for certified MBA products, as well as the most frequently produced MBA chemicals and polymers (PE is No. 1). The leading producers (BASF is No. 1) and regions are identified, with 60 % of demand from Europe, and the largest share stemming from Germany, Belgium and France.

DOI No.: https://doi.org/10.52548/VDRG6920

-

RCI’s Position Paper: Mass Balance and Attribution (MBA) – Update 2025 (PDF)

Markets & Economy, Policy

5 Pages

254 Downloads

254 Downloads

2025-08

FREE

Free Shipping254

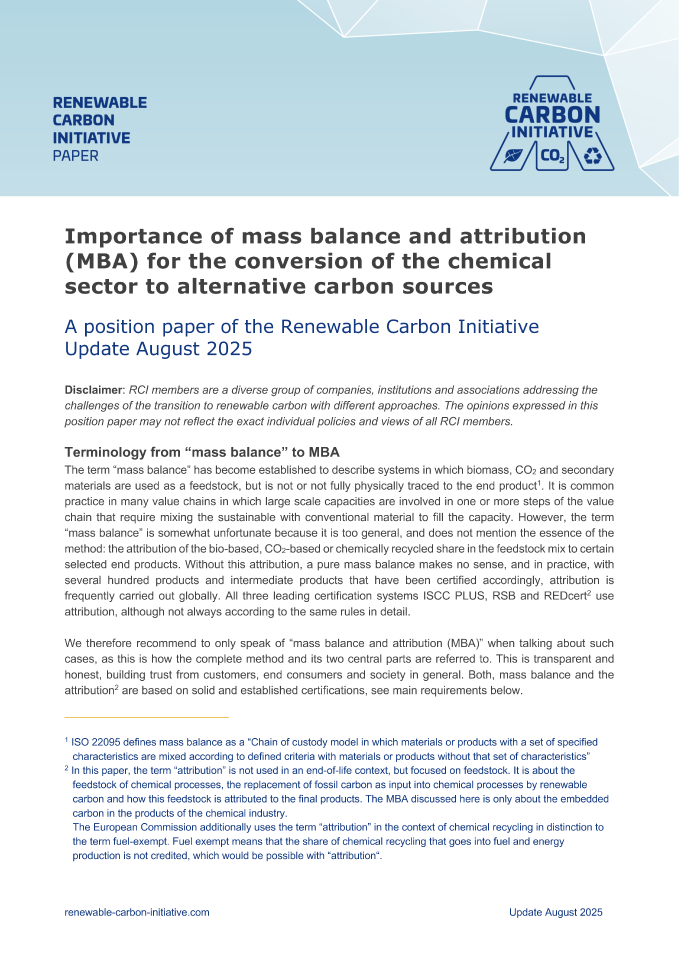

DownloadsThis position paper highlights the importance of mass balance and attribution “MBA” as one possible way to incentivise the transformation of the chemical sector away from fossil and on towards renewable carbon.

The term “mass balance” has become established to describe systems in which biomass, CO2 and secondary materials are used as a feedstock, but is not or not fully physically traced to the end product. Using the MBA approach makes it possible to substitute large quantities of fossil raw materials and attractive renewable content shares can be attributed to desired materials or products for which demand on the market exists. Through this, chemistry can stepwise, but continuously, increase the shares of renewable carbon

However, the term “mass balance” is somewhat unfortunate because it is too general, and does not mention the essence of the method: the free attribution of the bio-based, CO2-based or chemically recycled share in the feedstock mix to certain selected end products. Without this attribution, a pure mass balance makes no sense, and in practice, with several hundred products and intermediate products that have been certified accordingly, attribution is frequently carried out globally. The RCI recommends to only speak of “mass balance and attribution (MBA)” as this is transparent and honest, building trust from customers, end consumers and society in general. Both, mass balance and the free attribution are based on solid and established certifications.

Besides terminology, there is still a need for regulatory harmonisation between the schemes of the existing certification systems. MBA cannot only be applied for bio-based feedstock, but also for CO/CO2 or feedstock from chemical recycling, both will gain strongly in importance in the coming years. Every MBA scheme should cover these three renewable feedstocks: biomass, CO/CO2 and recycling.

This 2025 update now includes a brief overview and figure of MBA as defined at EU level, via the SUPD Implementing Decision on the recycling of a single-use plastics bottle- This establishes overall regulatory support for MBA in the EU as well as an applicable methodological framework for MBA in practice.

-

The fossil fuel trap: Why defossilising chemistry is essential – and feasible! (PDF)

Markets & Economy, Policy, Technology

8 Pages

224 Downloads

224 Downloads

2025-07

FREE

Free Shipping224

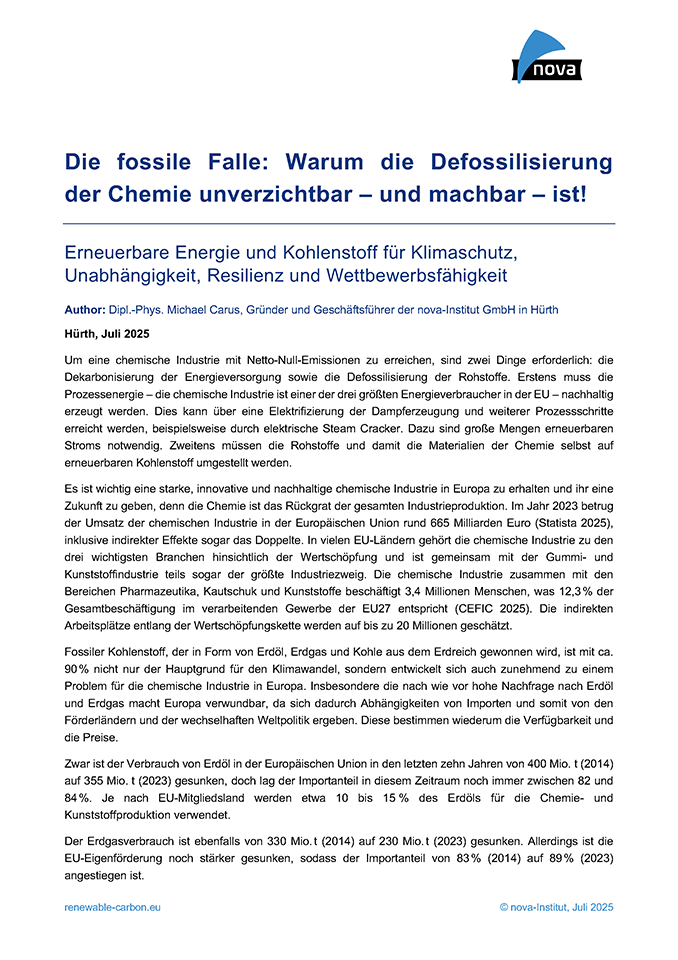

DownloadsHow can we escape the fossil fuel trap, our dependence on fossil fuels and the vulnerability that comes with it? In the long term, recycling, together with biogenic carbon and CO₂, can completely replace fossil carbon from crude oil or natural gas as a raw material for plastics production. This will enable the European Union to become independent of fossil carbon imports and increase its resilience and competitiveness. To achieve this, it is crucial to shape the transition phase in a politically astute and rapid manner so that the transformation of the chemical industry in Europe is successful – after all, Europe is the birthplace of modern chemistry. This is the only way to prevent the EU from remaining stuck in a fossil fuel trap while other regions successfully transform their economies.

-

Die fossile Falle: Warum die Defossilisierung der Chemie unverzichtbar – und machbar – ist! (PDF)

Markets & Economy, Policy, Technology

8 Pages

63 Downloads

63 Downloads

2025-07

FREE

Free Shipping63

DownloadsWie kommen wir raus aus der fossilen Falle, aus der fossilen Abhängigkeit und Verwundbarkeit? Langfristig kann Recycling zusammen mit biogenem Kohlenstoff und CO₂ den fossilen Kohlenstoff aus Erdöl oder Erdgas als Rohstoff für die Kunststoffproduktion komplett ersetzen. So kann die Europäische Union unabhängig von fossilen Kohlenstoffimporten werden und ihre Widerstandsfähigkeit und Wettbewerbsfähigkeit steigern. Dafür ist es entscheidend, die Übergangsphase politisch klug und rasch zu

gestalten, damit die Transformation der Chemieindustrie in Europa gelingt – schließlich ist Europa die Ursprungsregion der modernen Chemie. Nur so kann vermieden werden, dass die EU in der fossilen Sackgasse stecken bleibt, während anderen Regionen die Transformation gelingt.

-

Summary of RCI Scientific Background Report “RCI Policy Proposals for Facilitating the Transition to Renewable Carbon” (PDF)

Markets & Economy, Sustainability & Health

3 Pages

292 Downloads

292 Downloads

2025-06

FREE

Free Shipping292

DownloadsHow to defossilise the chemical industry – policy proposals

This is a summary of the RCI Scientific Background Report “RCI Policy Proposals for Facilitating the Transition to Renewable Carbon” published by the Renewable Carbon Plastics | bioplastics MAGAZINE [03/25] Vol. 20.

![Renewable Materials Conference 2025 (Proceedings, PDF) [Digital]](https://renewable-carbon.eu/publications/wp-content/uploads/2020/05/21-01-07_RC-Publications-Cover-Proceedings_RMC-100x141.png)