Showing 1–20 of 145

-

64 Downloads

2024-03

FREE

64

Downloads -

61 Downloads

2024-03

FREE

61

Downloads -

61 Downloads

2024-03

FREE

61

Downloads -

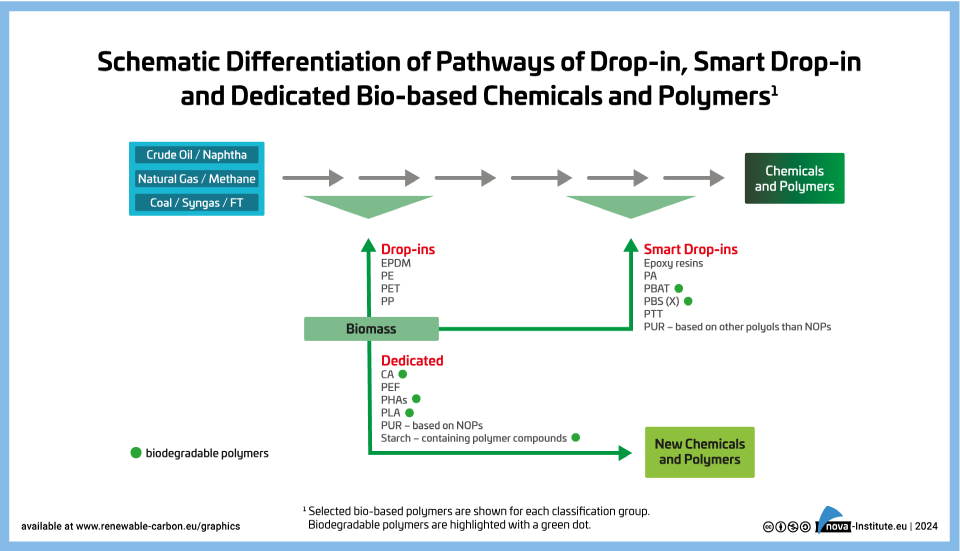

Schematic Differentiation of Pathways of Drop-in, Smart Drop-in and Dedicated Bio-based Chemicals and Polymers (PNG)

Markets & Economy

1 Page

37 Downloads

37 Downloads

2024-03

FREE

37

Downloads -

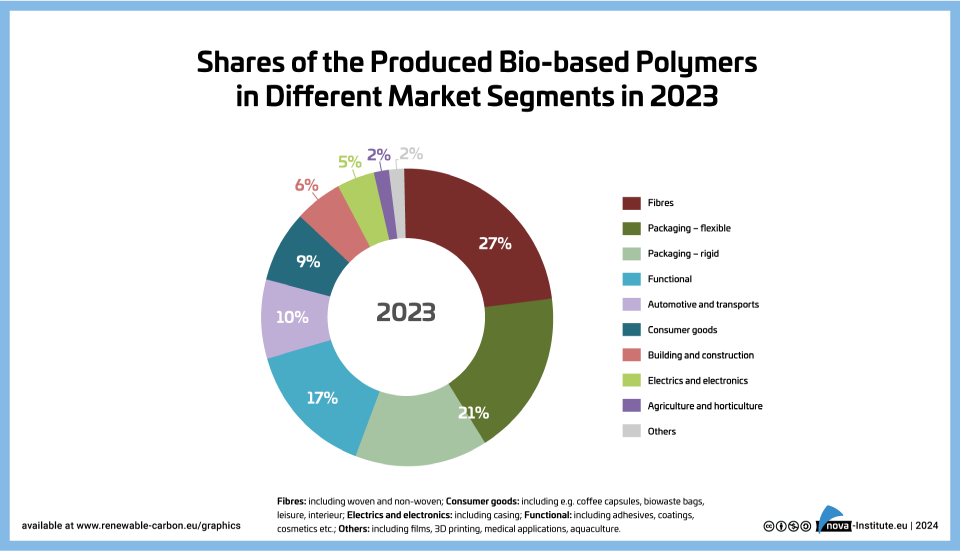

Shares of Produced bio-based polymers in different market segments (PNG)

Markets & Economy

1 Page

59 Downloads

59 Downloads

2024-03

FREE

59

Downloads -

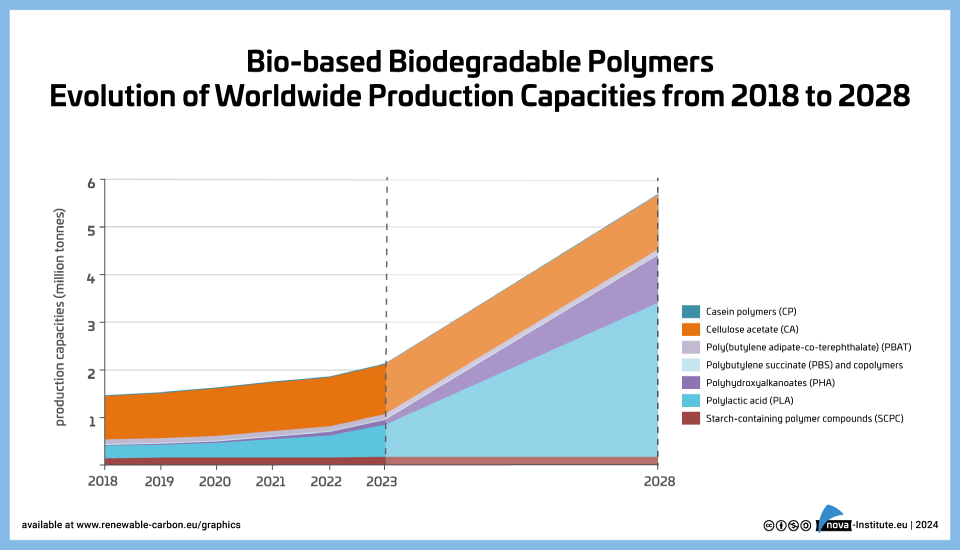

Bio-based Biodegradable Polymers Worldwide Production Capacities 2018-2028 (PNG)

Markets & Economy

1 Page

60 Downloads

60 Downloads

2024-03

FREE

60

Downloads -

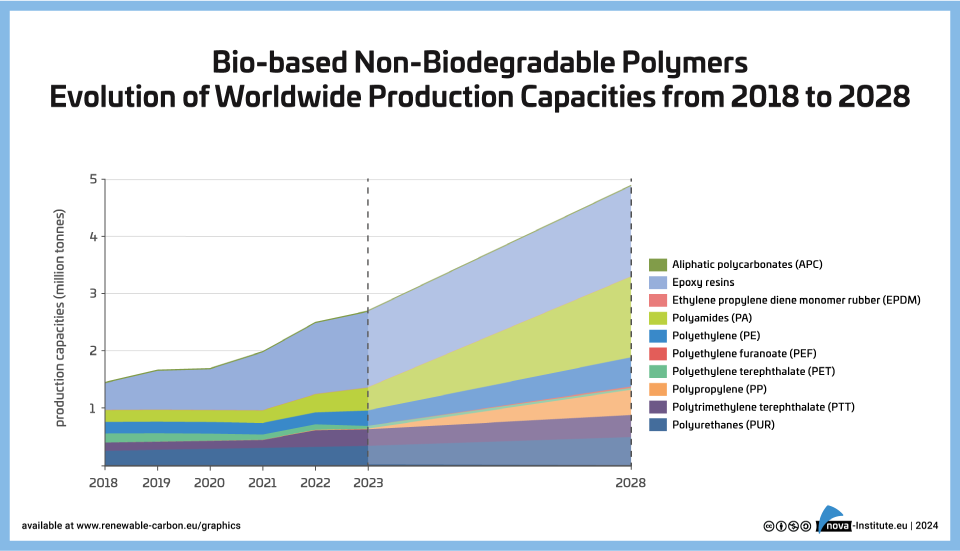

Bio-based Non-Biodegradable Polymers Evolution of Worldwide Production Capacities (PNG)

Markets & Economy

1 Page

34 Downloads

34 Downloads

2024-03

FREE

34

Downloads -

44 Downloads

2024-03

FREE

44

Downloads -

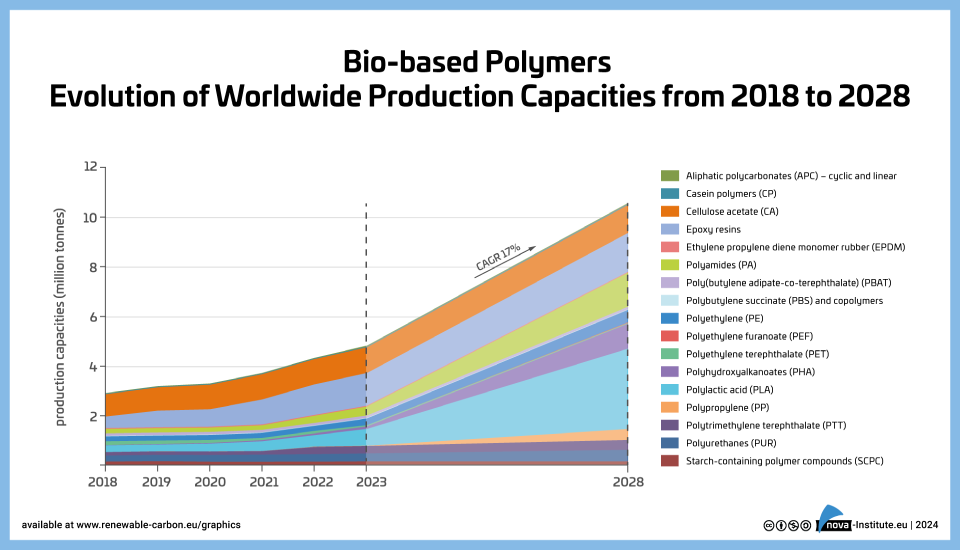

Bio-based Polymers – Evolution of worldwide production capacities from 2018 to 2028 (PNG)

Markets & Economy

1 Page

55 Downloads

55 Downloads

2024-03

FREE

55

Downloads -

58 Downloads

2024-03

FREE

58

Downloads -

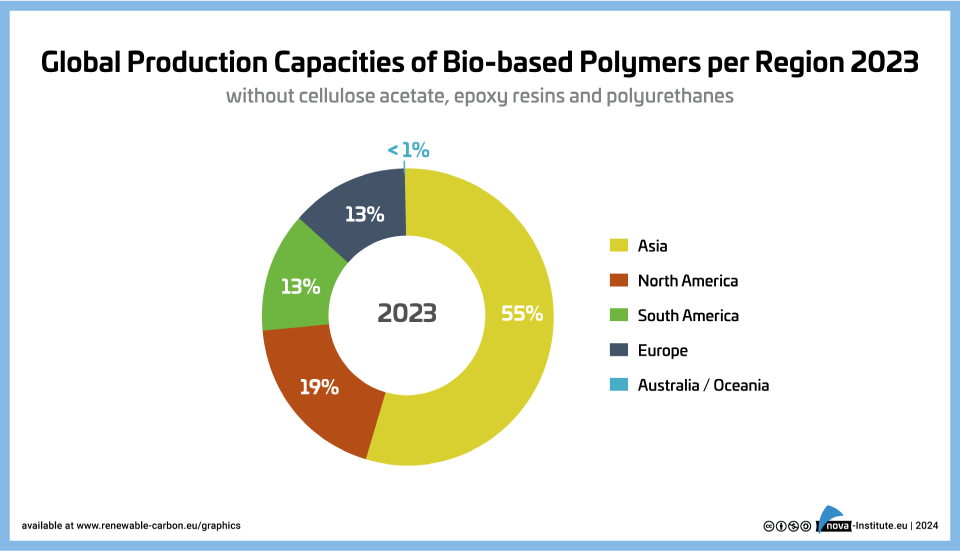

Global Production Capacities of Bio-based Polymers per Region 2022 (PNG)

Markets & Economy

1 Page

35 Downloads

35 Downloads

2024-03

FREE

35

Downloads -

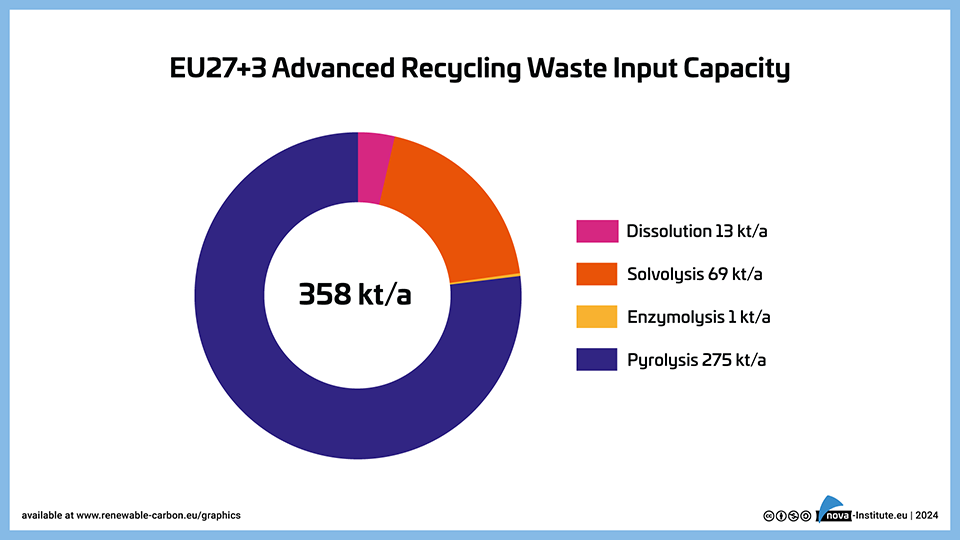

EU27+3 Advanced Recycling Waste Input Capacity (PNG)

Markets & Economy, Technology

1 Page

27 Downloads

27 Downloads

2024-03

FREE

27

DownloadsInstalled input capacities for different advanced recycling technologies in EU27+3.

-

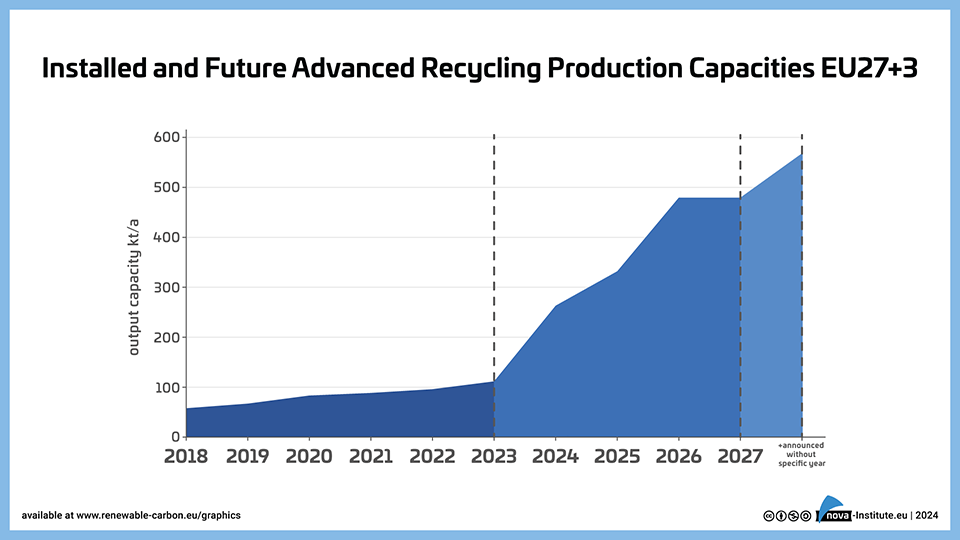

Installed and Future Advanced Recycling Production Capacities EU 27+3 (PNG)

Markets & Economy, Technology

1 Page

31 Downloads

31 Downloads

2024-03

FREE

31

DownloadsInstalled and future production capacities of naphtha, monomers and polymers through advanced recycling in the EU27+3.

-

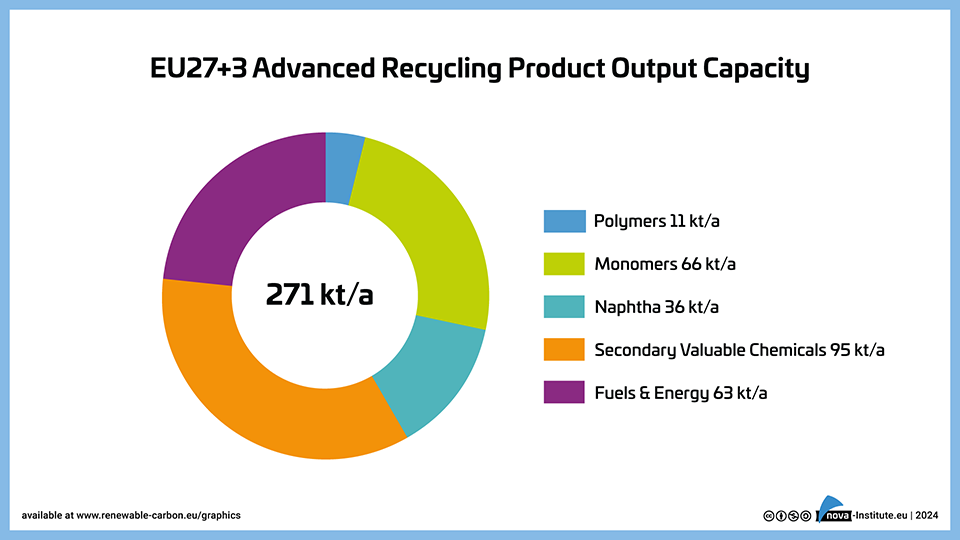

EU27+3 Advanced Recycling Product Output Capacity (PNG)

Markets & Economy, Technology

1 Page

24 Downloads

24 Downloads

2024-03

FREE

24

Downloads -

821 Downloads

2024-01

FREE

821

Downloads -

Nora and her flyphone on renewable carbon (Comic)

Policy, Sustainability & Health

2 Pages

435 Downloads

435 Downloads

2024-01

FREE

435

Downloads -

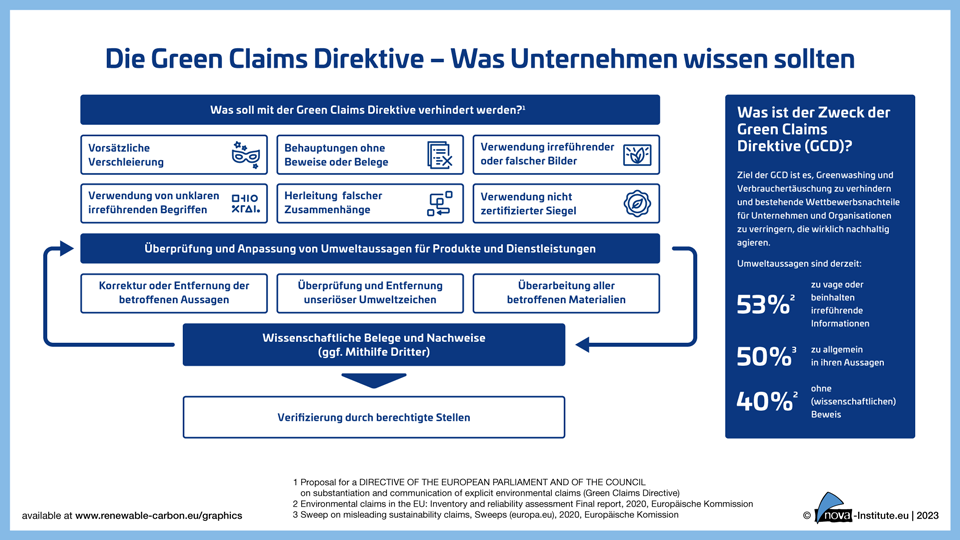

The Green-Claims-Directive – Was Unternehmen wissen sollten (PNG)

Policy, Sustainability & Health

1 Page

61 Downloads

61 Downloads

2023-12

FREE

61

DownloadsBisher können Firmen Begriffe wie “klimaneutral, “recycelbar”, “umweltfreundlich” oder selbst kreierte Logos, welche die Umweltfreundlichkeit eines Produkts hervorheben sollen, ohne Prüfung durch Dritte für die Bewerbung von Produkten und Services nutzen. Mit dem Vorschlag zur Green Claims Richtlinie will die EU diese Praxis ändern. Ziel ist die Prüfung und Zertifizierung der sogenannten green claims (Umweltaussagen) durch eine externe Prüfstelle. Notwendig dafür wird dann ein wissenschaftlicher Nachweis. Mit dieser Grafik können sich Unternehmen einen ersten Überblick darüber verschaffen, was mit dem neuen Vorschlag der EU auf sie zukommen könnte.Erfahren Sie mehr über dieses Thema und besuchen Sie unsere nova-Session “Sustainability Claims under New EU Legislation” (7. Februar, 13:00-15:00 CET, online): https://events.renewable-carbon.eu/event/green-claims-directive -

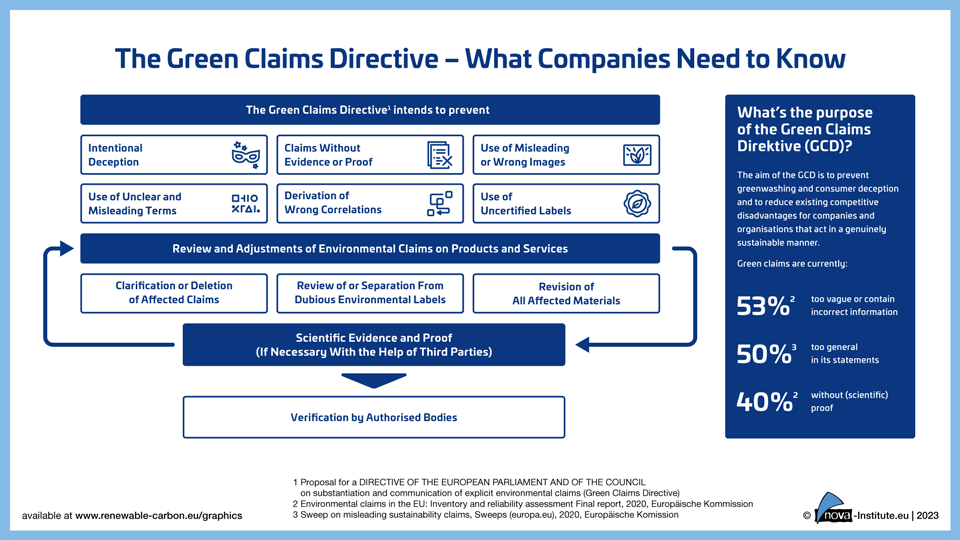

The Green-Claims-Directive – What Companies Need to Know (PNG)

Policy, Sustainability & Health

1 Page

193 Downloads

193 Downloads

2023-12

FREE

193

DownloadsSo far, companies can use terms such as “climate-neutral”, “recyclable”, “environmentally friendly” or self-created logos, which are intended to emphasise the environmental friendliness of a product, to advertise products and services without third-party verification. With the proposal for the Green Claims Directive, the EU wants to change this practice. The aim is to test and certify the green claims by an external testing authority. This would require a scientific verification. This graphic provides companies with an initial overview of what the new EU proposal could mean for them.

Lean more about this topic and join our nova-Session “Sustainability Claims under New EU Legislation” (7 February, 13:00-15:00 CET, online): https://events.renewable-carbon.eu/event/green-claims-directive

-

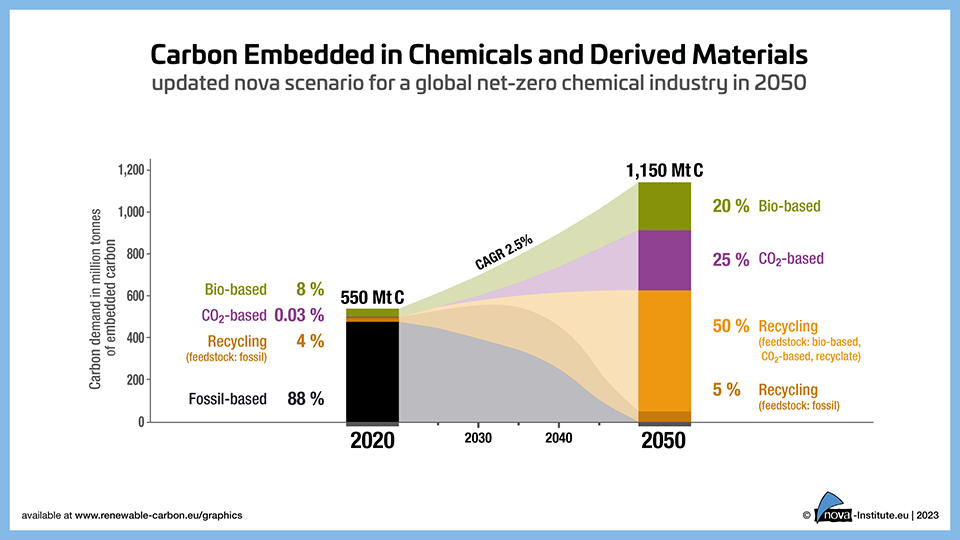

Explorative Scenario – Carbon Embedded in Chemicals and Derived Materials (PNG)

Markets & Economy, Policy

1 Page

475 Downloads

475 Downloads

2023-10

FREE

Free Shipping475

DownloadsFigure from the RCI Carbon Flows Report 2023The nova October 2023 update shows a steady increase in the share of bio-based chemicals from 8% in 2020 to 20% in 2050. CO2-based chemicals require a lot of investment to become relevant after 2030, with strong growth between 2040 and 2050. The recycling of virgin fossil chemicals and plastics dominates the recycling sector until 2035. After 2035, bio-based, CO2-based and recyclates increasingly dominate the recycling sector. -

120 Downloads

2023-10

FREE

120

Downloads